- The price of Solana surged by 12% on Wednesday, surpassing the $135 threshold for the first time in ten days.

- Volatility Shares has announced the introduction of Solana Futures ETFs that are expected to commence trading on Thursday.

- Open interest for SOL increased by 39% within a 24-hour period, reaching $8.3 billion as traders prepare for the futures ETF launch.

On Wednesday, Solana’s price jumped by 12%, reaching $136 as traders geared up for the launch of the futures ETF and rising chances of spot ETF approvals. Signals from derivatives trading indicate that the rally in SOL’s price may continue its upward trajectory.

Launch of Solana Futures ETFs Increases SEC Approval Chances

Volatility Shares, a US-based investment firm known for creating and managing pioneering leveraged ETFs, is set to unveil the first Solana futures ETFs on Thursday.

The firm is introducing two different funds: the Volatility Shares Solana ETF (SOLZ), which follows Solana futures, and the Volatility Shares 2X Solana ETF (SOLT), which provides twice the leverage. Disclosure filings indicate that these ETFs will have expense ratios of 0.95% and 1.85%, respectively.

Price movement of Solana following the confirmation of SOL Futures ETF launch | SOLUSDT

As a result of this announcement, the price of Solana climbed to a new high of over $136 on Thursday, representing a 12% increase from the recent low of $121 recorded on Tuesday.

Influence of Solana Futures ETF on SEC Decision Regarding Spot ETFs

The announcement regarding the Solana futures ETF follows similar regulatory trends where futures ETFs for Bitcoin and Ether received approval prior to spot ETFs.

In March, the initiative also received a boost when the US President referenced SOL in a proposed cryptocurrency strategic reserve.

These developments have evidently heightened institutional interest in Solana, potentially paving the way for a spot ETF approval in the upcoming year.

Solana ETF Approval Odds reach 88% | March 19, 2025

Traders have adjusted the likelihood of SOL ETF approval to 88%, based on real-time data from a cryptocurrency prediction market platform, as of Thursday.

Bloomberg analysts project a 75% chance that a spot Solana ETF could attain approval in 2025.

As the odds for the Solana ETF approval approach 90%, it could stimulate increased market demand for SOL, particularly among institutional investors.

Effects of Futures ETF Launch on Solana’s Price

The launch of the Solana futures ETF coincides with the network’s fifth anniversary.

This development is especially timely since Solana’s price has been under pressure, contending with sell-offs linked to compensations owed to FTX collapse victims in 2022.

Data trends from Solana’s derivative markets, showcased in the Coinglass chart, indicate signals that could incite positive price movement in the following days.

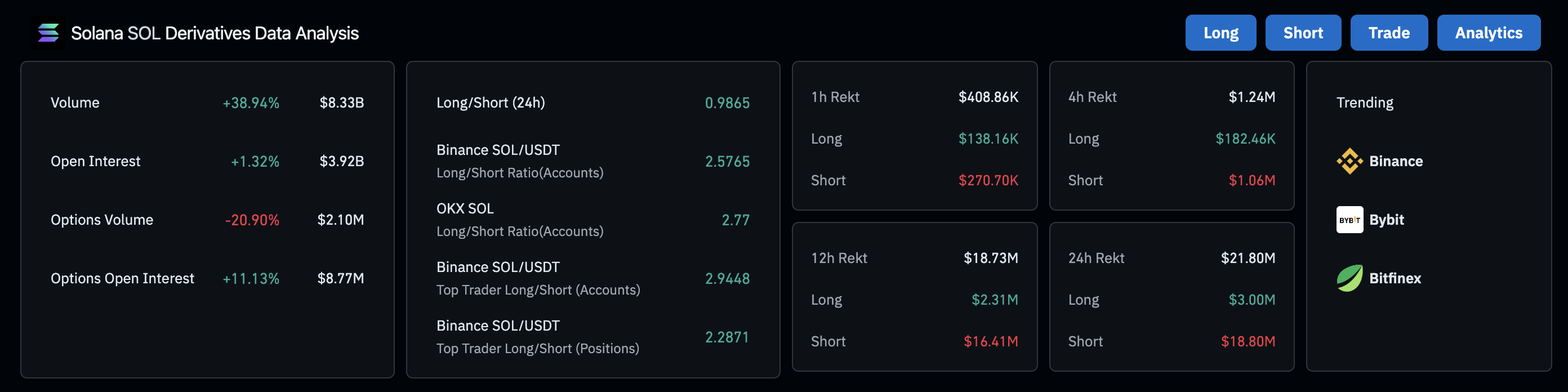

The derivatives market for Solana is experiencing a significant increase in activity, as shown by the latest Coinglass statistics. SOL futures trading volume surged by 38.94% over the past 24 hours, amounting to $8.33 billion, which indicates a growing interest from both institutional and retail traders.

Solana Liquidation Map, March 2025

Open interest has also increased by 1.32% to $3.92 billion, indicating that new positions are being established ahead of the futures ETF launch.

While options volume has decreased by 20.90%, open interest in options has increased by 11.13% to $8.77 million, showcasing a rising demand for leveraged bets on SOL’s price direction.

Moreover, the long/short ratio on major exchanges like Binance and OKX remains predominantly in favor of long positions, with Binance’s top trader positions showing a 2.29 ratio.

This suggests that key market players are preparing for an upward movement in SOL’s price.

However, liquidation data unveils short-term risks, with $21.8 million in total liquidations recorded over 24 hours, mostly from short sellers.

If the bullish momentum persists, SOL may see a breakout as leveraged short positions get squeezed out.

Solana Price Forecast:

With the impending Solana futures ETF launch coinciding with increasing institutional interest and an 88% probability of a spot ETF approval, SOL’s price outlook seems set for further growth, potentially approaching $200 in the coming weeks.