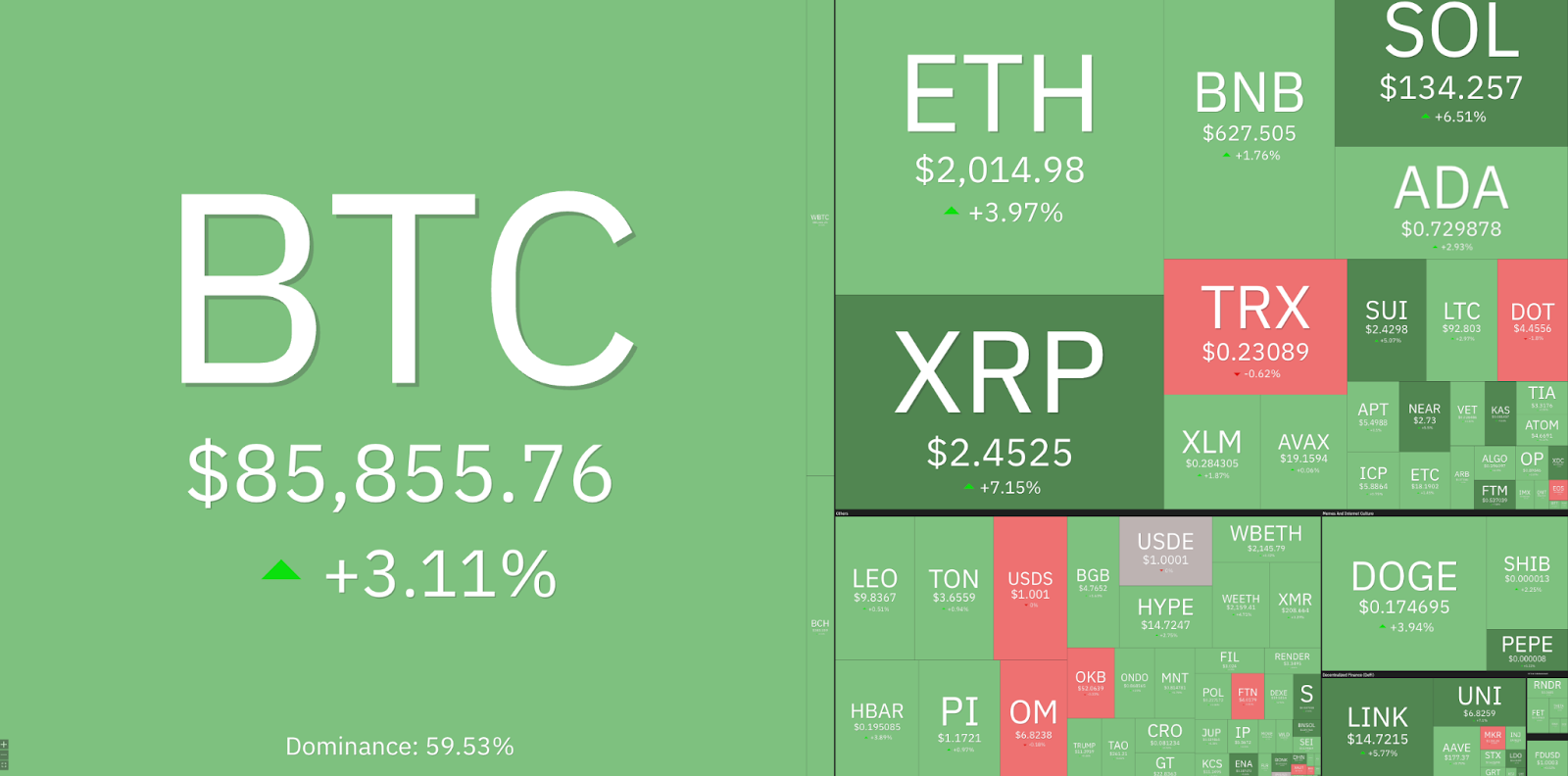

The cryptocurrency market is experiencing positive movement today, with the overall market capitalization increasing by about 3.2% over the last 24 hours, reaching approximately $2.8 trillion as of March 20. This upward trend has been primarily driven by Bitcoin (BTC) and Ether (ETH), which have seen gains of roughly 3% and 4%, respectively.

