Bitcoin enthusiasts who believe the peak of the current cycle has not yet arrived due to a lack of retail investor participation may be relying on outdated strategies, according to a crypto industry leader.

“The assumption that the cycle isn’t complete simply because there’s no on-chain retail activity deserves re-evaluation,” stated the founder and CEO of a prominent crypto analytics firm in a post on March 19.

This executive pointed out that those who monitor retail investor movements strictly through on-chain data may not have a complete understanding of the situation.

“Retail investors are likely entering the market via ETFs — the paper Bitcoin avenue — which remains invisible on-chain,” he explained.

“This results in a lower realized cap than if the funds were being deposited directly into exchange wallets,” he elaborated, noting that a significant 80% of spot Bitcoin ETF transactions originate from retail investors—a trend previously highlighted by analysts at another major exchange last October.

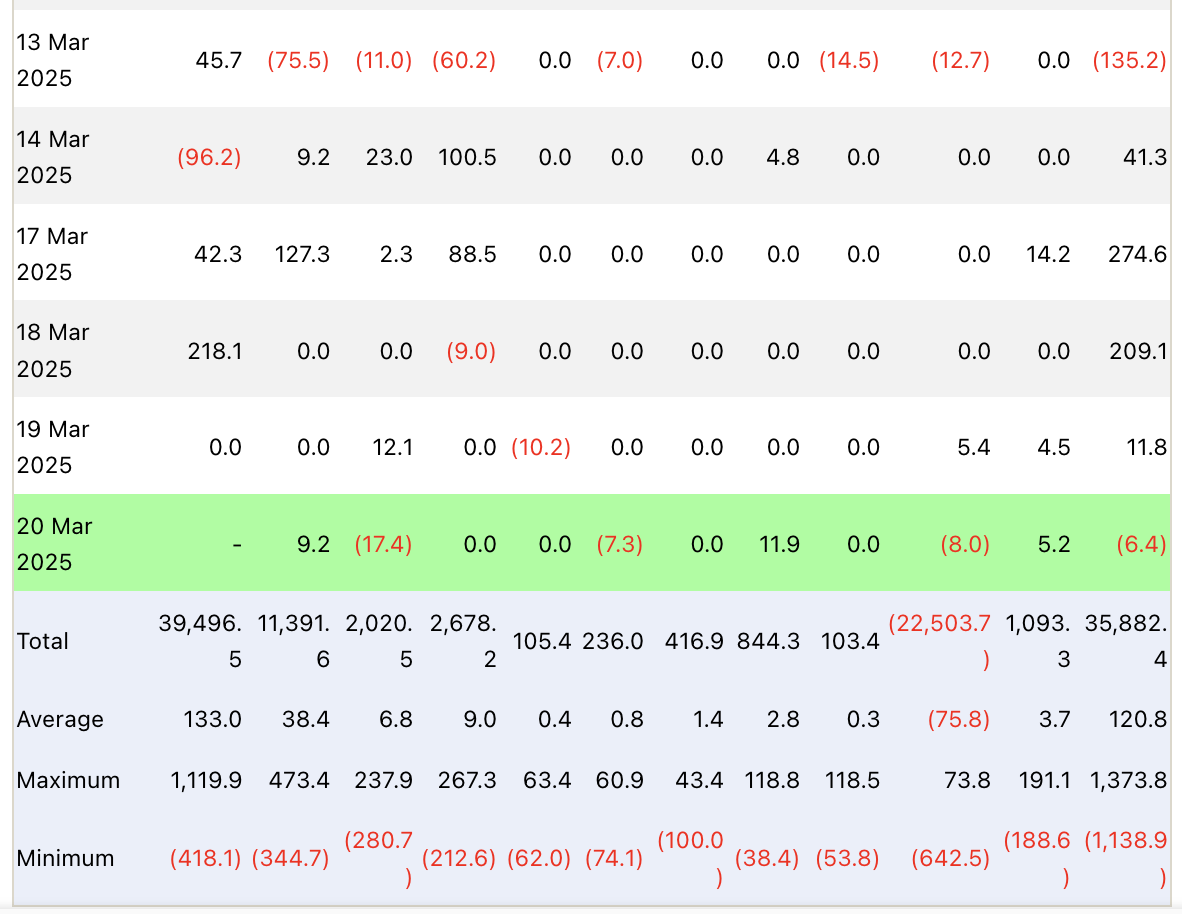

Since the launch of spot Bitcoin ETFs in January 2024, the inflow totals have reached approximately $35.88 billion.

Previously, analysts pointed out that the majority of ETF purchases likely came from retail investors transferring their assets from wallets and exchanges into more regulated funds.

