The current administration seems ready to expand its Strategic Bitcoin Reserve after a key advisor on crypto suggested budget-friendly methods for acquiring more of the digital currency.

“There have been numerous proposals” regarding how the government can increase its Bitcoin (BTC) holdings, said Bo Hines, executive director of the President’s Council on Digital Assets, during a discussion on a podcast.

Hines expressed that the crypto council welcomes innovative strategies to enhance the government’s Strategic Bitcoin Reserve.

One potential approach could involve capitalizing on the gains from the government’s gold certificates, which are valued significantly below the current market price of gold.

“I’ll direct you to Senator [Cynthia] Lummis’ Bitcoin Act of 2025, where she believes we can determine the actual value of some of these gold certificates,” Hines stated.

“If we were to realize profits from [these assets], it would offer a budget-neutral method for acquiring additional Bitcoin,” he explained.

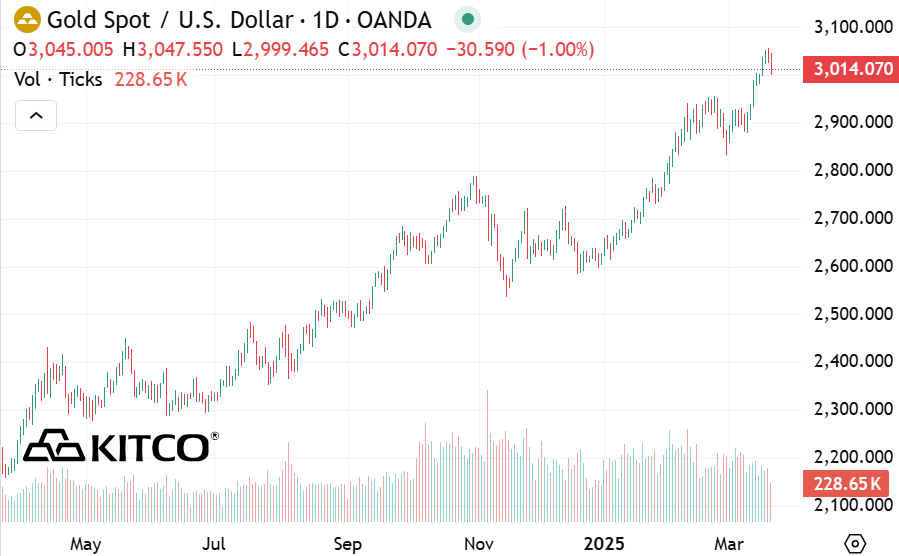

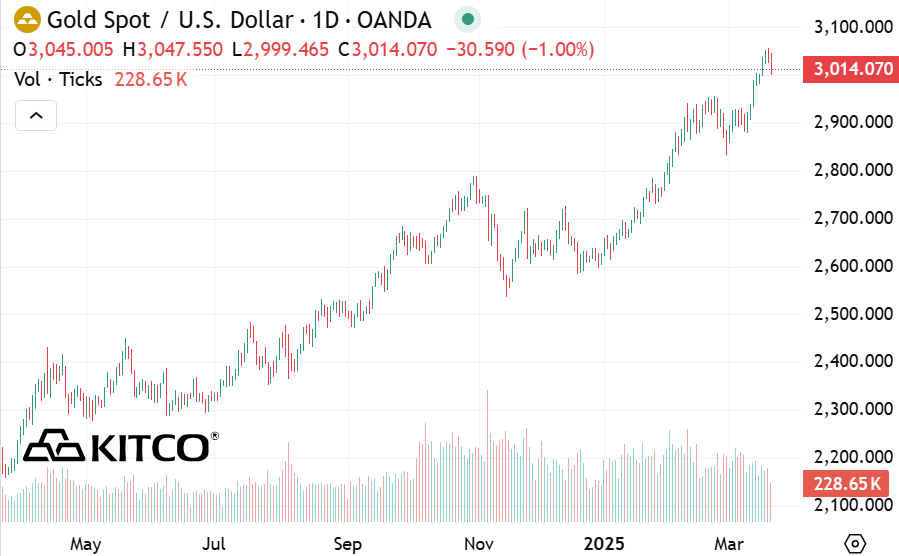

As outlined by the Federal Reserve Bank of St. Louis, all gold certificates in Federal Reserve banks are “valued at a statutory price of $42.22 per troy ounce,” while spot gold is currently priced over $3,000 an ounce.

The spot price of gold has surged by 40% in the past year.

The proposed Bitcoin Act of 2025 identifies “Federal Reserve System gold certificates” as a potential funding source for Bitcoin acquisitions.

The legislation mandates that Fed banks “submit all gold certificates in their possession to the Treasury Secretary” so that new certificates can be issued reflecting the equitable market value of the gold backing those certificates.

Hines indicated his willingness to consider any suggestions for growing the reserve, as long as it “doesn’t burden taxpayers.” This is the essence of budget-neutral strategies for Bitcoin acquisition outlined in an executive order from early March.

“With all the participants from various agencies coming together in these meetings, I anticipate we’ll receive remarkable proposals on how to proceed. However, I don’t want to limit our scope at this point, as I’m eager to hear input from everyone.”

Currently, the U.S. government possesses approximately 207,000 BTC, seized through civil and criminal actions, making it the largest known holder of Bitcoin among nations.

Bitcoin holdings by nation-state.

Related: Stablecoin legislation expected in the ‘next 2 months’ — key crypto advisor

Bitcoin’s Unique Position

During the discussion, Hines emphasized Bitcoin’s unique position, suggesting that the administration’s approach to the strategic reserve differs notably from their handling of other digital assets.

“We designed the [Strategic Bitcoin Reserve] in this manner because Bitcoin is exceptional. It’s a commodity rather than a security,” Hines noted, adding:

“As David [Sacks] puts it, it’s had an immaculate conception—there’s no issuer. It possesses inherent stored value and is widely recognized as a store of value. We aimed to clarify that distinction between the stockpile and the reserve.”

Following the announcement regarding plans for a digital asset stockpile, which includes some high-cap altcoins, the administration swiftly defended Bitcoin’s unique status. Even the Commerce Secretary, Howard Lutnick, clarified that Bitcoin would be handled differently compared to the other listed altcoins.

The administration is progressing in its cryptocurrency legislative efforts through bipartisan collaboration.

A California Congressman, Ro Khanna, indicated that Congress is poised to pass legislation regarding stablecoins and crypto market structure within the year.

Khanna pointed out that a majority of Democratic lawmakers now recognize the significance of stablecoin legislation.

Magazine: Unstablecoins: Risks of depegging, bank runs, and more