Bitcoin’s (BTC) rebound is still encountering selling pressure at elevated levels, suggesting that bearish forces remain active. A trading resource observed that a significant trader has been keeping Bitcoin’s price under control, capping it below $87,500.

Despite the current limitations on upward movement, some analysts are optimistic about the downside potential being limited. BitMEX co-founder Arthur Hayes mentioned in a social media post that Bitcoin might have found its low at $77,000, particularly as the Federal Reserve indicated plans to ease its quantitative tightening starting in April.

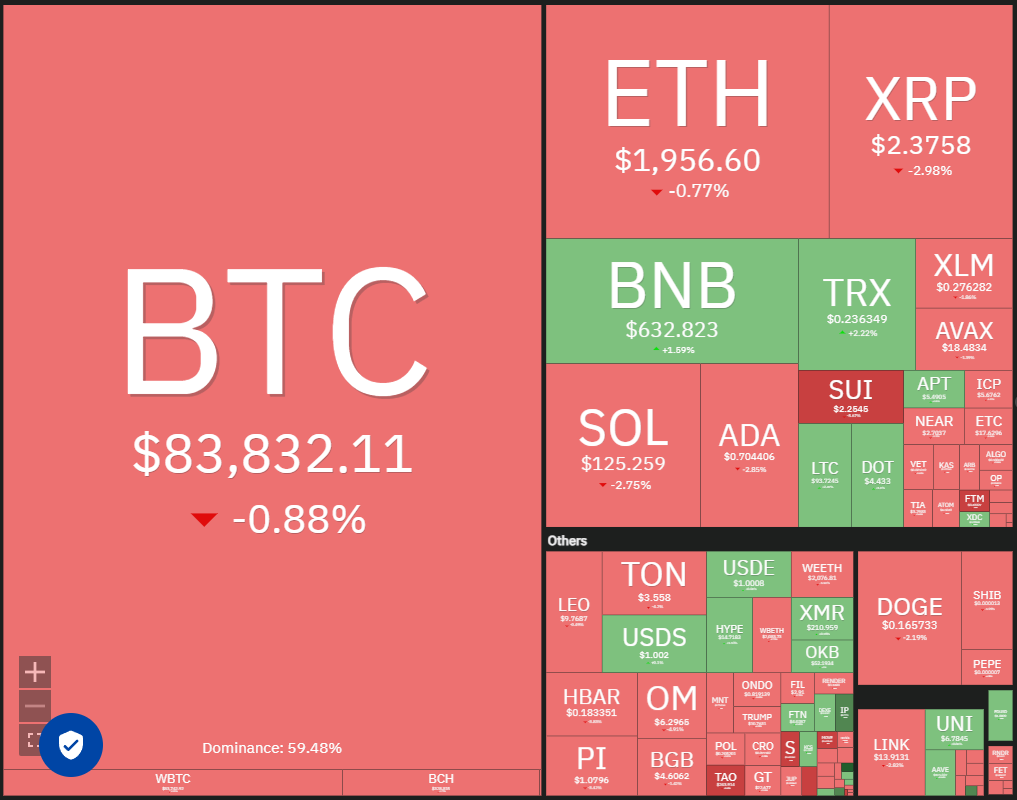

Crypto market data daily view. Source: Coin360

Another potential bullish driver for Bitcoin may be a looming recession, according to the head of digital assets at a major investment firm. In a discussion with a financial news outlet, he noted that their “sophisticated long-term Bitcoin accumulator” clients are undeterred by current economic challenges and view the market dip as a prime buying opportunity.

Can Bitcoin establish a higher low shortly and break through the $87,500 resistance? Would this encourage increased interest in altcoins? Let’s analyze the charts of the top 10 cryptocurrencies to uncover the insights.

Bitcoin Price Analysis

On March 19, Bitcoin surged past the 20-day exponential moving average ($85,332), but the bulls faced resistance at the upper boundary of the rally.

BTC/USDT daily chart. Source: Cointelegraph/TradingView

If the price falls below the uptrend line, the BTC/USDT pair may drop to $80,000 and possibly further to $76,606. The area between $76,606 and $73,777 is anticipated to attract considerable buying interest, but if bears dominate, the price might decline to $67,000.

On the flip side, if the price bounces off the uptrend line and breaks past $87,500, the pair is likely to gain momentum. While the 50-day simple moving average ($91,136) may present a challenge, it is likely to be overcome. Following that, the pair could rise to $95,000 and then aim for the significant $100,000 milestone.

Ether Price Analysis

Ether’s (ETH) recovery has stalled at the 20-day EMA ($2,067), suggesting that bears are active at these higher levels.

ETH/USDT daily chart. Source: Cointelegraph/TradingView

If the price declines below $1,927, the ETH/USDT pair may fall to $1,800. Buyers are expected to defend the $1,750 to $1,800 zone, as a drop below this level could lead to a decline to $1,550.

XRP Price Analysis

XRP (XRP) jumped above the moving averages on March 19, but the bullish momentum could not be maintained.

