The shuttered cryptocurrency exchange Garantex is reportedly making a comeback under a new name after laundering millions in ruble-backed stablecoins and transferring them to a newly established exchange, according to a Swiss blockchain analytics firm.

This firm claims that the operators of the Russian exchange have redirected liquidity and customer deposits to Grinex, which they describe as “Garantex’s full-fledged successor,” in a report shared on X.

“We can confidently assert that Grinex and Garantex are connected both onchain and offchain.”

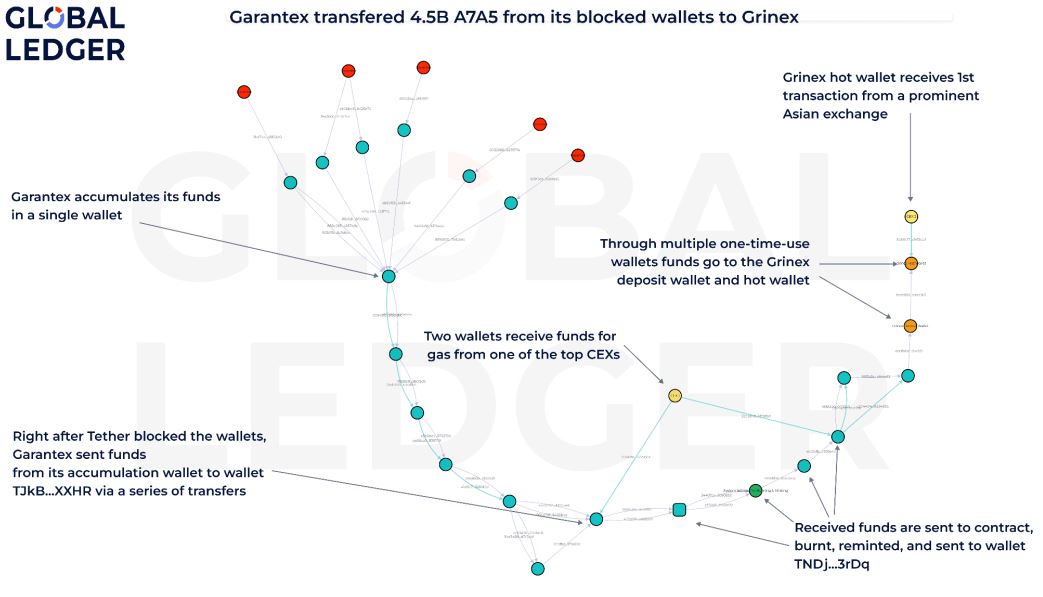

“The flow of funds, which includes the systematic transfer of A7A5 liquidity, the use of disposable wallets, and the involvement of addresses previously linked to Garantex, provides clear onchain evidence of their relationship,” the analytics team noted in the report.

After completing its investigation, the firm revealed findings showing that Garantex laundered over $60 million worth of A7A5 stablecoins and sent them to addresses tied to Grinex.

The analytics firm claims that Garantex has transferred all its funds to a newly launched exchange and is back in operation.

“In this instance, the process of burning and then minting was employed to launder funds from Garantex, enabling the generation of new coins from a system address with an unblemished history,” the team stated.

Additionally, a manager from Garantex reportedly informed the analytics firm that customers have been visiting the exchange’s office in person to transfer funds from Garantex to Grinex.

“Moreover, offchain indicators, such as transaction patterns, comments, and exchange behaviors, further solidify this connection,” it added.

The report also references a description of Grinex on a Russian crypto tracking website, which claims that the founders of Garantex established it. This suggests that “Grinex is not an independent entity but a full-fledged successor to Garantex, maintaining its financial activities even after the original exchange’s formal shutdown.”

According to reports, Garantex has resumed operations through a newly launched exchange.

As of March 14, the incoming transaction volume on Grinex had reached nearly $30 million, with the tracking site reporting that monthly trade volume has surpassed $68 million, including spot trading exceeding $2 million.

The US Department of the Treasury’s Office of Foreign Assets Control initially sanctioned Garantex in April 2022 for alleged money laundering violations.

Related: US, UK, Australia sanction Zservers for hosting crypto ransomware LockBit

On March 6, the US Department of Justice collaborated with authorities in Germany and Finland to freeze domains linked to Garantex, which they claim processed over $96 billion in criminal proceeds since it began operations in 2019.

The stablecoin operator also froze $27 million in Tether (USDT) on March 6, which compelled Garantex to cease all operations, including withdrawals.

Just days later, on March 12, officials from India’s Central Bureau of Investigation arrested Aleksej Bešciokov, who allegedly operated Garantex, on US charges including conspiracy to commit money laundering.

Magazine: How crypto laws are changing across the globe in 2025