- Bitcoin’s price has stabilized at around $84,000 on Friday, having rebounded nearly 2% this week.

- The recent declaration from the US SEC stating that PoW mining rewards are not considered securities could enhance investor confidence in BTC.

- The Federal Reserve decided against changing interest rates on Wednesday and kept its forecast for potential rate cuts this year intact.

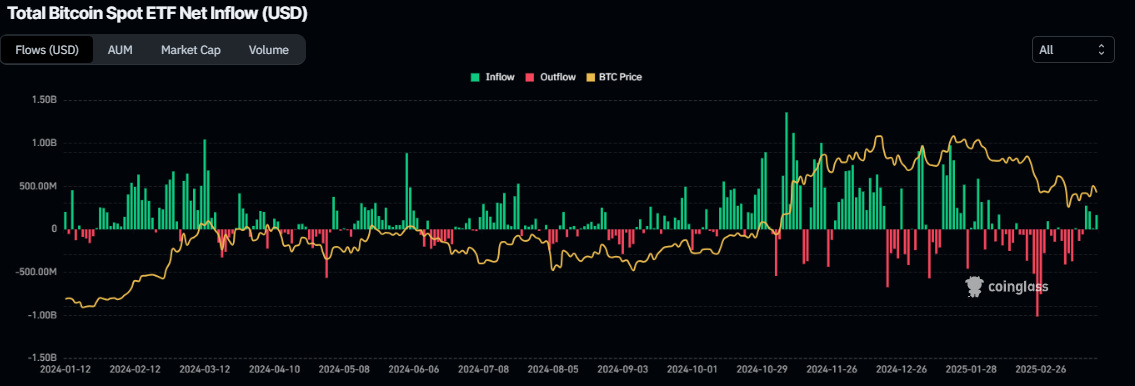

- Data for US Bitcoin spot ETFs reported a net inflow of $661.20 million as of Thursday.

At the moment, the price of Bitcoin (BTC) is around $84,000 on Friday, having gained nearly 2% throughout the week. A recent announcement by the US Securities and Exchange Commission (SEC), which clarified that Proof-of-Work (PoW) mining rewards do not qualify as securities, may bolster the confidence of BTC investors.

Additionally, the Federal Reserve’s choice to maintain its current interest rates and forecast potential rate cuts for the year, coupled with a net inflow of $661.20 million from US Bitcoin spot Exchange Traded Funds (ETFs), has contributed to a modest recovery in Bitcoin this week.

US SEC confirms that Bitcoin and crypto mining does not contravene securities law

On Thursday, the US SEC announced that PoW mining rewards are not considered securities. The statement indicated that both individual miners and mining pools are outside the realm of US securities laws since they don’t require the efforts of a central entity or entrepreneurial figure to generate income.

This clarification provides regulatory certainty for Bitcoin and other cryptocurrencies, minimizing legal risks, enhancing confidence among investors and miners, affirming the commodity status of these assets, and potentially driving up prices and market growth.

JUST IN: SEC confirms Bitcoin & crypto mining does not violate securities laws.

— A Twitter User (@ExampleUser) March 20, 2025

Signs of a resurgence in Bitcoin institutional demand

This week has shown a rebound in institutional demand for Bitcoin. Data from Coinglass indicates that Bitcoin spot ETFs experienced net inflows of $661.20 million through Thursday, interrupting the sell-off witnessed in previous weeks. Should this inflow persist and grow, Bitcoin’s price might continue to recover, reflecting a decrease in sell-side pressure.

Total Bitcoin spot ETF net inflow chart.

Macroeconomic data and global uncertainties

On Wednesday, Bitcoin’s price surged nearly 5%, reaching $87,000, thanks to the Federal Reserve’s decision to maintain interest rates and its outlook for potential cuts for this year.

Nonetheless, Fed officials have downgraded their growth forecasts for the year, highlighting growing concerns over the effects of the aggressive trade policies enacted by US President Donald Trump on economic activity. Since February, President Trump has imposed a 25% tariff on steel and aluminum and has threatened reciprocal tariffs, which are set to take effect on April 2, raising fears of a global trade war.

On that same day, Trump urged the Fed via the Truth Social platform to cut interest rates due to tariffs beginning to adversely affect the economy.

Trump posted: “The Fed would be MUCH better off CUTTING RATES as U.S. Tariffs start to transition (ease!) their way into the economy. Do the right thing. April 2nd is Liberation Day in America!!!”

