The President of the United States is increasingly aligning his administration with the cryptocurrency sector. On March 20, he participated in a community conference for the first time since taking office.

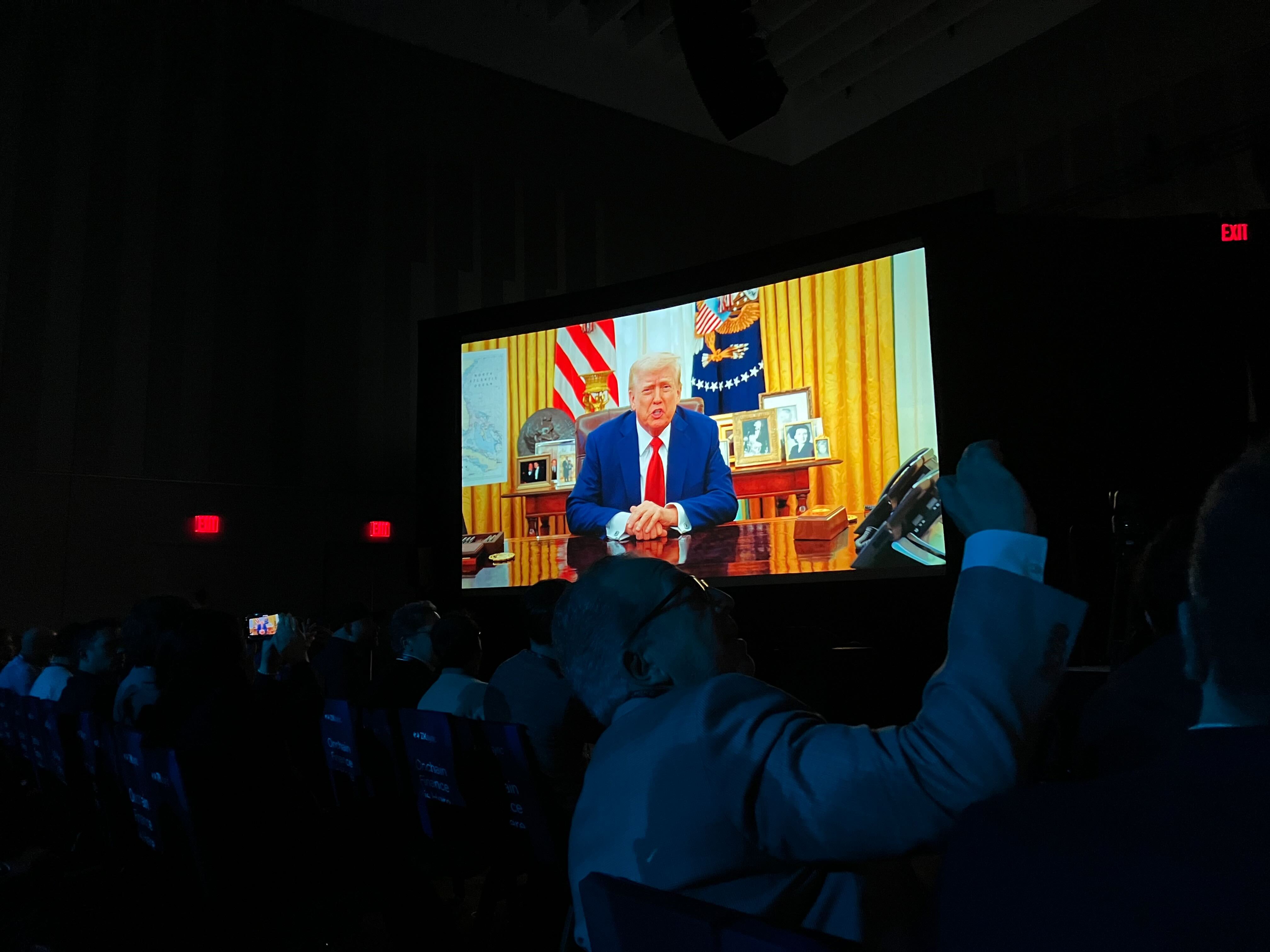

In a pre-recorded speech delivered at the Blockworks Digital Asset Summit, he emphasized that the nation would take measures to establish itself as the “crypto capital of the world.”

The President praised recent regulatory changes in the crypto space that differ from those of the prior administration, stating:

“Innovators like you will enhance our banking and payment systems, foster greater privacy, safety, security, and prosperity for American consumers and businesses. You will spark significant economic growth.”

He added, “With dollar-pegged stablecoins, you will contribute to the dominance of the US dollar for many years ahead.”

