Tether has maintained its significant presence in the US Treasury market, reinforcing its status as the seventh-largest purchaser of these government securities in 2024.

In a March 20 update on X, Tether’s CEO Paolo Ardoino disclosed that the company has obtained $33.1 billion in US Treasuries. This figure surpasses the holdings of countries such as Canada, Taiwan, Mexico, Norway, Hong Kong, South Korea, Germany, and Saudi Arabia.

Even with this achievement, Ardoino pointed out that the Cayman Islands topped global purchases with over $100 billion in total acquisitions. This was followed by France, Luxembourg, Belgium, Singapore, and the United Kingdom.

However, he noted that the figures from regions such as the Cayman Islands and Luxembourg reflect the investments of numerous hedge funds, whereas Tether’s holdings are attributed to a single entity.

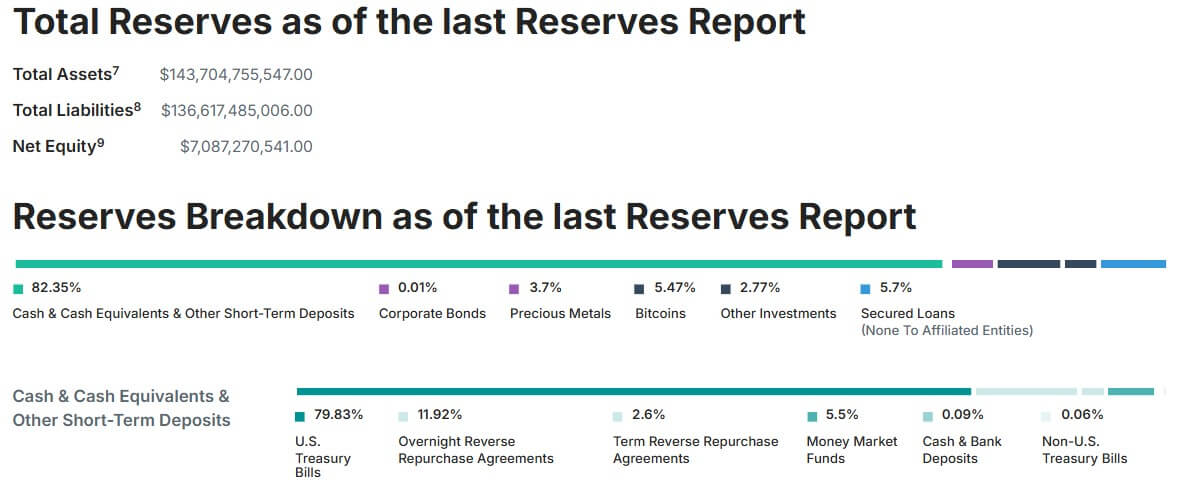

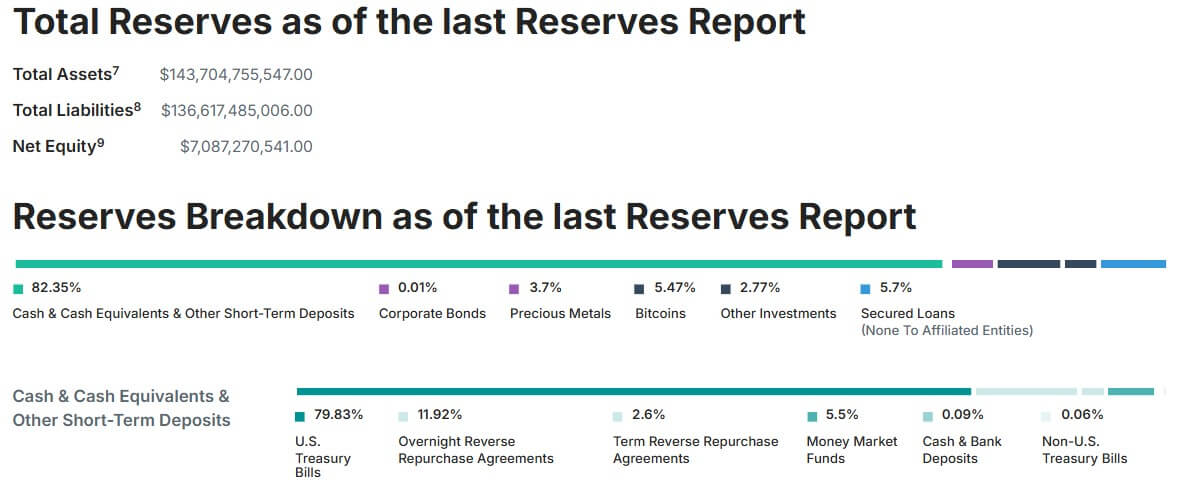

Tether depends on US Treasuries as a foundational aspect of its reserve strategy. Considered among the safest and most liquid assets worldwide, these government securities underpin the stability of the company’s USDT stablecoin.

In Tether’s latest quarterly reserve report from December 2024, the company’s total holdings in US Treasuries were valued at $94 billion. This positions the stablecoin issuer ahead of most nations in terms of its expanding role within the global financial landscape.

Ardoino has previously stated that the significant holdings in Treasuries bolster the US’s economic power and are crucial for preserving the dollar’s supremacy in international trade.