The price of XRP surged on Wednesday following the announcement from Ripple’s CEO, Brad Garlinghouse, that the U.S. Securities and Exchange Commission would be withdrawing its appeal in the ongoing lawsuit against the company. After Garlinghouse’s tweet on X, XRP experienced a significant double-digit increase.

The protracted legal conflict between the U.S. financial regulator and Ripple has lasted for several years and is finally coming to a conclusion. Traders in the cryptocurrency market had anticipated this outcome, especially given the SEC’s swift dismissal of legal actions against various crypto exchanges and companies since January 2025, coinciding with the return of U.S. President Donald Trump to office.

This analysis explores whether XRP represents a sound investment amidst the recent price dip and what we might expect from the native token of XRPLedger in the coming week.

XRP sees double-digit rally; should you invest now?

XRP saw a rally as traders responded positively to the groundbreaking news about the SEC dropping its appeal against Ripple. The sustained legal dispute between these two parties has garnered extensive media coverage for years, adversely affecting both the price of XRP and its adoption.

The SEC’s lawsuit against Ripple, initiated in 2020, led to major exchanges removing the token from their platforms, resulting in a significant price decline. Wednesday’s increase in XRP was a reaction from traders to the conclusion of this long-standing conflict.

While XRP was expected to continue its upward trajectory, it has since receded slightly from Wednesday’s gains as of this report.

XRP is currently trading at $2.4013, reflecting a decrease of nearly 6% since Wednesday, according to data.

Technical indicators on the daily chart suggest a potential for price gains for XRP. As market volatility begins to stabilize, the altcoin may rise in the coming week. The low of $2.2653 from Wednesday serves as a support level for XRP; closing a daily candlestick below this point could indicate a possible trend reversal.

Ripple lawsuit concludes; CEO delivers surprising news on X

While the announcement regarding the end of the Ripple lawsuit was anticipated by seasoned traders, it caught newcomers and less experienced market participants off guard. For several years, the SEC had extended its legal confrontation with Ripple but has recently withdrawn from multiple crypto-related investigations before reaching this conclusion.

Garlinghouse expressed confidence in his proclamation about the legal battle’s conclusion but noted that the commission has yet to officially vote on or endorse the decision to withdraw the appeal in the SEC vs. Ripple case.

The absence of a defined timeline or confirmation from the U.S. financial regulator might be a significant factor contributing to the recent drop in XRP’s price. Although traders reacted favorably to the news of the lawsuit’s resolution, the uncertainty surrounding an official declaration remains a concern. A formal announcement could help alleviate trader apprehension and potentially lead to further gains for XRP.

Garlinghouse’s tweet was supported by Ripple’s Chief Legal Officer Stuart Alderoty and was positively received by XRP holders and crypto traders alike.

XRP weekly price prediction

The daily price chart for XRP/USDT indicates the potential for additional gains for the second-largest altcoin. The native token of XRPLedger may aim for the $2.59 mark in the upcoming week, hinting at a modest 7% increase from its current price.

XRP is on track to continue its ascent, as both the RSI and MACD indicators show positive momentum in the altcoin’s price trend. Currently, the RSI is at 50, which is considered neutral, while the MACD displays a series of rising green histogram bars, reflecting positive sentiment on the XRP/USDT price chart.

If the price of XRP declines, it may drop to the February 3 low of $1.7711, though a rebound from this level is anticipated, given several bullish imbalance zones that lie ahead.

A decline in XRP’s value could see it tested against the February 3 low of $1.7711. There, the altcoin is likely to find support with several bullish imbalance zones aiding a recovery.

XRP derivatives and on-chain assessment

Data from Coinglass indicates that the long/short ratio for XRP is greater than 1 on most derivatives exchanges, signaling that derivatives traders are generally optimistic about the rise of XRP’s price. On Binance and OKX, the long/short ratios stand at 2.45 and 2.06, respectively.

In the past 24 hours, over $20 million in derivative positions were liquidated, predominantly long positions, as traders anticipated a price increase for XRP while the token experienced a decline on Thursday.

An analysis of derivative data suggests that potential buyers should hold off on establishing long positions in XRP for now. It appears that profit-taking is the prevailing trend while XRP maintains its position above the $2.2653 support level.

