Bitcoin (BTC) experienced a recovery of up to 14% after dropping to a four-month low around $76,600 on March 11. However, it remains about 25% lower than its peak of approximately $110,000, which is typical for a “bull market correction.”

Despite this rebound, some experts expect further declines in Bitcoin’s price in the future.

“Dark cloud” signals a potential peak for Bitcoin

Bitcoin is coming under increasing bearish pressure after failing to break past $87,470, the resistance level of a descending channel. This is further confirmed by a “dark cloud cover” pattern that indicates a continuation of the downward trend, as per insights shared on X.

BTC/USD daily price chart.

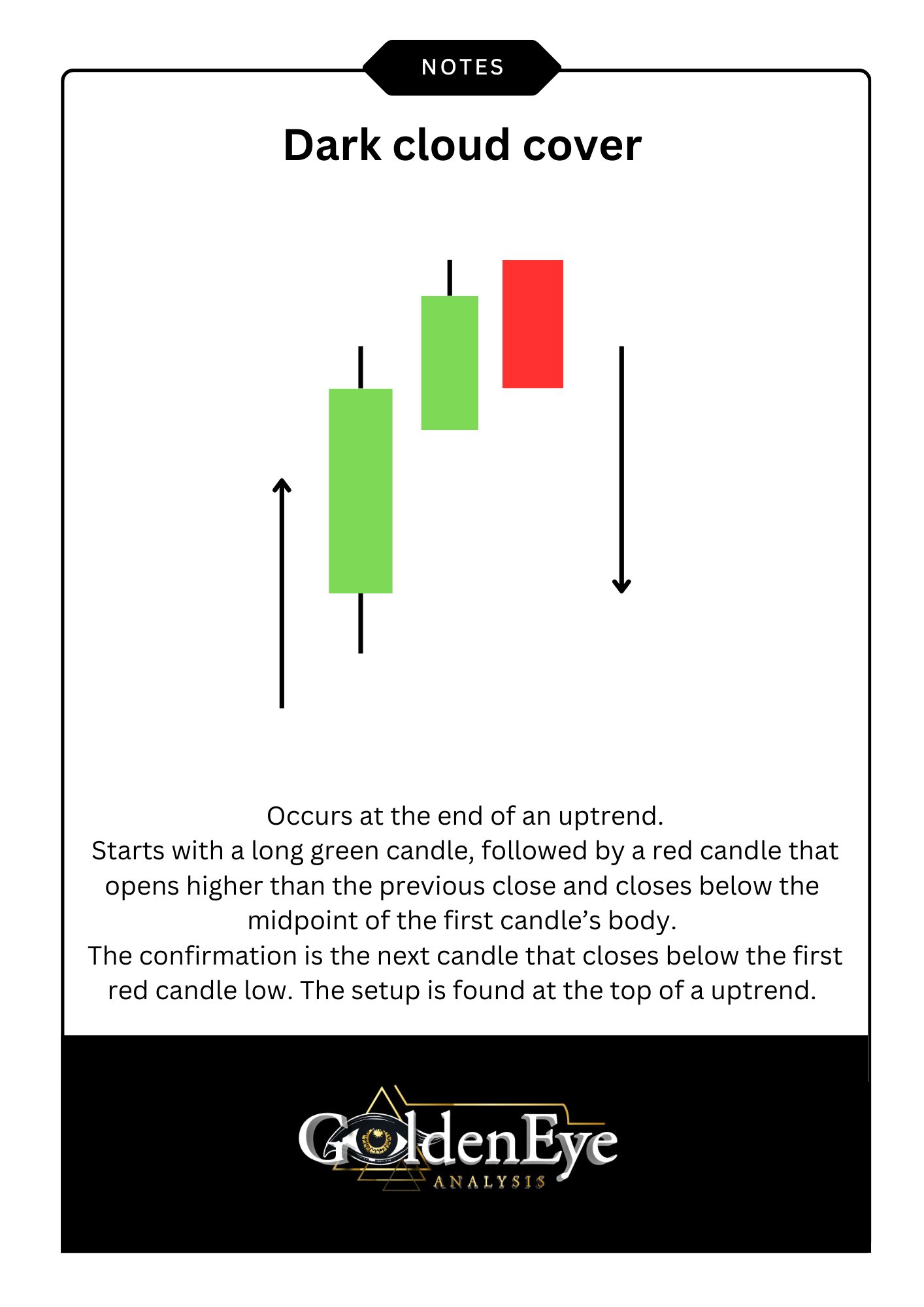

The dark cloud cover pattern appears when a significant green candle is followed by a red candle that opens above the previous close but finishes below the midpoint of the first candle’s body.

Illustration of a dark cloud cover.

This shift in market sentiment suggests that buyers tried to push prices higher but were outmatched by sellers, which often results in further declines.

The inability of Bitcoin to close within the resistance zone of $90,000-$93,000 signals a lack of buyer confidence, highlighting that the cryptocurrency will likely remain under bearish pressure unless it breaks above this range decisively.

“Perfect rejection” could lead to a drop to $65,000

Bitcoin’s risk of further decline stems from what has been termed a “perfect rejection” after approaching the $86,000-88,000 zone as resistance, according to analysis from a well-known trader.

Related: Insights into why Bitcoin price struggles to surpass $87.5K

Importantly, Bitcoin attempted to ascend toward the local supply zone, marked in red, but was unable to hold above this resistance, as shown by the orange circle in the accompanying chart.