Crypto market performance as of January 30.

Let’s examine the key factors contributing to the cryptocurrency market’s recovery today.

Risk appetite drives crypto market upward

The rebound in the crypto sector reflects the gains seen in US stocks after the Federal Reserve opted to maintain interest rates.

-

The S&P 500 and Nasdaq indexes climbed by 1.08% and 1.4%, respectively, during late trading on March 19.

-

Shares in cryptocurrency-related firms also saw gains, with cryptocurrency exchange Coinbase (COIN) rising by 4.75% and MicroStrategy (MSTR) increasing nearly 7.4%.

BREAKING: The S&P 500 adds +$500 billion of market cap today as the Fed extends their rate cut pause for the 2nd straight meeting. pic.twitter.com/948U2U7gKe

— The Kobeissi Letter (@KobeissiLetter) March 19, 2025

-

The US Dollar Index (DXY) is currently at its lowest point since early November, down over 6.04% from its peak of 110.17 on January 13.

-

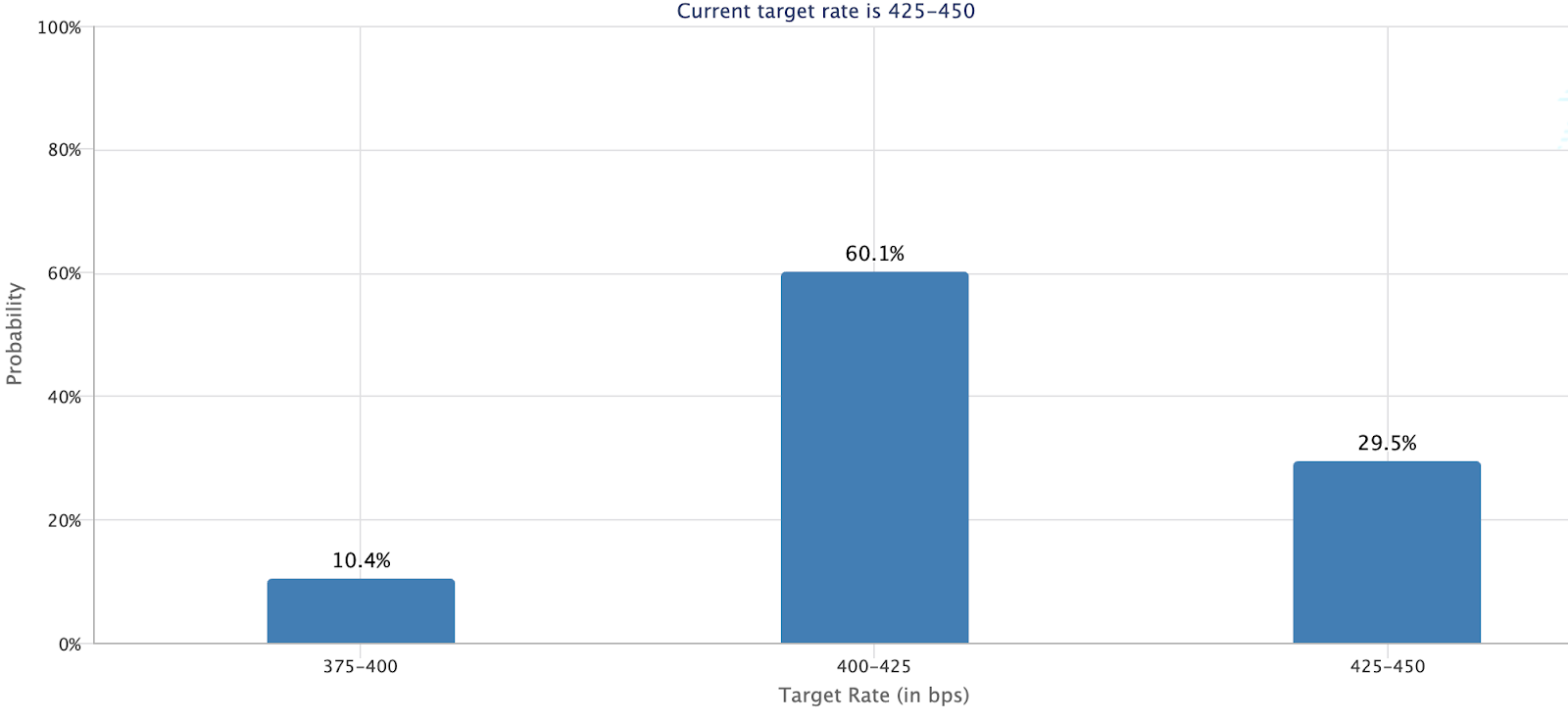

This drop follows the Federal Open Market Committee meeting, during which the central bank maintained interest rates at 4.25%-4.50%, aligning with market predictions.

-

The committee now anticipates two interest rate cuts by the year’s end.

-

Recent data from CME Group’s FedWatch Tool shows a 16% probability of a 0.25% cut in May, with those odds rising to 60.1% for June.

Fed target rate probabilities for the June 18 meeting.

-

As traders factor in a greater likelihood of interest rate decreases, there has been renewed interest in risk assets like cryptocurrencies.

Expectations for pro-cryptocurrency policies

Additionally, the upward trend is fueled by speculation that the US government is preparing to revise its cryptocurrency regulations.

Key highlights include:

BREAKING: President Trump will address DAS tomorrow.

This marks the first instance of a sitting President addressing a cryptocurrency conference. pic.twitter.com/x3gnGP0yAN

— Blockworks (@Blockworks_) March 19, 2025

-

There are indications that Trump will announce significant updates to his administration’s cryptocurrency policies.

-

“This would be his first major update since March 6, when the national cryptocurrency reserve was created,” noted a capital markets expert, adding:

