The cryptocurrency sector is preparing to launch the first Solana futures exchange-traded fund (ETF), marking a pivotal moment that could lead to the introduction of the first Solana spot ETF, viewed as the “next logical progression” for crypto trading products by market analysts.

Volatility Shares is set to unleash two Solana (SOL) futures ETFs, namely the Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2X Solana ETF (SOLT), starting March 20.

The arrival of the first Solana futures ETF could stimulate substantial institutional interest in the SOL token, as noted by Ryan Lee, chief analyst at Bitget Research.

Volatility Shares Solana ETF SEC filing. Source: SEC

The analyst commented:

“The launch of the initial Solana ETFs in the US could significantly enhance Solana’s market position by boosting demand and liquidity for SOL, potentially decreasing the gap with Ethereum’s market capitalization.”

The introduction of Solana ETF is expected to foster greater institutional adoption by providing a regulated investment option, which could attract billions in capital and bolster Solana’s competitiveness compared to Ethereum, Lee remarked, while also acknowledging the significant challenges posed by Ethereum’s well-established ecosystem.

Nonetheless, some in the industry express concerns that the Solana futures ETF might lead to a letdown for investors if there is a lack of substantial inflows, similar to the reception of the spot Ether ETF, which, according to Bloomberg’s senior ETF analyst Eric Balchunas, only served as a “sidekick” to Bitcoin ETFs in terms of investments.

Related: Bitcoin surpasses global assets after Trump election, despite BTC correction

The Solana futures ETF may experience lackluster inflows, yet spot Solana ETFs could follow

Though the futures ETF might not draw in considerable inflows, it solidifies Solana’s status as a leading cryptocurrency, particularly after the announcement from US President Donald Trump that his Working Group on Digital Assets would include Solana in the country’s crypto strategic reserve, alongside Cardano’s (ADA) token and XRP (XRP).

“The emergence of Solana ETFs is paving the way for broader adoption,” remarked Anmol Singh, co-founder of Bullet, a decentralized exchange specializing in Solana-native perpetual futures.

Singh stated:

“A spot ETF for Solana is still awaiting approval, but the heightened awareness surrounding Solana and the launch of Futures ETFs make this a logical subsequent move.”

“We anticipate moderate inflows into the futures ETF—spot ETFs generally provide better exposure, and that will mark a significant milestone,” he added.

Related: Trump-linked WLFI triples Ether holdings; Solana experiences $485M outflows: Finance Redefined

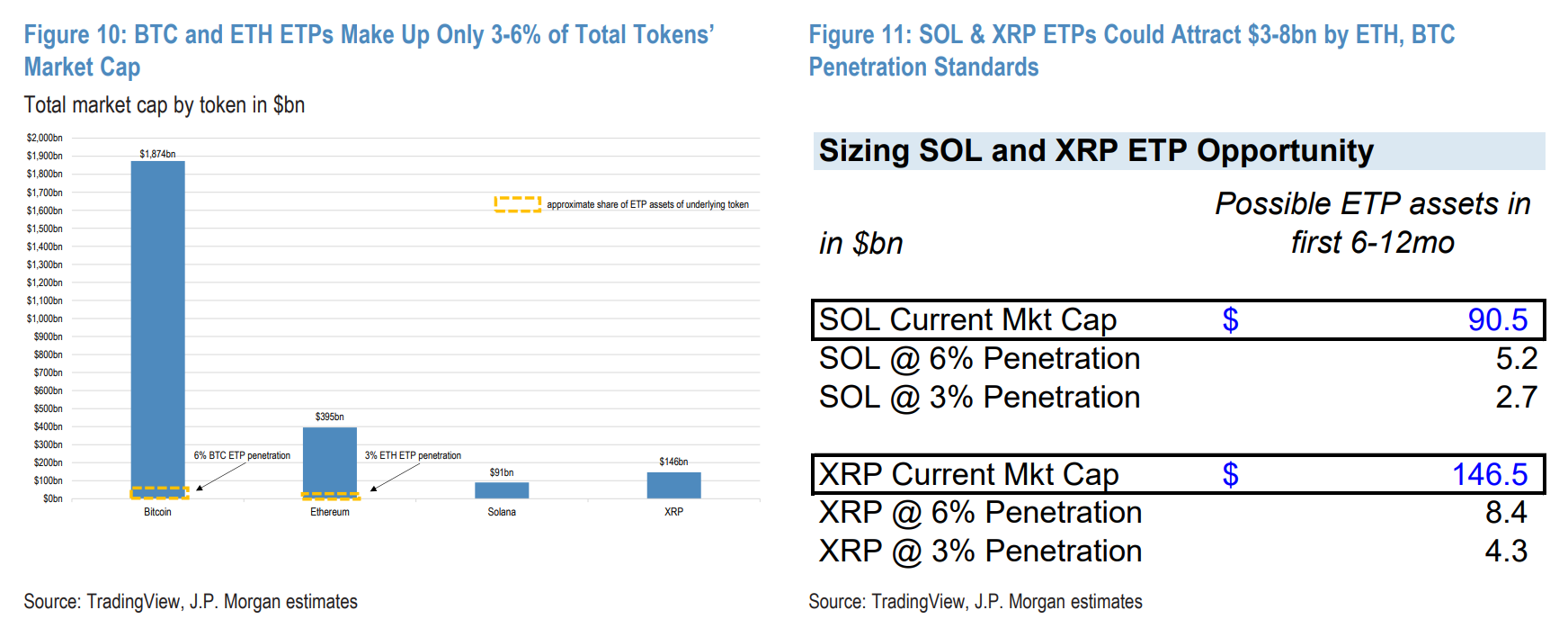

While measuring the adoption rate of futures ETFs poses challenges, a spot Solana ETF could potentially garner between $3 billion and $6 billion in net assets in its first six months, surpassing the adoption rate of Ether ETFs, as indicated by a JPMorgan report reviewed by industry experts.

SOL and XRP ETPs could attract $3–8 billion. Source: JP Morgan

“When applying these so-called “adoption rates” to SOL and XRP, we project SOL might attract approximately $3 billion-$6 billion in net assets and XRP could see $4 billion-$8 billion in new assets,” the report stated.

However, “the timeline could extend into 2026 due to the SEC’s precedent of taking approximately 240–260 days to review filings,” remarked James Seyffart, an analyst from Bloomberg Intelligence, on January 16.

Magazine: Memecoins may be fading — But Solana is ‘100x better’ despite revenue decline