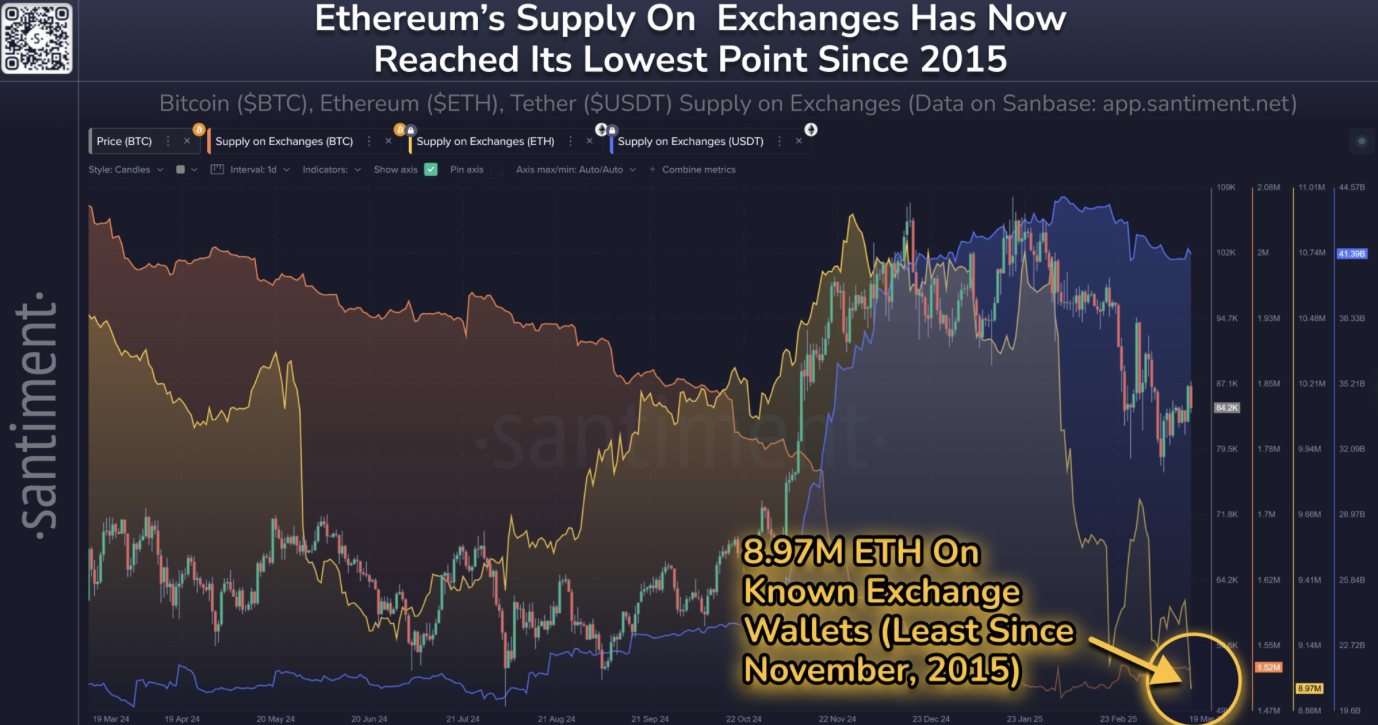

The supply of Ether on cryptocurrency exchanges has plummeted to its lowest point since November 2015, prompting analysts to speculate about a significant price surge in spite of recent negative trends.

Current data indicates that Ethereum’s available supply on exchanges has dwindled to 8.97 million, marking its lowest level in almost a decade (since November 2015). This development has sparked discussions among market observers about future price movements.

Ether’s supply on crypto exchanges has reached a historic low since November 2015.

Reports indicate that a significant amount of ETH has been leaving exchanges, with current balances reflecting a 16.4% decrease since the end of January. This trend suggests that investors are opting to transfer their ETH into cold storage wallets, indicating a long-term holding strategy fueled by growing confidence in a potential price increase for Ether (ETH).

A notable reduction in ETH supply on exchanges may indicate an impending price jump, often referred to as a “supply shock.” However, such a rally can only occur if demand remains robust or increases sufficiently to outstrip the dwindling supply.

A recent example is seen with Bitcoin (BTC), where on January 13, reserves across all exchanges fell to 2.35 million BTC, the lowest figure recorded since June 2018. Shortly after, Bitcoin’s price skyrocketed to a new peak of $109,000 coinciding with the inauguration of President Donald Trump.

Some traders and analysts foresee a similar situation unfolding for Ether.

One trader expressed to their 230,800 followers that it’s merely a matter of time before a major supply shock occurs.

Another commentator stated that as ETH supply on exchanges continues to diminish daily, “buyers will soon engage in bidding wars.”

Related: ‘Successful’ ETH ETF less perfect without staking — BlackRock

Additionally, another trader noted on the same day that significant accumulation of ETH is underway, potentially pushing the price to between $8,000 and $10,000. Even at the lower bracket of $8,000, that would represent a 64% increase from its all-time high of $4,878 in November 2021.

While the decrease in supply provides a glimmer of hope for traders, there are other indicators that have cast a shadow over Ether’s outlook.

Its performance against Bitcoin is currently at its lowest in five years. One analyst observed that it seems unlikely for Ether to regain its previous highs anytime soon.

Ether has dropped 26% in the past 30 days.

As it stands, Ether is trading at $1,971, representing a 26% decline over the last month. Furthermore, spot Ethereum ETFs have experienced 12 consecutive days of outflows totaling $370.6 million.

“This has been one brutal downtrend,” remarked one analyst.

A well-known trader commented, “Ethereum is at a critical juncture; either it rebounds now marking a generational low, or it’s finished.”

Magazine: Memecoins may be fading — But Solana is ‘100x better’ despite a revenue drop

This content does not offer investment advice or recommendations. All investment and trading activities entail risk, and readers should conduct their own research when making decisions.