The price of Solana (SOL) has seen a rise today, supported by a marked recovery across the wider cryptocurrency market.

According to data from Cointelegraph Markets Pro and TradingView, SOL is currently trading around $134, appreciating over 6% within the past 24 hours. This represents a rebound of nearly 20% from a local low of about $112 reached on March 11.

SOL/USD daily chart.

Several factors are contributing to the rise in SOL’s price today, including:

-

The ongoing SOL price surge follows the introduction of the first-ever Solana futures ETF.

-

Approximately $18 million in short positions were liquidated in the last 24 hours.

-

The technical indicators for SOL suggest a target price of $220.

Launch of the Solana Futures ETF Sparks Price Increase

The debut of Solana futures exchange-traded funds (ETFs) by Volatility Shares has generated new excitement among SOL investors.

🚨 BREAKING: The first-ever Solana futures ETFs are launching tomorrow. Volatility Shares is debuting two ETFs:

• SOLZ: Tracks Solana futures

• SOLT: Offers 2x leveraged exposure pic.twitter.com/Wt2gt6oBPc— [Name] (@[handle]) March 19, 2025

Key highlights:

-

Volatility Shares, a U.S.-based investment firm, is set to introduce the inaugural Solana futures ETFs on Thursday, March 20.

-

A submission to the Securities and Exchange Commission reveals that two Solana-based ETFs from Volatility Shares will commence trading on March 20.

-

These include Solana ETF (SOLZ), which will monitor Solana futures, and the Volatility Shares 2X Solana ETF (SOLT), which offers leveraged exposure.

-

SOLZ will feature a management fee of 0.95%, while traders will incur a fee of 1.85% for SOLT.

-

These ETFs, following a precedent set by Bitcoin and Ethereum futures, indicate a growing institutional acceptance and facilitate easier access for conventional investors.

-

Market experts believe that the introduction of these funds may significantly impact the approval of a spot Solana ETF.

-

Several issuers, including major names in the industry, have submitted applications for spot Solana ETFs, pending the SEC’s approval.

-

ETF analysts estimate a 75% likelihood of approval by the end of the year.

-

This move is viewed as a regulatory endorsement, enhancing confidence in Solana and the broader market.

“With the launch of Solana ETF right after BTC/ETH ETFs, traditional finance’s doors are opening wide,” stated a crypto analyst in a post.

“Futures are merely the beginning—spot ETFs are inevitable. $SOL is just warming up, and the Solana ecosystem is about to be inundated with institutional liquidity.”

“This is remarkable,” commented an ETF analyst in response to the news, adding that Solana futures likely bode well for the approval chances of spot ETFs.

