- The total market value of cryptocurrencies sees a 1.7% increase on Friday, attracting $47 billion in inflows despite a decline in Bitcoin prices.

- Bitcoin is trading below the $84,000 threshold, with bullish investors implementing strategies to stave off significant liquidations.

- Alongside BNB, leading altcoins such as ETH, XRP, and SOL experienced losses, indicating a shift of funds towards lower-cap assets.

Bitcoin Market Overview:

On Friday, Bitcoin’s price fell beneath $84,000 as investors redirected their funds towards altcoins. Bitcoin ETFs registered outflows of $165 million on Thursday, marking a continuation of four consecutive days of inflows that began last week.

Bitcoin ETF Flows, March 20 | Source

Throughout this timeframe, Bitcoin ETFs have accumulated more than $680 million. Importantly, this is the first time Bitcoin ETFs have seen a four-day buying streak since January.

The latest trading trends indicate that U.S. corporate investors are focusing on strategic acquisitions rather than realizing profits after a modest increase when Bitcoin reached $85,900, influenced by the Federal Reserve’s announcement on Wednesday to pause interest rates.

Altcoin Market Updates: XRP, SOL, ETH Trade Steadily as Funds Flow to Low-Cap Assets

The overall cryptocurrency market is currently valued at $2.79 trillion, reflecting a 1.74% rise in the past 24 hours. Despite this increase, investor sentiment remains cautious, as evidenced by the Fear & Greed Index, which currently sits at 31 (Fear).

Meanwhile, while Bitcoin’s dominance remains strong, the Altcoin Season Index stands at 21/100, indicating a continued preference for Bitcoin over alternative cryptocurrencies. Tron and SUI emerged as leaders in the top-20 ranks, each achieving a 3% increase.

Limited Upside Amid Rotation Toward Low-Cap Assets

Despite the slight gains across the broader market, major altcoins have faced challenges in building momentum.

Ethereum (ETH) is currently trading at $1,966.41, reflecting a 1.24% decrease over the last 24 hours but registering a 3.36% uptick on a weekly basis.

XRP is now priced at $2.38, marking a 4.13% decline on the day, while Solana (SOL) is at $126.45, showing a drop of 3.37% for the day.

Crypto Market Performance, March 20 | Source

In comparison, lower-cap altcoins have dominated daily gains, indicating a shift in investor interest away from larger-cap assets. The underwhelming performance of key altcoins suggests that traders are reallocating funds into smaller, high-potential assets, fueled by recent regulatory victories and the latest Federal Reserve decision, which has enhanced risk-on attitudes.

Latest Crypto News Updates:

