This week, cryptocurrency investors celebrated after the U.S. Securities and Exchange Commission dropped one of the most debated lawsuits in the crypto realm—an ongoing legal struggle with Ripple Labs that lasted over four years.

In another noteworthy regulatory development, Solana-focused futures exchange-traded funds (ETFs) have launched in the U.S., which might indicate that lawmakers see the approval of spot Solana (SOL) ETFs as the “next logical move.”

SEC’s XRP dismissal a “triumph for the sector”: Ripple’s CEO

Ripple’s CEO, Brad Garlinghouse, characterized the SEC’s decision to end its lengthy lawsuit against Ripple Labs, the company behind the XRP Ledger blockchain, as a “triumph for the sector” at the 2025 Digital Asset Summit in New York hosted by Blockworks.

On March 19, Garlinghouse disclosed that the SEC would no longer pursue its legal case against Ripple, concluding four years of litigation regarding an alleged $1.3 billion unregistered securities offering in 2020.

“It feels like a victory for the sector and the beginning of a new chapter,” Garlinghouse stated on March 19, during the attended Summit.

The CEO of Ripple announced the SEC’s withdrawal of its case against the blockchain developer.

Continue reading

Solana futures ETF poised to enhance institutional interest, despite modest inflows

The crypto landscape is set to introduce the first SOL futures ETF, marking a substantial milestone that could lead to the initial spot SOL ETF, considered by experts as the “next logical step” for crypto trading products.

Volatility Shares will be launching two SOL futures ETFs, specifically, the Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2X Solana ETF (SOLT), on March 20.

Volatility Shares Solana ETF SEC filing.

The introduction of the first SOL futures ETF is expected to drive significant institutional interest in the SOL token, according to Ryan Lee, chief analyst at Bitget Research.

The analyst noted:

“The rollout of Solana ETFs in the U.S. has the potential to significantly elevate Solana’s market standing through heightened demand and liquidity for SOL, potentially closing the gap with Ethereum’s market capitalization.”

Lee also mentioned that the Solana ETF would foster institutional adoption by “providing a regulated investment vehicle, attracting billions in capital, and strengthening Solana’s competitiveness against Ethereum,” though he acknowledged that “Ethereum’s established ecosystem remains a significant obstacle.”

Continue reading

Pump.fun unveils its own DEX, moving away from Raydium

Pump.fun has introduced its own decentralized exchange (DEX) named PumpSwap, which may replace Raydium as the main trading platform for Solana-based memecoins.

Beginning on March 20, memecoins that successfully establish liquidity or “bond” on Pump.fun will transition directly to PumpSwap, as announced by Pump.fun in a post on X.

Previously, tokens that had bonded on Pump.fun would transition to Raydium, which had gained popularity as Solana’s leading DEX, heavily driven by memecoin transactions.

Pump.fun indicated that PumpSwap “operates similarly to Raydium V4 and Uniswap V2” and aims to “create the most efficient environment for coin trading.”

“Migrations were a considerable source of friction—slowing a coin’s momentum and complicating the process for new users,” Pump.fun stated.

“Now, migrations are instantaneous and free of charge.”

Raydium’s trading volumes surged in 2024, thanks in large part to memecoins.

Continue reading

Bybit: 89% of the misappropriated $1.4 billion cryptocurrency remains traceable after the hack

The majority of funds stolen from Bybit are still traceable following the historic cyber heist, with blockchain analysts tirelessly working to freeze and recover the assets.

The crypto world faced significant upheaval on February 21 when Bybit lost over $1.4 billion in liquid-staked Ether (stETH), Mantle Staked ETH (mETH), and other cryptocurrencies.

Blockchain security firms, including Arkham Intelligence, have identified the Lazarus Group from North Korea as the likely perpetrator behind the Bybit breach, as the attackers continue to swap the funds in a bid to obscure their trail.

Despite the efforts of the Lazarus Group, over 88% of the stolen $1.4 billion remains traceable, according to Ben Zhou, co-founder and CEO of Bybit.

In a March 20 post on X, the CEO outlined:

“Total hacked funds of USD 1.4 billion comprising approximately 500,000 ETH. 88.87% remain traceable, 7.59% are unaccounted for, and 3.54% have been frozen.”