In a supportive turn of macroeconomic data this week, global uncertainties have also shown signs of easing. Earlier, US President Trump and Russian President Vladimir Putin reached an agreement to immediately halt strikes on energy infrastructure in the ongoing Ukraine conflict.

Additionally, Ukrainian President Volodymyr Zelenskiy and Trump affirmed their commitment to collaborate in efforts to resolve the lengthy Russia-Ukraine conflict, further enhancing investor confidence in riskier assets like Bitcoin.

However, traders should remain vigilant regarding escalating tensions in Gaza. The Israeli military confirmed a limited ground incursion into Gaza, which occurred shortly after an aerial bombardment ended a two-month ceasefire with Hamas. Israeli Prime Minister Benjamin Netanyahu also cautioned of a potential expansion of warfare, which could negatively impact investor sentiment and induce a risk-averse atmosphere in the cryptocurrency market.

Digital Crypto Summit and US SEC’s inaugural roundtable

This week, the Blockworks Digital Asset Summit became historic as it hosted the first address from a sitting US President, Donald Trump. During his speech, he advocated for the supremacy of the US dollar and pledged to position America as a leader in cryptocurrency.

In an exclusive pre-summit interview, analysts from Bitfinex noted, “President Trump’s appearance at the Digital Asset Summit (DAS) in New York City is a historic moment, marking the first time a sitting US president has spoken at a cryptocurrency conference.”

The analysts further commented, “Political endorsements have traditionally influenced Bitcoin’s market dynamics. For example, following Trump’s announcement of a US strategic crypto reserve, Bitcoin saw a 7.2% intra-day spike. Similarly, his potential re-election in 2024 along with pro-crypto sentiments could push Bitcoin past the $100,000 mark.”

“Broader macroeconomic factors, including trade policies and ongoing tariff discussions, will significantly influence the long-term impact on digital asset markets. While Blockworks’ involvement points to a well-coordinated media event, the fundamental outlook for Bitcoin and the wider crypto market remains stable,” the Bitfinex analysts concluded.

In conjunction with this, the SEC’s Crypto Task Force is hosting its inaugural roundtable discussion on crypto asset regulations on Friday. This meeting aims to explore regulatory strategies for crypto assets while fostering innovation and safeguarding investors’ interests. The roundtable is also open to public participation.

Bitcoin technical outlook: BTC struggles to find support around its 200-day EMA

Bitcoin’s price surpassed and settled above its 200-day Exponential Moving Average (EMA) on Wednesday, peaking at $87,000 that day. However, it was unable to maintain that level and fell by 3% on Thursday, closing below the EMA. As of Friday, it continues to drift lower at around $84,000.

If BTC continues its downward trend, it may retest its next support level at $78,258.

The Relative Strength Index (RSI) on the daily chart stands at 45, having been rejected from its neutral point of 50 on Wednesday, suggesting a rise in bearish momentum. Should the RSI continue to decline, Bitcoin’s price could decrease significantly.

BTC/USDT daily chart

Conversely, if BTC manages to recover, breaks through, and finds support around the 200-day EMA at $85,508, this could allow for a further recovery towards the key psychological milestone of $90,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization and is designed to function as a form of currency. As a decentralized digital currency, it is not controlled by any single entity, which eliminates the necessity for third-party involvement in financial transactions.

Altcoins refer to any cryptocurrency that is not Bitcoin. Some consider Ethereum outside this classification as it is one of the two most significant cryptocurrencies from which forks occur. If so, Litecoin would be the first altcoin, derived from the Bitcoin protocol and regarded as an improved variant.

Stablecoins are a type of cryptocurrency designed to maintain a stable value, with their worth typically backed by a reserve of the asset they represent. Their value is often pegged to a commodity or financial instrument, such as the US Dollar (USD), with supply controlled by either demand or an algorithm. The primary function of stablecoins is to act as a bridge for investors engaging with cryptocurrencies, while also providing a secure means to store value amidst cryptocurrency’s general volatility.

Bitcoin dominance refers to the proportion of Bitcoin’s market capitalization relative to the combined market capitalization of all cryptocurrencies. This metric provides insight into Bitcoin’s appeal among investors. A high Bitcoin dominance typically precedes and coincides with a bull run, where investors gravitate towards Bitcoin due to its relative stability and substantial market capitalization. Conversely, a decline in Bitcoin dominance usually indicates that investors are reallocating their funds or profits into altcoins in search of better returns, potentially triggering significant altcoin rallies.