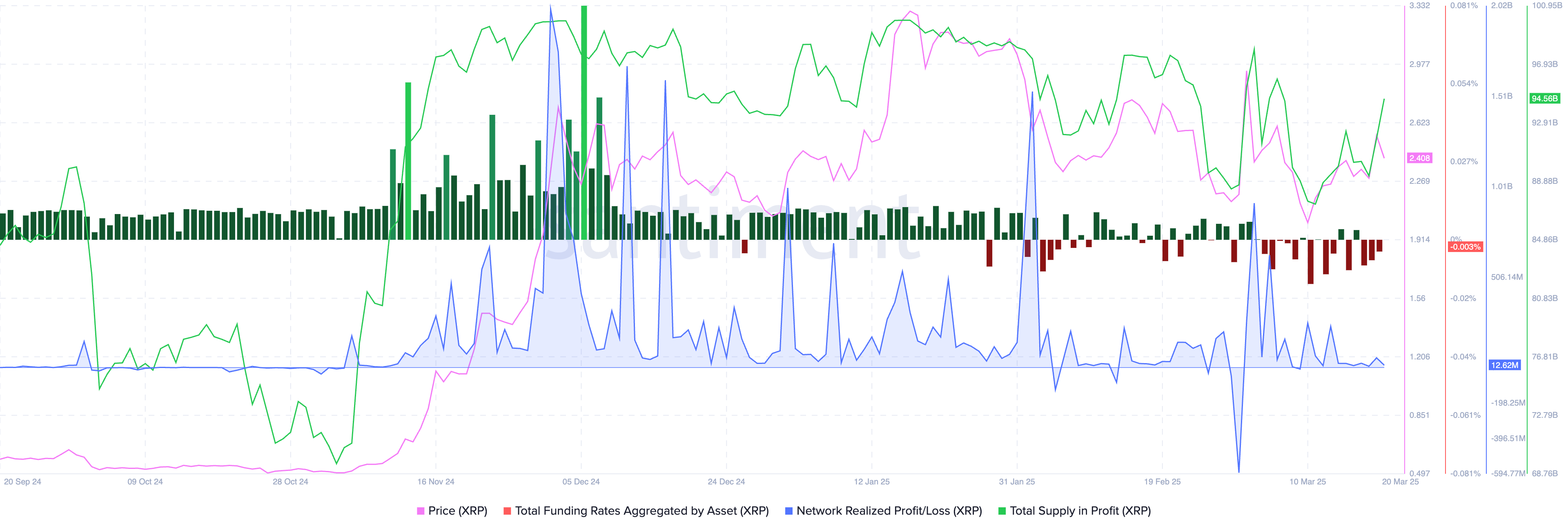

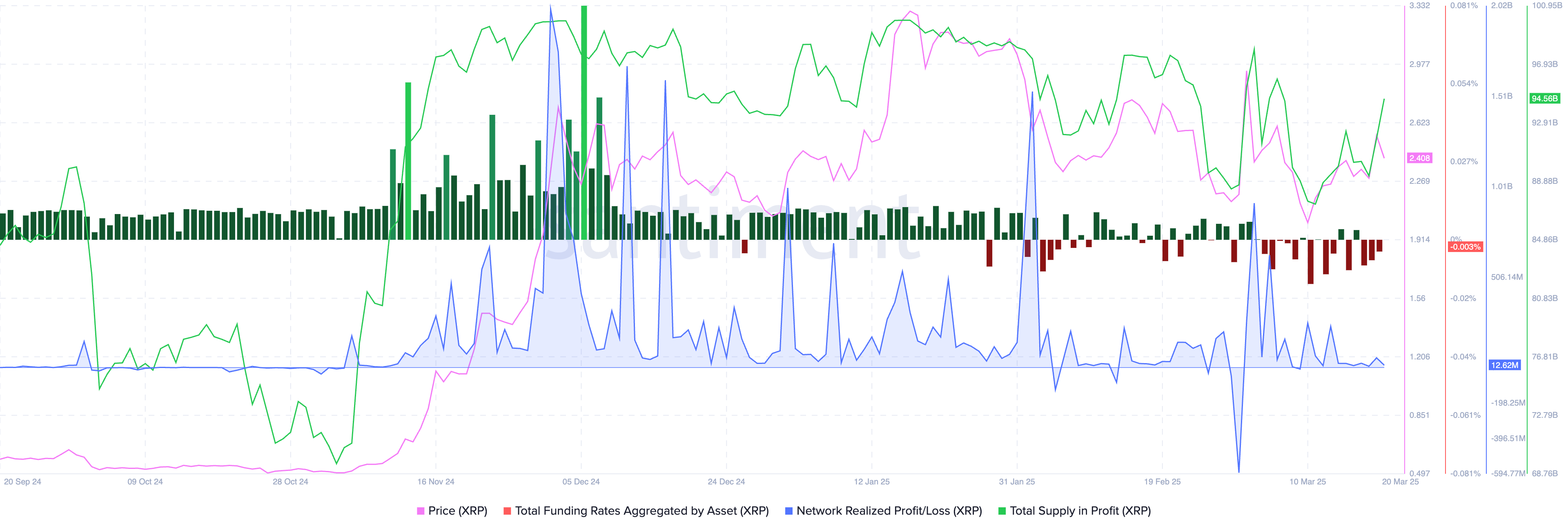

According to Santiment, the total XRP supply in profit rose to 94.56 billion on Thursday, despite the price drop. The network’s realized profit and loss metric, which assesses whether traders are making gains on their holdings or incurring losses on tokens transferred on a particular day, indicates an ongoing trend of profit-taking by XRP holders.

Typically, sustained profit-taking can lead to increased selling pressure on XRP and could negatively impact its price. However, technical indicators point to a likelihood of price gains, suggesting traders should brace for volatility in the altcoin over the coming week.

Funding rates for XRP have shown negative sentiment, indicating a bearish outlook for the token. Potential buyers are advised to proceed with caution before expanding their positions during this ongoing price retracement, waiting for clearer signals from technical indicators.

What lies ahead for XRP

With 11 XRP Exchange-Traded Fund filings currently pending with the SEC, Garlinghouse informed crypto traders that approval for an XRP spot ETF is likely in the latter half of 2025. Many in the crypto trading community regard this as one of the most significant catalysts expected this year, mirroring the launch of Bitcoin (BTC) spot ETFs in 2024 that spurred a major bull market.

Garlinghouse expressed optimism about two crucial milestones for XRP—its potential inclusion in the U.S. crypto stockpile and ETF approval expected by H2 2025. He elaborated on these topics and more in a recent interview.

Disclosure: This content is not intended as investment advice. The information provided on this page is solely for educational purposes.