“86.29% (440,091 ETH, roughly $1.23 billion) have been converted into 12,836 BTC across 9,117 wallets (averaging 1.41 BTC each),” he noted, adding that the funds were primarily funneled through Bitcoin (BTC) mixers such as Wasabi, CryptoMixer, Railgun, and Tornado Cash.

Source:

The CEO’s update comes almost a month after the hack. Investigations revealed it took the Lazarus Group 10 days to move all stolen assets through the decentralized cross-chain protocol THORChain, reported earlier.

Continue reading

The creator of Libra and Melania’s “Wolf of Wall Street” memecoin plummets 99%

The individual behind the Libra token has introduced yet another memecoin, exhibiting some concerning on-chain patterns that indicated notable insider trading activity before the coin’s 99% decline.

Hayden Davis, co-creator of both the Official Melania Meme (MELANIA) and Libra tokens, recently launched a new Solana-based memecoin with over 80% of the supply held by insiders.

Davis rolled out the Wolf (WOLF) memecoin on March 8, leveraging rumors of Jordan Belfort, the “Wolf of Wall Street,” planning to release his own token.

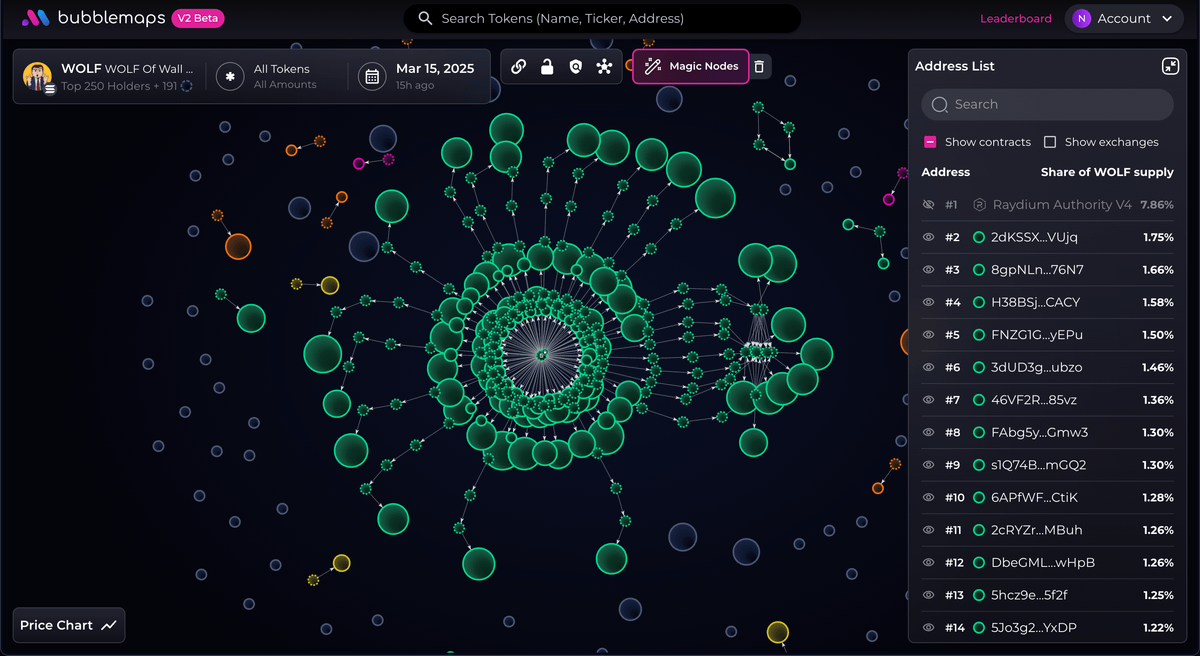

The token achieved a maximum $42 million market cap. However, 82% of WOLF’s supply was consolidated under a single entity, as indicated in a March 15 post on X, which stated:

“The bubble map revealed something unusual—$WOLF exhibited the same patterns as $HOOD, a token launched by Hayden Davis. Could he be behind this one as well?”