BTC/USD hourly price chart.

The failure to reclaim this supply zone has increased the likelihood of a downturn towards lower support levels around $77,000-79,000 (highlighted in green) by March. Historically, testing this area as support has resulted in sharp rebounds during the month.

However, if this support zone is breached, a more significant decline below the $77,000-79,000 area could potentially drop to the $65,000-74,000 range, which represents the broader liquidity zone illustrated in the chart above, by April.

Another analyst shared a similar perspective, as evidenced below.

Source of the analysis.

“Challenging to maintain a bullish stance” amid bear flag patterns

As noted by an analyst, Bitcoin continues to move in tandem with traditional stock markets, particularly the S&P 500 and Nasdaq 100, both of which are exhibiting bear flag formations on their charts.

A bear flag develops when prices consolidate higher within a rising parallel channel. The pattern typically resolves if the price dips below the lower trendline, potentially dropping by an amount equivalent to the height of the previous downtrend.

Source information.

Bitcoin is mirroring a comparable bear flag structure, with $84,000 serving as the lower trendline support. A drop below this level could lead to a more profound sell-off towards $72,000, as per the technical rules outlined earlier.

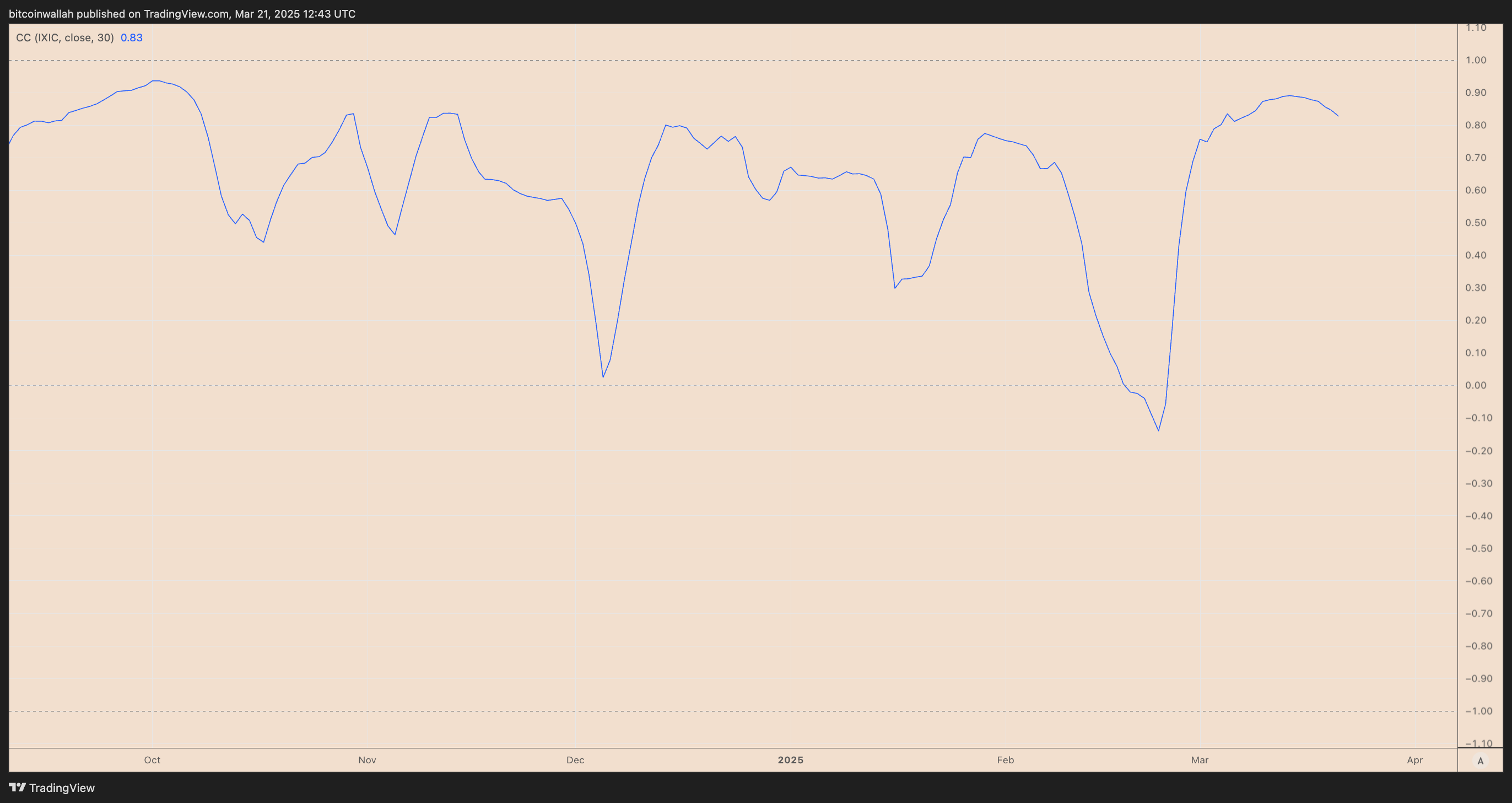

Furthermore, Bitcoin’s correlation with the stock market has intensified, stemming from a general decline in risk appetite, partly driven by geopolitical tensions.

BTC/USD and Nasdaq Composite 30-day correlation.

A prominent figure in the crypto space has identified a potential U.S. recession as one of the top external threats to the market.

This content does not offer investment advice. All investments and trading decisions involve risk; readers should perform their own due diligence.