The Australian government, led by its center-left Labor Party, has introduced a new framework for regulating cryptocurrency exchanges under existing financial services legislation while also committing to address the issue of debanking.

This announcement comes in the lead-up to a federal election expected by May 17, with current polls indicating a closely contested race between Prime Minister Anthony Albanese’s Labor and the Coalition headed by Peter Dutton.

A statement made by the Treasury on March 21 noted that the new regulations will apply to crypto exchanges, custody services, and certain brokerage firms involved in trading or storing digital currencies.

The new regulatory framework will impose compliance requirements similar to those for other financial services in the nation, including adherence to rules that protect customer assets, obtaining an Australian Financial Services License, and fulfilling minimum capital obligations.

The Treasury outlines four priorities for the new crypto regulations.

The Treasury’s statement indicated, “Our legislative reforms will apply existing financial services laws to critical digital asset platforms, though not to the entire digital asset ecosystem.”

Platforms that are small or startup entities not meeting defined size thresholds will be exempt from these regulations, along with companies focused on developing blockchain software or producing digital assets that do not qualify as financial products.

Under the government’s Payments Licensing Reforms, payment stablecoins will be categorized as a type of stored-value facility, although certain stablecoins and wrapped tokens will not fall under this definition.

Furthermore, the Treasury emphasized that trading or secondary market transactions involving these products will not be classified as dealing activities, meaning platforms facilitating such trades will not be deemed to operate a market simply due to this activity.

As part of its cryptocurrency strategy, the Albanese administration has also committed to collaborating with Australia’s four largest banks to gain a better understanding of the prevalence and implications of debanking.

A review of a central bank digital currency and an Enhanced Regulatory Sandbox is also planned for 2025, which will allow companies to pilot new financial products without needing a formal license.

Related: The upcoming election could lead to significant institutional interest in crypto.

The Labor government plans to circulate a draft of the proposed legislation for public feedback. However, a potential government shift may be on the horizon as the federal election approaches, which has not yet been officially scheduled.

Earlier, Dutton’s Coalition has promised to focus on crypto regulation should they secure election victory.

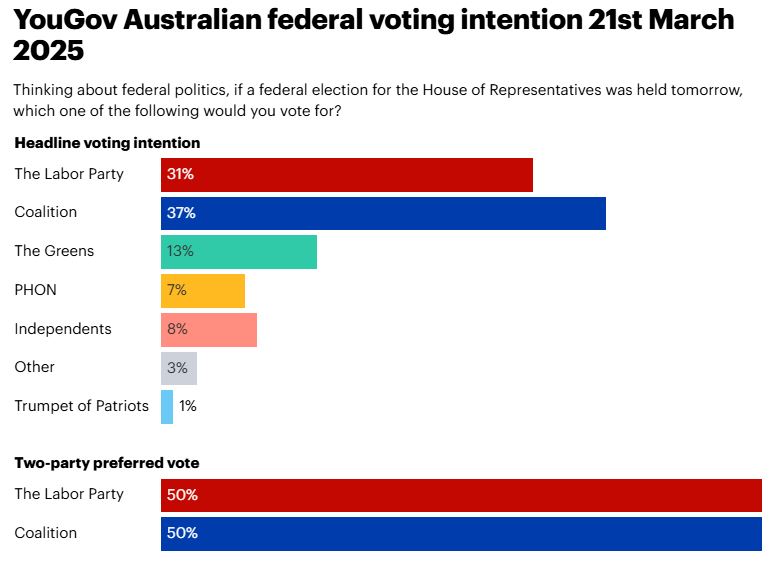

The most recent poll from YouGov, published on March 20, shows the Coalition and Labor virtually tied in the two-party preferred vote.

The Coalition leads in overall voting intentions, while Albanese remains the preferred prime minister.

Caroline Bowler, CEO of a local cryptocurrency exchange, stated that the proposed reforms are logical and would help maintain Australia’s competitiveness alongside global counterparts.

However, she expressed the need for “more detailed information on capital adequacy and custody demands.”

Bowler noted the importance of ensuring that these requirements do not create excessive barriers to business investment in Australia.

Jonathon Miller, managing director of Kraken Australia, highlighted the pressing necessity for tailored crypto legislation to resolve the existing confusion and uncertainty in the industry.

“By creating a clear regulatory framework for cryptocurrencies and tackling issues such as debanking, the government can eliminate obstacles hindering economic growth in Australia,” he stated.

Magazine: Challenges ahead for blockchain governance in Elon Musk’s vision.