The shift towards pro-crypto policies in the United States has become a commitment embraced by both major political parties, as they aim to preserve the strength of the US dollar as a global reserve currency. California Democrat Ro Khanna, a US Representative, notes that over 70 of his colleagues from the same party now recognize the crucial need for stablecoin regulation.

Khanna indicates that this year, Americans can anticipate the introduction of thoughtful structures for the crypto market and bills related to stablecoins. Normally, such news would trigger a surge in crypto prices; however, this has not happened, as concerns over recession due to President Trump’s trade policies loom large.

Cathie Wood, CEO of ARK Invest, has joined the chorus of voices warning about the impending recession. While the prospect of a recession is rarely positive, Wood mentioned it might give Trump and the Federal Reserve the flexibility to implement growth-oriented strategies.

“We are worried about a recession” — Cathie Wood

Despite US Treasury Secretary Scott Bessent feeling optimistic about avoiding a recession, Wood is taking precautions against that possibility.

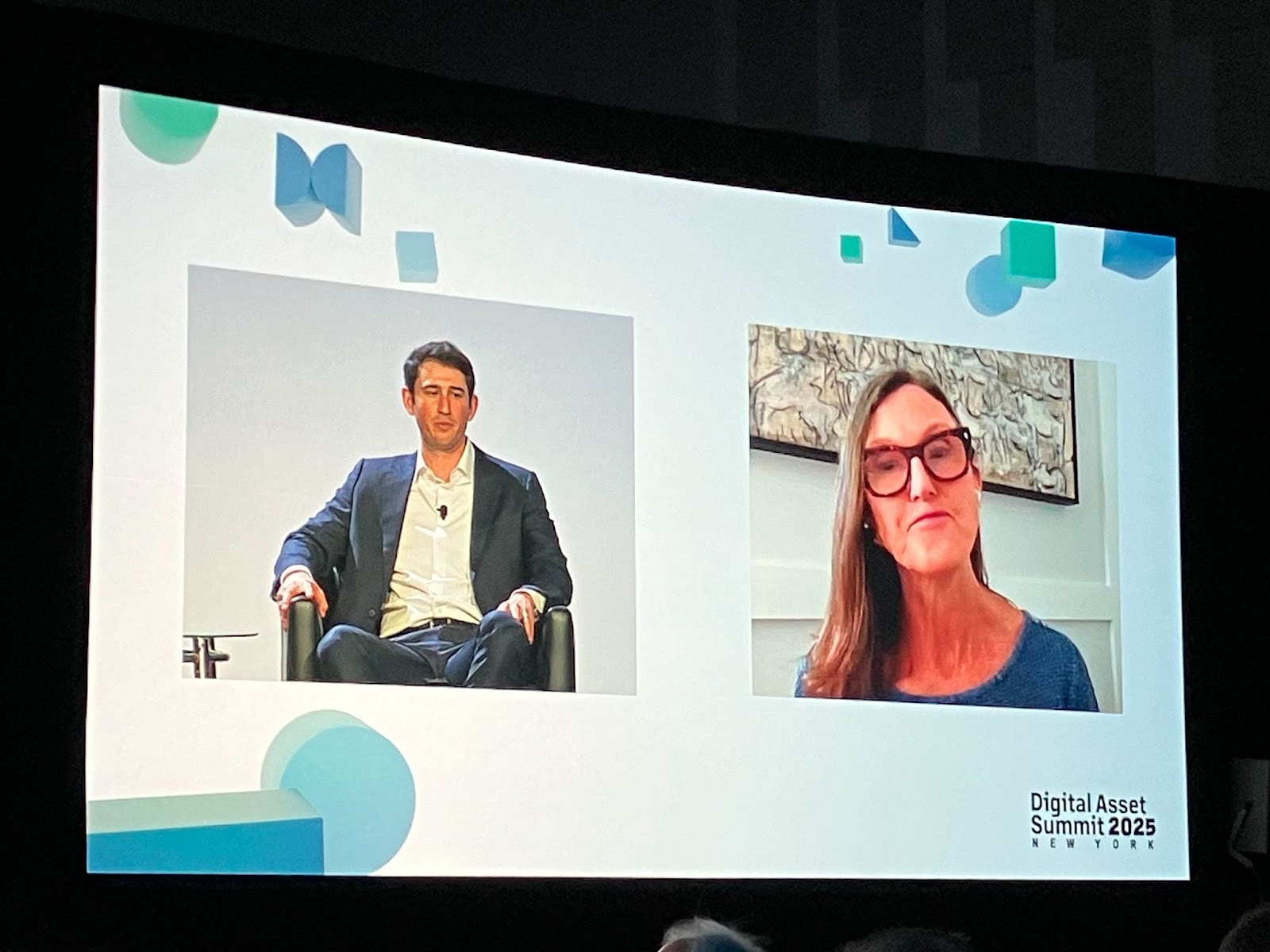

During a virtual address at the Digital Asset Summit in New York, Wood suggested that the White House might be underestimating the recession risks associated with Trump’s recent trade conflicts.

“We are worried about a recession,” Wood said. “We believe the velocity of money is slowing significantly.”

A decline in the velocity of money indicates that capital is being exchanged less frequently as both consumers and businesses cut back on expenditures. Such trends usually herald the beginning of a recession.

Nevertheless, the pressures of a recession could potentially benefit riskier assets like crypto, as a declining GDP might provide “the president and the Fed with considerably more latitude to implement tax cuts and adjust monetary policy,” Wood stated.

Cathie Wood addresses the Digital Asset Summit, emphasizing the growing threat of recession. Source: Cointelegraph

US stablecoin legislation is “imminent” — Bo Hines

According to Bo Hines, the newly appointed executive director of Trump’s Presidential Council of Advisers on Digital Assets, the US could see comprehensive stablecoin legislation in as soon as two months.

At the Digital Asset Summit in New York, Hines praised the Senate Banking Committee’s bipartisan endorsement of the Guiding and Establishing National Innovation for US Stablecoins Act, also referred to as the GENIUS Act.