Source:

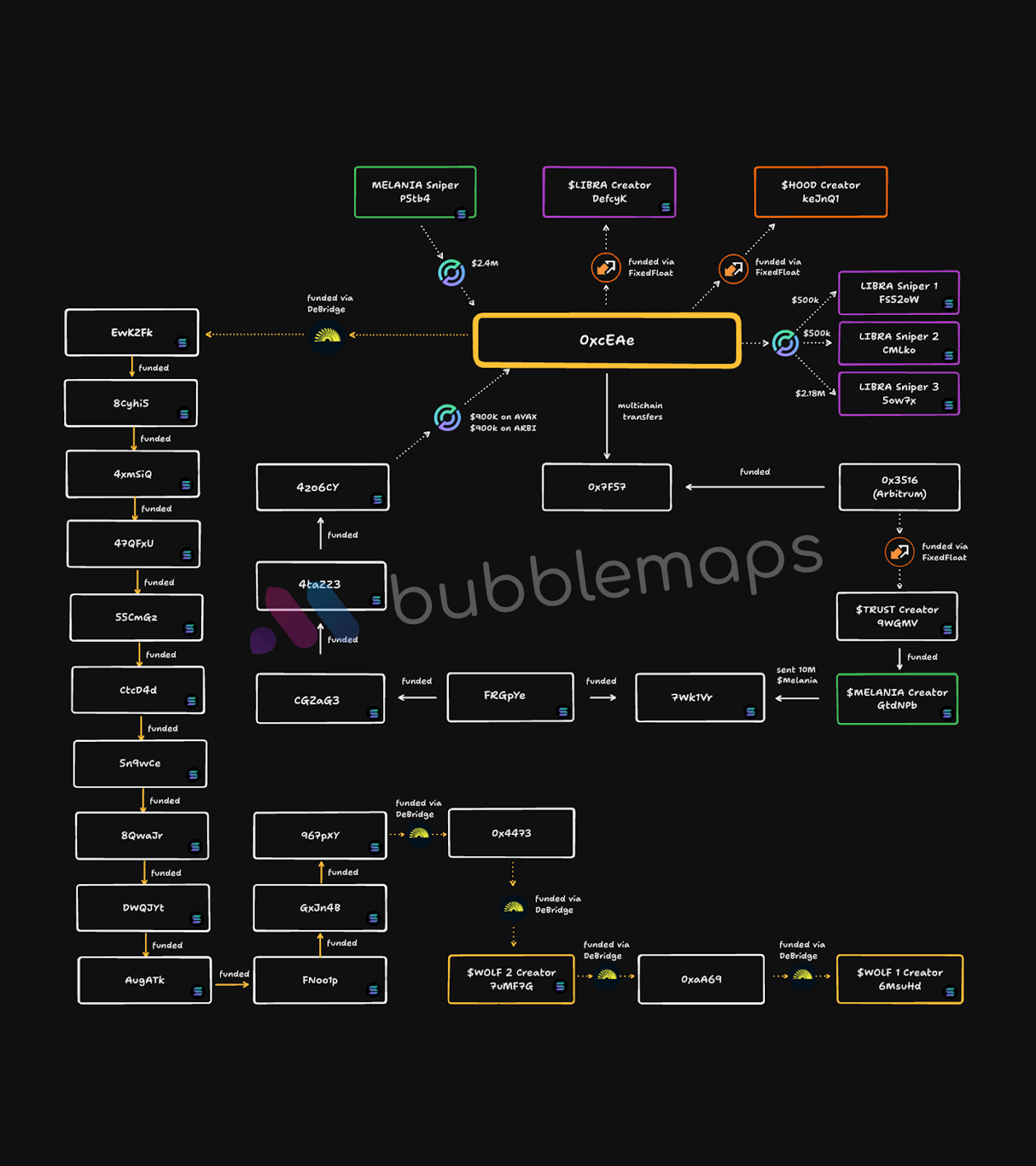

The blockchain analytics firm has identified transactions across 17 different addresses linking back to the address “OxcEAe,” associated with Davis.

“He financed these wallets months before $LIBRA and $WOLF launched, moving funds through 17 addresses and two different chains,” the analytics firm reported.

Source:

The Wolf memecoin saw a staggering loss of more than 99% in value within two days, dropping from a peak market cap of $42.9 million on March 8 to just $570,000 by March 16, according to market data.

