- Increased XRP whale holdings and activity within the network indicate a growing optimism among investors.

- Nonetheless, bearish sentiment in the derivatives market may hinder XRP’s price advancement.

- If XRP manages to bounce off the upper edge of a descending channel, it may revisit the $2.60 resistance level.

XRP is trading around $2.43 on Thursday after facing resistance at the $2.60 mark. The remittance-focused cryptocurrency has seen a remarkable 400% increase in network activity since early March, a trend likely to continue given the Securities and Exchange Commission’s (SEC) recent decision to drop its appeal against Ripple.

On-chain metrics for XRP suggest escalating investor confidence

Over the last two months, XRP whales have boosted their holdings by 10%. Even as macroeconomic conditions have kept prices subdued, these significant holders—wallets with between 1 million and 10 million XRP—have maintained their accumulation, increasing their total to 5.81 billion XRP valued at about $14 billion.

XRP supply distribution.

On the other hand, whales with 10M to 100M XRP have had a mixed pattern of distribution and accumulation during this same timeframe.

Concurrently, network activity for XRP has surged, showing more than a 400% increase in daily active addresses compared to February.

XRP active addresses.

Moreover, XRP’s Dormant Circulation indicates that holders have significantly slowed their distribution in recent days, remaining relatively quiet despite the price uptick observed on Wednesday.

These combined metrics highlight increasing optimism among investors regarding XRP’s growth potential, especially following the recent announcement that the SEC has concluded its legal disputes with the company.

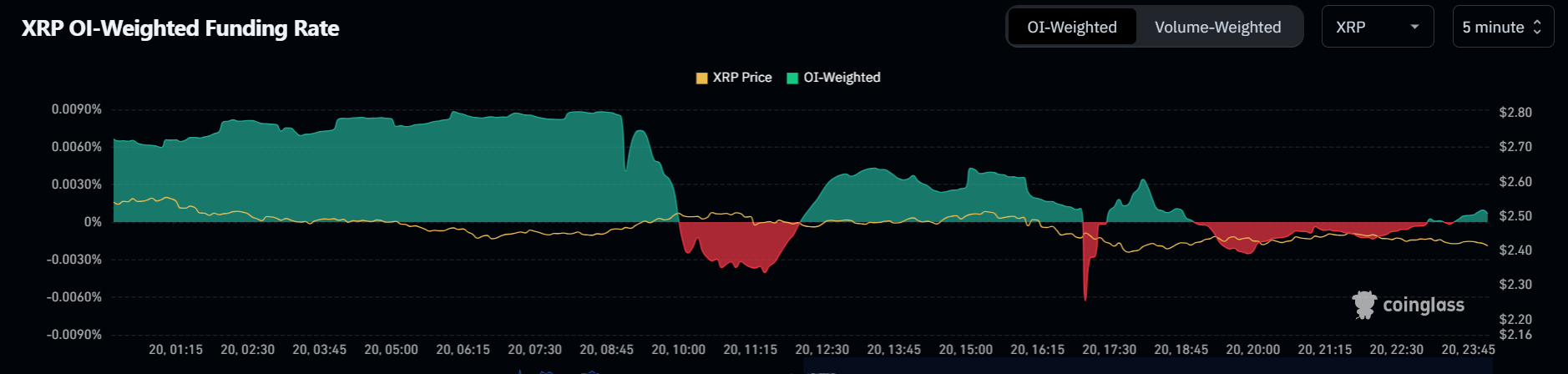

However, this bullish sentiment appears not to extend into the XRP derivatives market, where negative funding rates are present. This situation partially explains XRP’s recent pullback after an approximate 14% increase on Wednesday.

XRP funding rates.

In a recent discussion, the CEO of Ripple expressed confidence that an XRP ETF will be launched in the United States by 2025.

“I have a great deal of faith in the [XRP] ETF,” the CEO stated. “I believe these will be operational in the latter half of the year,” he added.

The SEC has recently postponed its decision on several XRP ETF applications from asset management firms, including Bitwise, Franklin Templeton, and 21Shares. The Ripple CEO also noted that the U.S. digital asset reserve will likely involve XRP.

XRP may bounce off the upper boundary of the descending channel

According to data from Coinglass, XRP faced $13.86 million in futures liquidations within the last 24 hours, with liquidated long and short positions totaling $11.68 million and $2.18 million, respectively.

XRP has encountered rejection at the resistance level near $2.60 and has dropped 4% on the day, reflecting a pullback in the broader cryptocurrency market.

XRP/USDT daily chart.

If XRP rebounds off the upper boundary of its descending channel, it might revisit the $2.60 resistance. Surpassing $2.60 could open the door for the token to challenge its seven-year high resistance level at $3.40. Nevertheless, it must first overcome essential hurdles at $2.78 and $2.95 for this movement to occur.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are showing attempts to dip below their respective moving average lines, which suggests a weakening of bullish momentum.

Additionally, a daily candlestick closure beneath the upper boundary of the descending channel would invalidate this theory and potentially push XRP to seek support around $1.96.

%20[00.04.11,%2021%20Mar,%202025]-638781085694926885.png)