“The bipartisan vote from the Senate Banking Committee was a fantastic outcome,” Hines remarked.

The GENIUS Act aims to create clear standards for US stablecoin issuers, including requirements for collateralization and adherence to Anti-Money Laundering regulations.

“I believe our colleagues across the aisle appreciate the significance of maintaining US leadership in this domain, and they’re ready to collaborate, which is truly exciting,” Hines added.

Bo Hines suggests US stablecoin legislation may be on President Trump’s desk within two months. Source: Cointelegraph

Ethena Labs and Securitize introduce DeFi-centered blockchain

Ethena Labs and Securitize are set to unveil a new blockchain aimed at enhancing the adoption of DeFi products and tokenized assets among retail and institutional investors.

The new blockchain, named Converge, will operate on the Ethereum Virtual Machine, providing retail investors with access to “standard DeFi applications” while focusing on institutional-grade offerings to connect traditional finance with decentralized applications. Additionally, Converge will enable users to stake Ethena’s native governance token, ENA.

Converge will also utilize Securitize’s Real-World Asset (RWA) infrastructure, which has already successfully minted nearly $2 billion in tokenized RWAs across various blockchains, including the BlackRock USD Institutional Digital Liquidity Fund, which originated on Ethereum and has branched into networks like Aptos, Arbitrum, Avalanche, Optimism, and Polygon.

Canary Capital applies for Sui ETF

Canary Capital has filed an application with the US Securities and Exchange Commission (SEC) for an exchange-traded fund linked to Sui (SUI), the native token of the layer-1 blockchain used for staking and transactional fees.

The filing, submitted on March 17, highlights the heightened competition to broaden institutional access to digital assets following the tremendous success of last year’s spot Bitcoin (BTC) ETFs. So far, Canary Capital has filed six crypto ETF proposals with the SEC.

Sui ranks as the 22nd largest cryptocurrency by market capitalization, boasting a total value of $7.5 billion, as per CoinGecko. The Sui blockchain has recently joined forces with World Liberty Financial, the DeFi venture supported by Trump’s family.

Crypto Biz is your weekly update on the business dynamics of blockchain and crypto, delivered directly to your inbox every Thursday.