Continue reading

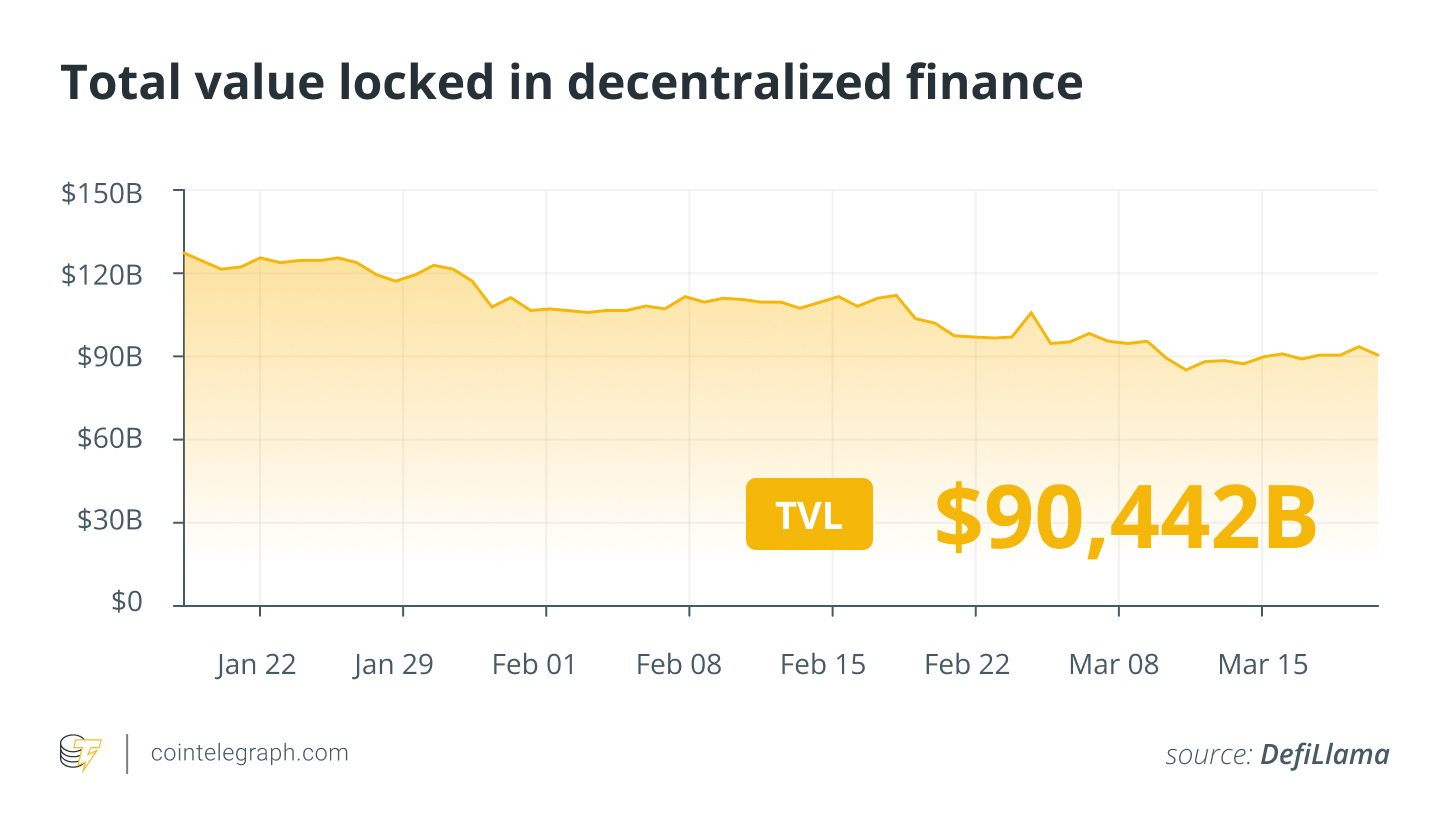

Overview of the DeFi Market

Based on data from various sources, most of the top 100 cryptocurrencies by market capitalization finished the week positively.

Among the top 100, the BNB Chain-native Four (FORM) token surged over 110% to become the week’s top performer, followed by PancakeSwap’s CAKE (CAKE) token, which rose by more than 48% over the week.

Total value locked in DeFi. Source: DefiLlama

Thank you for reading our summary of this week’s most significant DeFi events. Be sure to join us next Friday for more news, insights, and education on this rapidly evolving space.