The President has enacted various executive orders supporting the crypto landscape, including one on January 23 that established the Working Group on Digital Assets and another that created a strategic reserve for Bitcoin and a separate crypto reserve.

The President speaks at the Digital Asset Summit.

Related:Bitcoin reaches two-week highs as market anticipates news from the President about crypto.

Varied Reactions to the Crypto Summit

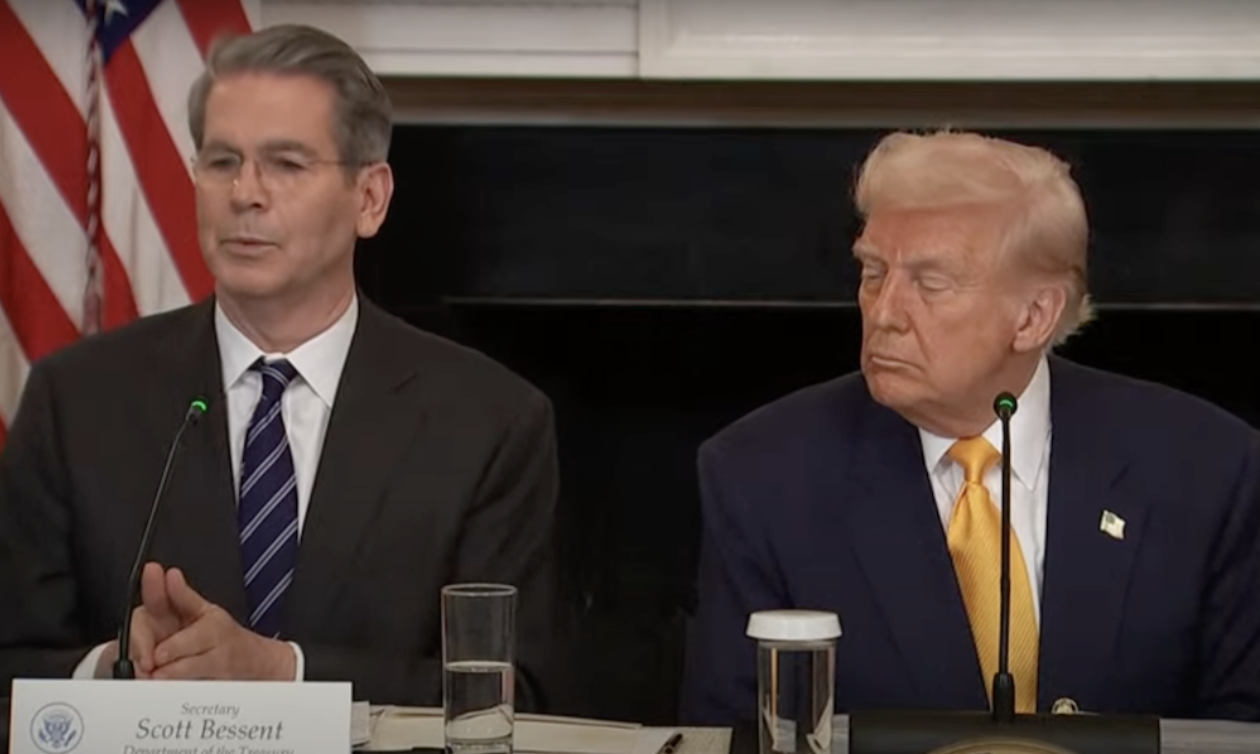

The President held the first White House Crypto Summit on March 7, gathering industry leaders to discuss the future of cryptocurrency regulation.

During this meeting, the Treasury Secretary highlighted the focus on developing stablecoin regulations, asserting that these digital assets are crucial for maintaining the US dollar’s status as the global reserve currency.

At the Blockworks Digital Asset Summit, the executive director of the Council of Advisers on Digital Assets mentioned that a stablecoin bill is expected to be presented to the President within the next two months.

The Treasury Secretary discusses stablecoin strategies at the White House Crypto Summit.

The much-anticipated crypto summit did not meet all expectations, and the crypto community expressed mixed views on the event.

Institutional investors and industry leaders generally saw the event’s historical context as a positive development, whereas retail investors and the Bitcoin community regarded it as somewhat disappointing.

“The White House crypto summit is a meeting of lobbyists seeking government endorsement for state-sanctioned surveillance tokens,” remarked a Bitcoin maximalist on social media.

Following the White House Crypto Summit and the announcement of the Bitcoin strategic reserve order—which stipulated that the government could only acquire BTC through budget-neutral tactics—the price of Bitcoin fell by 7.3%.

Magazine: The crypto sector has four years to expand so significantly that ‘no one can shut it down’: Kain Warwick, Infinex.