Bitcoin (BTC) aimed to solidify support at the opening of Wall Street on March 20, as bulls successfully emerged from a significant downward trend.

BTC/USD 1-hour chart.

Trump vows to transform the US into a “Bitcoin superpower”

Data indicated that BTC/USD prices climbed back above $86,000, thanks to figures from market analytics platforms.

As it hovered around the daily opening, Bitcoin continued to gain momentum from the previous day’s positive macroeconomic indicators provided by the US Federal Reserve.

Speculations regarding an upcoming announcement concerning cryptocurrencies from the US administration also contributed to Bitcoin hitting two-week highs.

President Donald Trump was set to deliver virtual remarks on the third day of the Blockworks Digital Asset Summit 2025 event in New York.

He reiterated his commitment not to liquidate seized US Bitcoin and to eliminate regulatory frameworks like Operation Chokepoint 2.0, although he did not provide new details on BTC purchases.

He stated:

“Together we will make America the undisputed Bitcoin superpower and the crypto capital of the world.”

In this context, BTC/USD reclaimed two vital moving average trend lines, including the 200-day simple moving average (SMA), which serves as a crucial support element in bullish markets.

Notable trader and analyst Rekt Capital analyzed the current situation, emphasizing a similar recovery of the 200-day exponential moving average (EMA).

“Bitcoin most recently closed above the 200 EMA on a daily basis and is currently testing it as new support,” he noted in his latest update on social media, referring to the trend line as a “long-term indicator of investor sentiment towards BTC.”

BTC/USD 1-day chart featuring 200 SMA and EMA.

An additional update indicated a noteworthy achievement by bulls, revealing a breakout from a downtrend in Bitcoin’s relative strength index (RSI), which had been in place since November 2024.

“Bitcoin has broken the Daily RSI Downtrend dating back to November 2024,” Rekt Capital confirmed.

BTC/USD 1-day chart.

Market Analysis: A potential awakening to a hawkish Fed

Related: Peak ‘FUD’ suggests a $70K support level — 5 key insights about Bitcoin this week

They cautioned that the initial bounce in risk assets following the Fed’s decision could quickly reverse.

“Beyond the initial excitement, the Fed’s stance was evidently cautious. Policymakers reduced economic growth predictions to 1.7% (a 0.4% decrease) while increasing their inflation forecast to 2.8%, indicating a heightened risk of stagflation,” they explained in a recent bulletin to their subscribers.

“Furthermore, the Fed’s dot plot showed a shift towards a more hawkish outlook compared to December, with four officials now anticipating no rate cuts in 2025.”

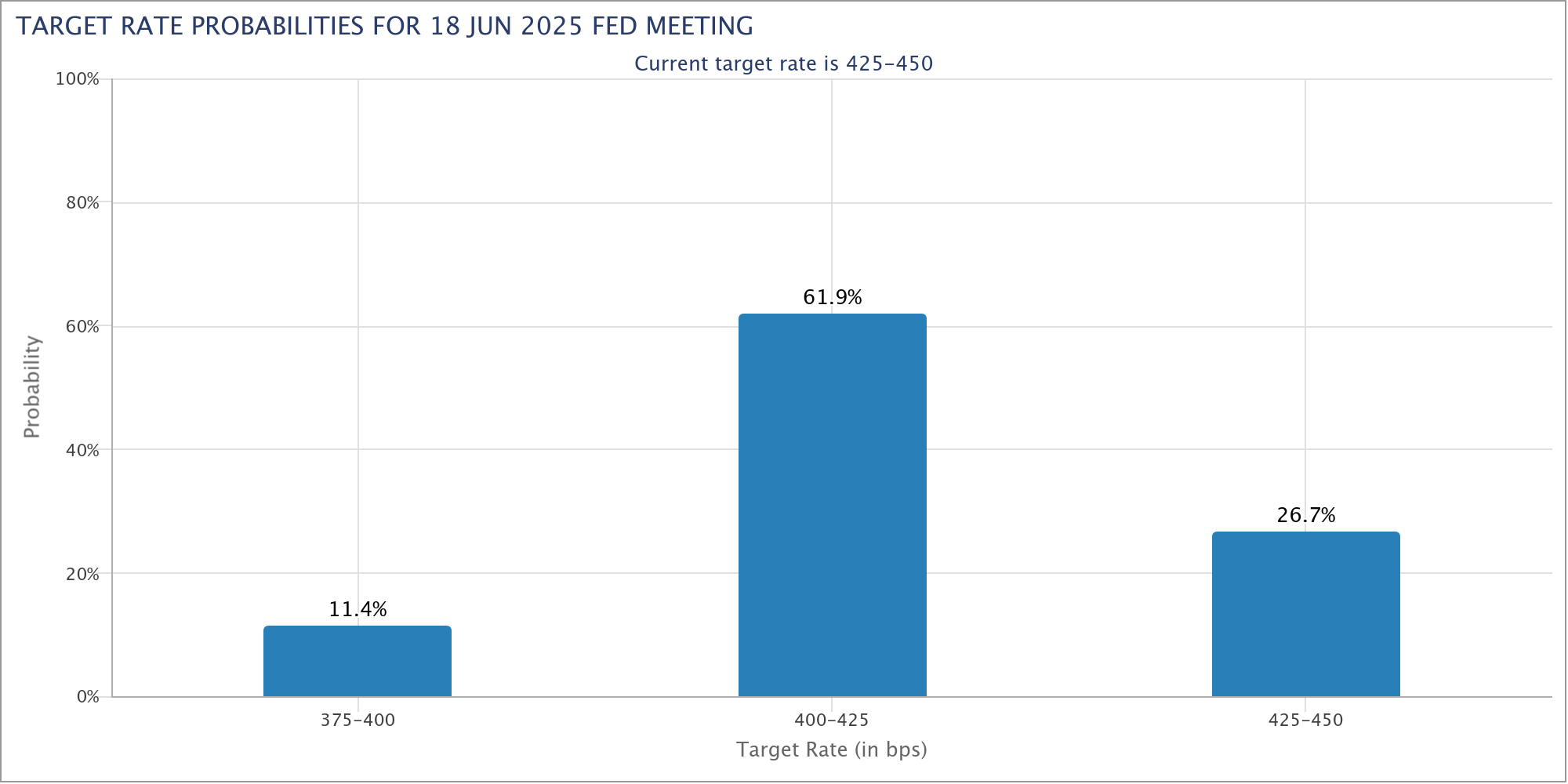

Fed target rate probabilities for the upcoming June FOMC meeting.

Recent data from an interest rate tracking tool showed that markets expect interest rate cuts to take place no earlier than June.

“Will the current rally maintain its momentum, or will investors come to terms with persistent risks?” queried QCP.

This article does not offer investment advice or recommendations. All investment and trading decisions carry risks, and readers should carry out independent research before making any decisions.