XRP/USDT daily chart. Source: Cointelegraph/TradingView

The bears are attempting to push the price below the 20-day EMA ($2.36). If this occurs, the XRP/USDT pair may decline to $2.22 and subsequently to notable support at $2. Buyers are expected to vigorously defend the $2 mark, as failure to do so may finalize a bearish head-and-shoulders pattern.

Conversely, if the price rebounds from the 20-day EMA, it may suggest that buyers are stepping in on dips. The pair could then aim for the resistance line.

BNB Price Analysis

BNB’s (BNB) retracement found support at the 20-day EMA ($608) on March 19, indicating buying action during pullbacks.

BNB/USDT daily chart. Source: Cointelegraph/TradingView

The 20-day EMA has begun to increase, and the RSI is in positive territory, indicating that buyers may have a slight edge. A decisive break and close above $644 could pave the way for a rally to $686. Sellers are likely to defend the $686 resistance fiercely, as a breakthrough could propel the price up to $745.

To halt upward movement, sellers must push the price below the 20-day EMA, with the BNB/USDT pair possibly retracting to $550.

Solana Price Analysis

Solana (SOL) reversed from the 20-day EMA ($135) on March 20, indicating ongoing selling pressure during minor relief rallies.

SOL/USDT daily chart. Source: Cointelegraph/TradingView

The SOL/USDT pair could decline to $120, followed by $110. Buyer interest is anticipated to be strong in this support area. If the price bounces back from this zone, bulls will once more attempt to push the pair above the 20-day EMA. A successful breakthrough may see the pair rally to the 50-day SMA ($163).

However, if a break and close occur below $110, it could indicate a resumption of the downtrend, with the pair possibly tumbling to $98 and ultimately to $80.

Cardano Price Analysis

Cardano (ADA) declined from the moving averages on March 20, suggesting that sellers are active in this range.

ADA/USDT daily chart. Source: Cointelegraph/TradingView

Sellers will attempt to drive the price down to the uptrend line, where bulls are expected to respond. If the price rebounds from the uptrend line robustly, this may increase the chances of breaking through the moving averages. The ADA/USDT pair could then ascend to $1.02.

If, however, the price breaks and closes below the uptrend line, it signals a loss of bullish momentum. This scenario could initiate a downward trend toward $0.58 and eventually $0.50. The $0.50 support level is anticipated to be strongly defended by buyers.

Dogecoin Price Analysis

Buyers are facing challenges in pushing Dogecoin (DOGE) above the 20-day EMA ($0.18), reflecting a bearish sentiment.

DOGE/USDT daily chart. Source: Cointelegraph/TradingView

If the price drops below $0.16, the DOGE/USDT pair may retest crucial support at $0.14. This level is vital for bulls to defend, as a slip below it could take the pair down to $0.10.

On the upside, a break and close above the 20-day EMA would be the first sign that buyers are regaining strength. The pair could then increase to the 50-day SMA ($0.22) and subsequently to $0.29.

Related: XRP price chart hints at 75% gains next as SEC ends lawsuit against Ripple

Toncoin Price Analysis

Toncoin (TON) successfully surpassed the 50-day SMA ($3.51) on March 19, yet bears are attempting to halt the ascent at $4.

TON/USDT daily chart. Source: Cointelegraph/TradingView

The 20-day EMA ($3.32) has begun to trend upward, and the RSI is in a positive position, indicating that buyers have an advantage. Support is expected to hold at the 20-day EMA, and if it does, the likelihood of breaking above $4 increases. The TON/USDT pair could potentially rise to $5 and later to $5.50.

Bears will need to pull the price below the 20-day EMA to turn the tide. In that case, the pair could dip to $3.

Chainlink Price Analysis

Chainlink (LINK) moved above the 20-day EMA ($14.59) on March 19, but bulls could not maintain momentum thereafter.

LINK/USDT daily chart. Source: Cointelegraph/TradingView

The price slipped back below the 20-day EMA on March 20, indicating that selling is occurring at these higher levels. The bears will aim to bring the price down to significant support at $12.

If the price rebounds from the current level or from $12, it will hint at a shift in sentiment from selling on rallies to buying on dips. Bulls will then try to push the LINK/USDT pair toward the 50-day SMA ($16.83) and potentially to $19.25.

This optimistic outlook will be nullified if the price declines further and breaks below $12, which could lead to a drop to psychological support at $10.

UNUS SED LEO Price Analysis

UNUS SED LEO (LEO) remains confined below the overhead resistance of $10, suggesting that bears are in control.

LEO/USD daily chart. Source: Cointelegraph/TradingView

The flat moving averages and the RSI hovering around the midpoint indicate no clear advantage for either bulls or bears. A downturn that breaks below $9.60 hints at an increased bearish position. The LEO/USD pair could head toward the uptrend line.

Conversely, a bullish ascending triangle pattern would complete with a break and close above $9.90, potentially sending the pair to a target of $12.04.

This article does not constitute investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before taking action.