-

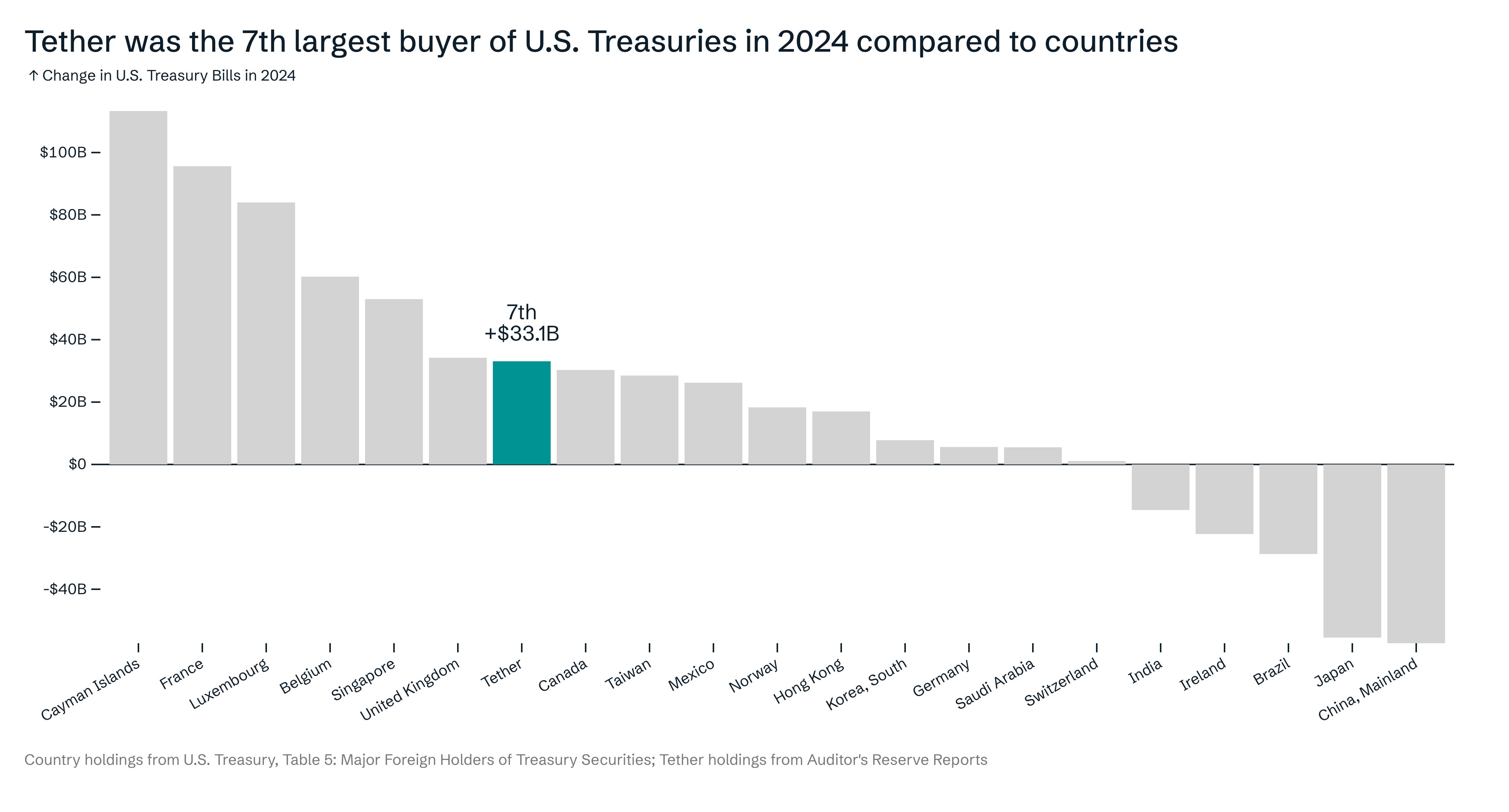

Tether Surpasses Canada in U.S. Treasury Holdings, Now Seventh Globally

Tether (USDT), the largest issuer of stablecoins worldwide, has become the seventh biggest buyer of U.S. Treasury bills in 2024, exceeding Canada’s total holdings.

Data from U.S. Treasury reports and audits of Tether’s reserves reveal that the company has added $33.1 billion in U.S. Treasuries.

USD Treasury Holdings by Entity, Source

This news follows a day after a prominent political figure advocated for regulations concerning stablecoins at a recent digital asset summit.

-

Metaplanet Brings Eric Trump on Board as Strategic Advisor

Metaplanet, Japan’s leading corporate Bitcoin holder based in Tokyo, has appointed Eric Trump to its newly formed Strategic Board of Advisors.

Eric Trump, the son of a notable political figure, is recognized for his support of blockchain technology and contributes expertise in finance and brand enhancement to the organization.

Metaplanet’s Appointment of Eric Trump | March 21, 2025

Metaplanet’s Appointment of Eric Trump | March 21, 2025

The Representative Director of Metaplanet, Simon Gerovich, highlighted that Eric Trump’s involvement is aimed at advancing the company’s strategies focused on Bitcoin growth and innovation, aligning with their mission to foster Bitcoin adoption and solidify their position in the cryptocurrency landscape.

-

Trump Media Executives Launch $179 Million SPAC Targeting Crypto and Data Security Companies

Executives from a media and technology firm have unveiled Renatus Tactical Acquisition Corp I, a SPAC designed to merge with a U.S.-based company in the fields of cryptocurrency, blockchain, data security, or dual-use technology.

This SPAC, registered in the Cayman Islands, has submitted a registration statement to the Securities and Exchange Commission (SEC) detailing its plans to raise $179 million through an initial public offering and private placement.

Renatus is led by prominent figures associated with the media group, including CEO Eric Swider, the chair of the board Devin Nunes, and COO Alexander Cano.