Short Position Liquidations Drive SOL Price Up

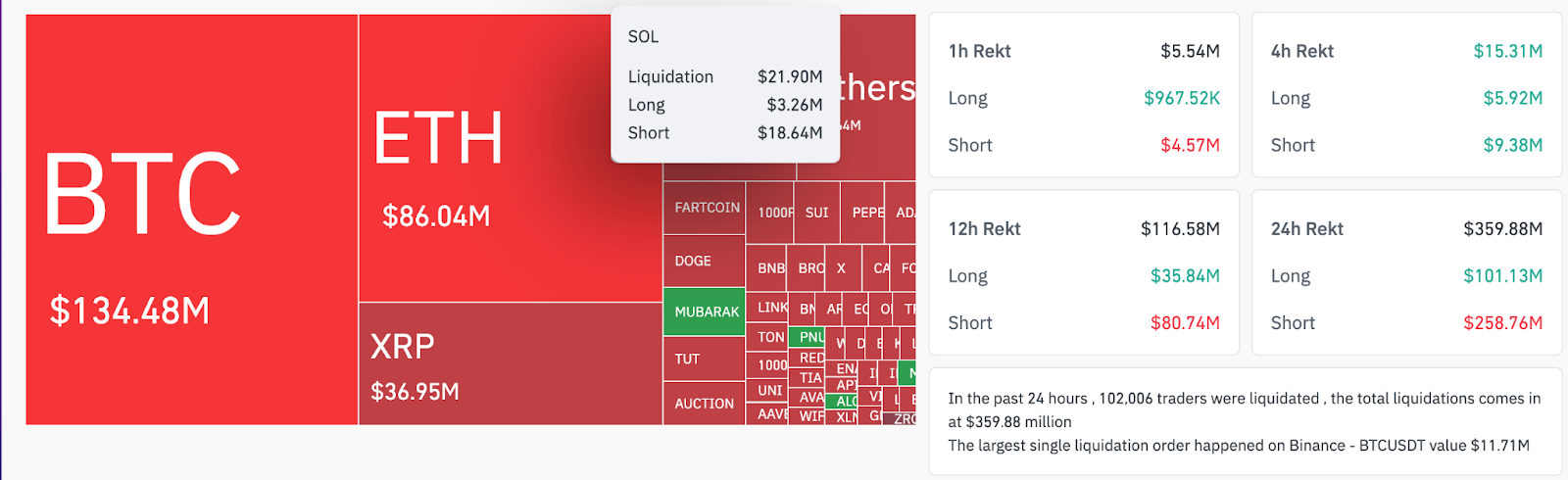

As Solana experiences price gains, there have been significant liquidations within the derivatives market, according to information from industry sources.

-

The crypto futures market saw the liquidation of over $359 million in leveraged positions within the last day, with a notable $258.7 million attributed to short liquidations.

-

Specifically, over $18.64 million in short SOL positions were terminated compared to around $3 million in long liquidations during the same timeframe.

Total crypto liquidations.

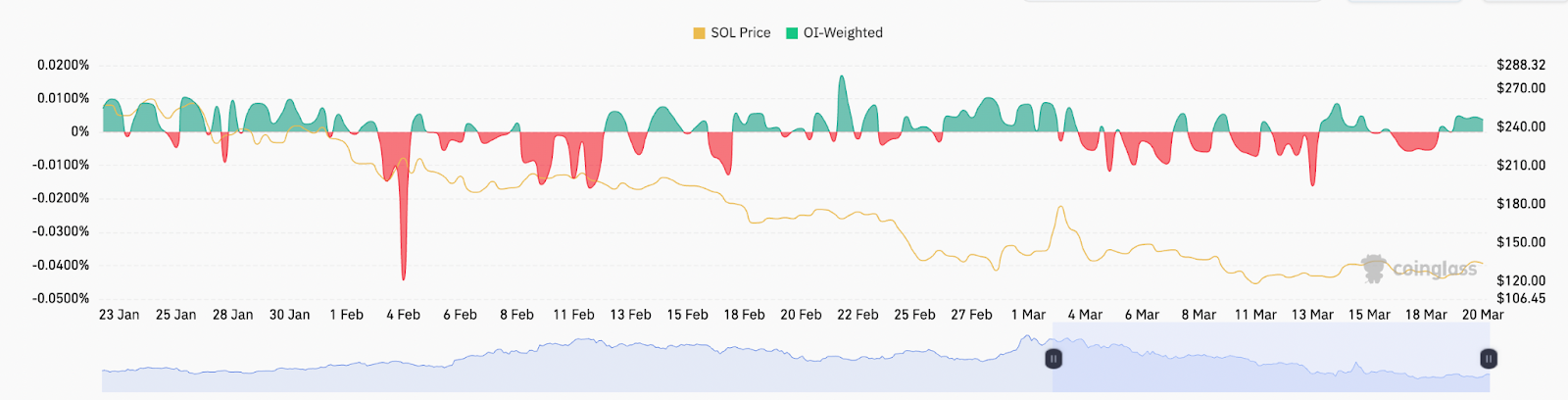

Additionally, the recent price increase is aligned with a rebound in SOL’s funding rates.

SOL funding rates performance.

Related: ‘I am ashamed’—Solana CEO addresses backlash regarding recent advertisement.

Will SOL Price Recover to $220?

Although SOL is currently trading significantly below its February 5 peak of $220, bullish trends have established support around $110 and $125 within a descending channel.

Since March 10, the daily relative strength index (RSI) has displayed consistent upward movement without divergence, suggesting robust upward momentum.

XRP/USD daily chart.

The immediate resistance level is positioned at $140; if surpassed, SOL may rally towards the $165 to $190 supply zone, where key moving averages are present.

In order to enhance the chances of achieving the $220 mark, bulls will need to convert this area into support, as a pause is likely at that level.

According to an analyst, the recent low of $112 signifies a potential bottom for the altcoin. They mentioned that Solana’s underlying fundamentals remain strong, buoyed by escalating investment interest from institutional players.

“Keeping all these factors intact, I foresee $SOL reclaiming the $200 level and ultimately breaking its all-time high of $296.”

This article does not constitute investment advice or recommendations. Every investment and trading action carries risk, and readers should conduct thorough research before making decisions.