“Rumors suggest that President Trump may be altering his strategy significantly.”

-

Trump’s recent statements regarding a potential Strategic Bitcoin Reserve and his favorable view of cryptocurrencies have generated excitement among investors.

-

Since his election, Bitcoin ETF inflows have surged to an all-time high of $3.4 billion weekly, with Bitcoin surpassing the $100,000 threshold before reaching new records above $109,000.

-

This trend illustrates institutional enthusiasm for a regulatory environment that is supportive of cryptocurrencies.

-

Combined with the Fed’s accommodating stance, this optimism has pushed BTC prices back above $85,000.

According to BitMEX co-founder Arthur Hayes, “QT is essentially over on April 1,” emphasizing that markets should now focus on potential SLR exemptions or a reboot of quantitative easing. He suggests that $77,000 appears to be the likely low point for Bitcoin.

JAYPOW delivered, QT basically over April 1. The next things we need to prepare for are either SLR exemption or restarting QE.

Was $BTC $77k the bottom? Probably. But stocks likely have more challenges ahead to fully sway Jay to join Team Trump, so stay alert and maintain cash positions.

— Arthur Hayes (@CryptoHayes) March 20, 2025

Related: A recession in the US could significantly impact Bitcoin: BlackRock

Technical rebound in the crypto market

Technical analysis indicates that today’s gains in the crypto market are part of a recovery that began after the market value fell to a multi-month low of $2.44 trillion on March 11.

Daily candle chart for total cryptocurrency market cap.

The total market cap, now at $2.77 trillion, is attempting to breach the resistance level situated between $2.8 trillion and $3 trillion, coinciding with both the 200-day and 50-day SMAs.

If successful, this could signify a bullish breakout from the current downtrend, with traders targeting previous all-time highs around $3.20 trillion, identified as the 100-day SMA.

Meanwhile, the daily Relative Strength Index (RSI) has risen from near oversold territory at 31 on March 11 to 47, indicating building bullish momentum.

This article does not provide investment advice or recommendations. All investments and trading come with risks, and readers are encouraged to conduct their own research before making decisions.