Both cryptocurrency and traditional markets are expected to remain under pressure due to apprehensions surrounding a global trade war, at least until early April. However, a resolution could potentially serve as the next significant market driver.

Since US President Trump first introduced tariffs on Chinese products on January 20—the day after his inauguration—Bitcoin’s price has dropped over 17%.

Despite various positive developments specific to the crypto space, concerns over global tariffs are likely to weigh on the markets until at least April 2, according to a research analyst.

BTC/USD, 1-day chart.

The analyst shared insights during a recent daily show:

“I’m eager to see the developments regarding tariffs from April 2 onward. There might be some reductions, but that hinges on whether all countries can reach an agreement. This is currently the most significant factor at play.”

Risk assets may struggle to find a clear direction until these tariff-related issues are cleared up, which could occur sometime between April 2 and July, potentially serving as a positive influence for the market.

President Trump’s reciprocal tariff rates are set to go into effect on April 2, despite earlier indications from Treasury Secretary that there might be a delay in implementation.

The Fed’s interest rate stance is also adding to market pressure

Elevated interest rates will continue to impact investors’ risk appetite until the Federal Reserve begins to lower rates, the analyst explained, adding:

“We’re observing the Fed’s response; they seem to be waiting for substantial ‘bad news’ before initiating any rate cuts.”

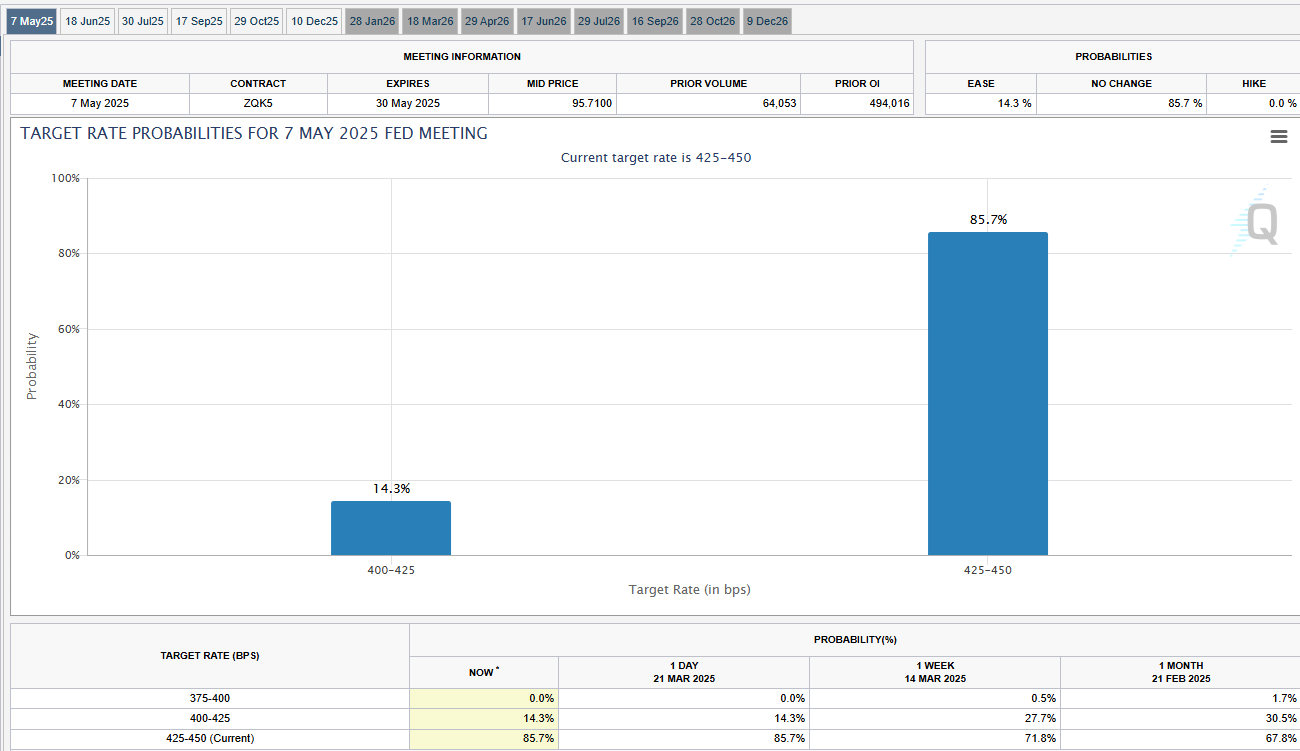

Probability of Fed target interest rates.

Current market expectations indicate an 85% chance that the Fed will maintain interest rates at their current levels during the forthcoming Federal Open Market Committee meeting on May 7, based on the latest estimates.

Nevertheless, the Federal Reserve seems to view inflation and recession-related issues as temporary, particularly concerning tariffs, which may signal some positive prospects for investors.

“Markets might now approach upcoming economic data with increased confidence,” the analyst stated, adding:

“A decrease in inflation and a stable economic environment could further enhance investor interest, promoting upward movement for Bitcoin and other digital assets.”

“Be sure to monitor crucial reports, such as Consumer Confidence, Q4 GDP, jobless claims, and next week’s vital PCE inflation release, as they will provide insights into potential future rate cuts,” the analyst concluded.

Magazine: SEC’s repositioning on crypto leaves key questions unresolved