This executive was addressing counterarguments to his earlier prediction on X, made on March 17, that the “Bitcoin bull cycle has ended.”

“I’ve been anticipating a bull market for the past two years, even amid uncertain signals. I regret to shift my stance, but it appears we are now entering a bear market,” he commented.

He explained that various indicators are suggesting a slowdown in new liquidity, which is likely influenced by broader macroeconomic factors.

Additionally, he clarified that when he mentioned the bull cycle was over, he meant that Bitcoin could take “6-12 months” to surpass its previous all-time high, not that a crash is imminent.

Market participants often analyze retail investor behavior to identify signs of fatigue or to decide when to sell if the market seems overextended.

Numerous sentiment indicators aid those in the market to gauge the level of retail interest. One such indicator is the Crypto Fear & Greed Index, which recently recorded a “Fear” score of 31, a decline of 18 points since its “Neutral” score of 49 from the day before.

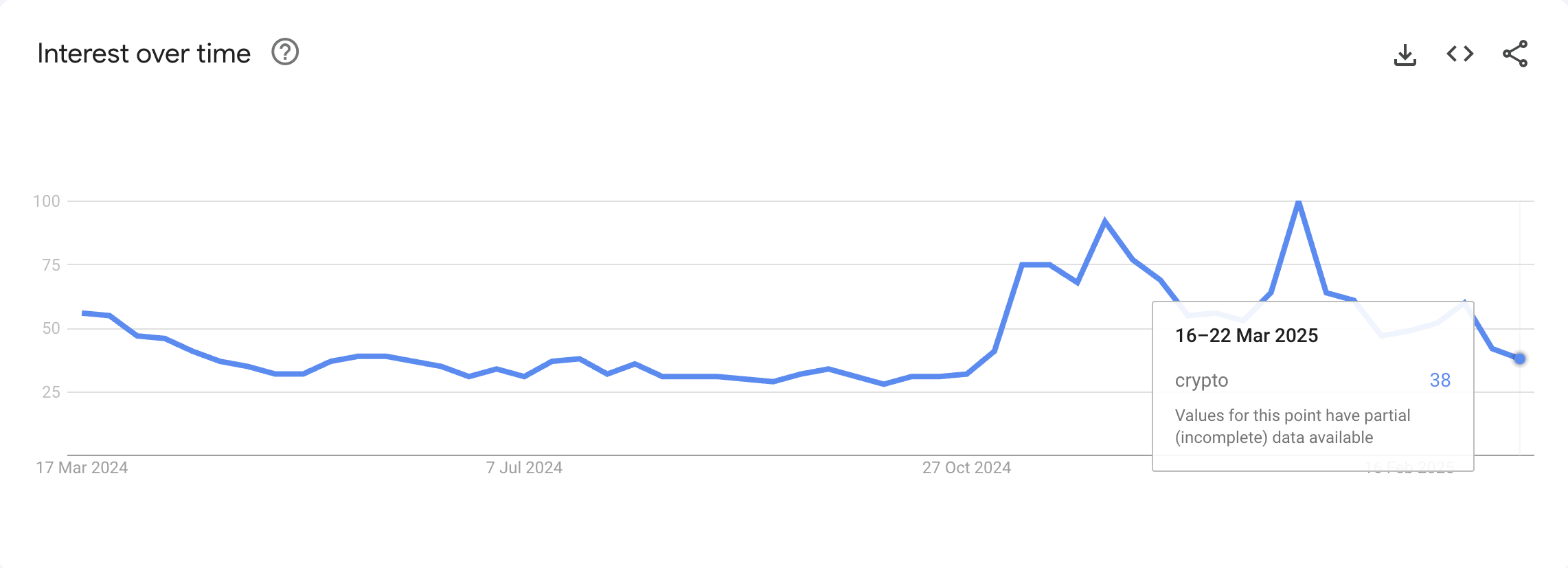

Other common methods to track retail interest in cryptocurrencies include Google search trends for the term “crypto” and the popularity of crypto-related applications in key app stores globally.

While the worldwide Google search score for “crypto” peaked at 100 during the week of January 19-25, coinciding with Bitcoin hitting its all-time high of $109,000 and the inauguration of U.S. President Donald Trump, it has since fallen by nearly 62%.

Search interest for the term “crypto” on Google has decreased by almost 62% since late January.

As of the time of this writing, the Google search score for “crypto” stands at 38, with Bitcoin trading 22% below its January peak.

Note: This article is not intended as investment advice. Every investment carries risk, and it is crucial for readers to conduct their own research before making any investment decisions.