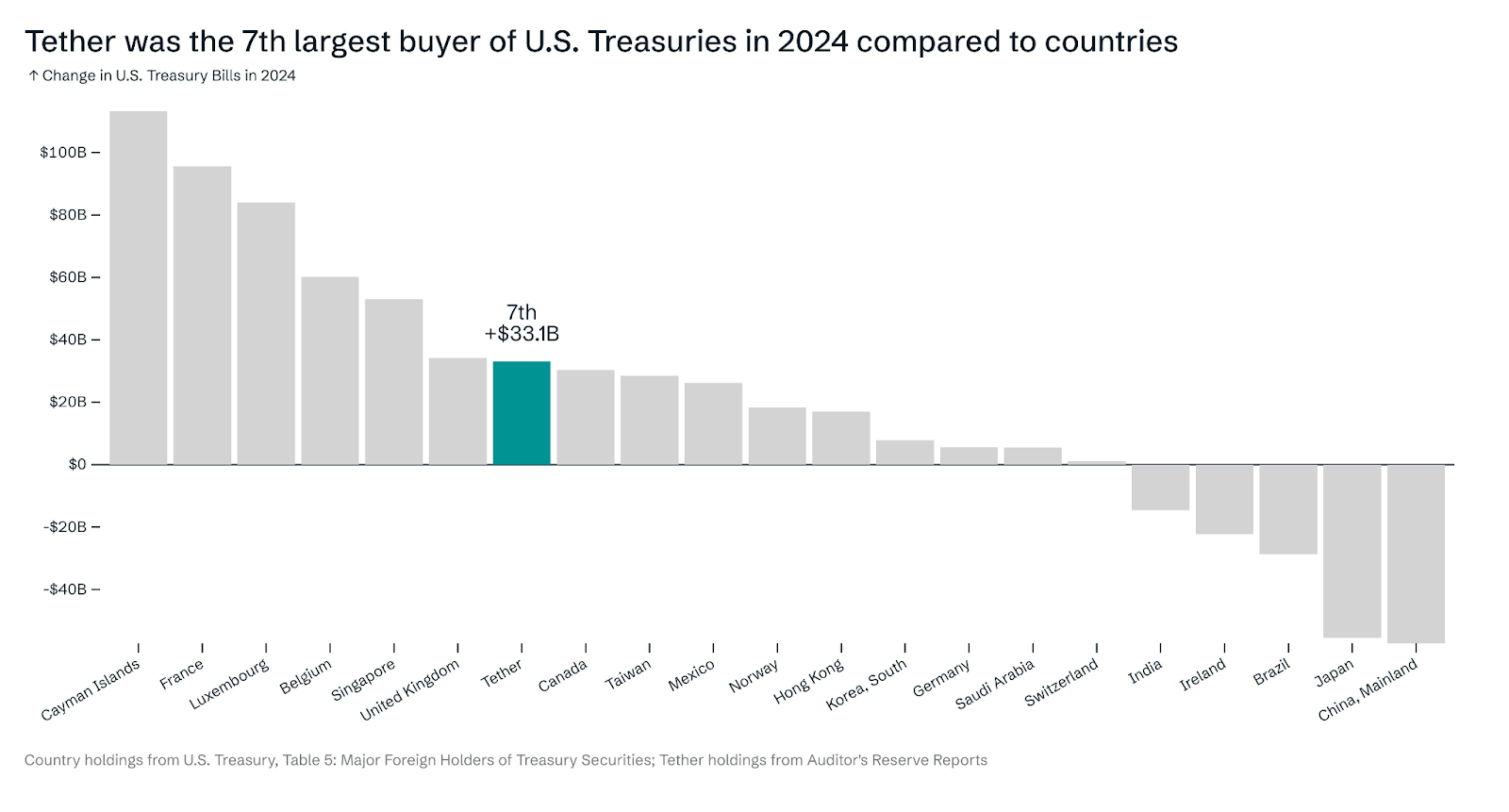

Tether, valued at $143 billion, has emerged as the seventh-largest purchaser of United States Treasurys globally, outpacing several major nations.

The issuer of the USDt (USDT), the top stablecoin in the world, ranks as the seventh biggest buyer of US Treasurys, exceeding purchases from Canada, Taiwan, Mexico, Norway, Hong Kong, and various other countries.

According to Tether’s CEO, the company acquired more than $33.1 billion in Treasurys, in contrast to over $100 billion secured by the Cayman Islands, which holds the top position in the global rankings.

“Tether ranked as the seventh largest buyer of US Treasurys in 2024, outpacing numerous countries,” the CEO mentioned in a post on March 20.

Image Credit: Prepared by the CEO

However, the figures for Luxembourg and the Cayman Islands encompass “all the hedge funds investing in T-bills,” the CEO clarified in replies, while Tether’s numbers reflect the investments of a single entity.

Tether is channeling investments into US Treasurys to provide additional backing for its US dollar-pegged stablecoin, as Treasurys are short-term debt instruments issued by the US government, recognized for being among the safest and most liquid investments available.

Related: US Bitcoin reserves signify a ‘real step’ towards global financial integration

The substantial growth of Tether comes amid increasing adoption of stablecoins by both investors and lawmakers in the United States.

Image Credit: Prepared by IntoTheBlock

The rising supply of stablecoins has recently exceeded $219 billion and continues to climb, indicating that the market is “probably still mid-cycle,” rather than having reached the height of the bull market, according to analysts.

Related: CEO: Competitors and politicians are determined to ‘destroy Tether’

Stablecoin legislation could be enacted by August: Industry Association

US lawmakers are poised to pass legislation establishing rules for stablecoins and the cryptocurrency market structure by as early as August, according to the CEO of an industry advocacy group, who spoke at a recent digital asset summit in New York.

This projection aligns with a similar outlook from the executive director of a presidential advisory council on digital assets, who stated that comprehensive legislation on stablecoins is expected in the coming months.

“I believe we’re close to finalizing these matters for August […] there’s considerable work happening behind the scenes right now,” the CEO remarked at the summit, which was attended by various representatives.

Image: Former President and Treasury Secretary during a recent Crypto Summit

“I’m hopeful when you have the chairs of relevant committees and the White House showing interest, combined with bipartisan support in Congress,” she added.

Magazine: ETH may bottom at $1.6K, SEC delays multiple crypto ETFs, and more: Market Digest, March 9 – 15