Current Ethereum price: $1,960

- Ethereum’s supply on exchanges has fallen to a decade-low, according to recent analytics.

- Ethereum accumulation addresses recorded an addition of 2.11 million ETH in March.

- ETH may find support at $1,800 if it cannot maintain a critical descending trendline.

On Friday, Ethereum (ETH) is trading above $1,900 as investors increased their buying activity throughout March. This leading altcoin could be poised for a rebound if the anticipated Pectra upgrade serves as an effective price driver.

Ethereum investors ramp up buying despite sluggish prices

The supply of Ethereum available on exchanges decreased further on Friday, reaching a 10-year low of 8.71 million ETH. Recent data indicates that there’s been a 16.4% reduction in exchange supply compared to just seven weeks prior.

This decline in supply on exchanges indicates that investors may be transferring their holdings to private wallets for long-term retention. However, it is essential to recognize that this metric may vary when assessed through other on-chain analysis tools.

ETH supply on exchanges.

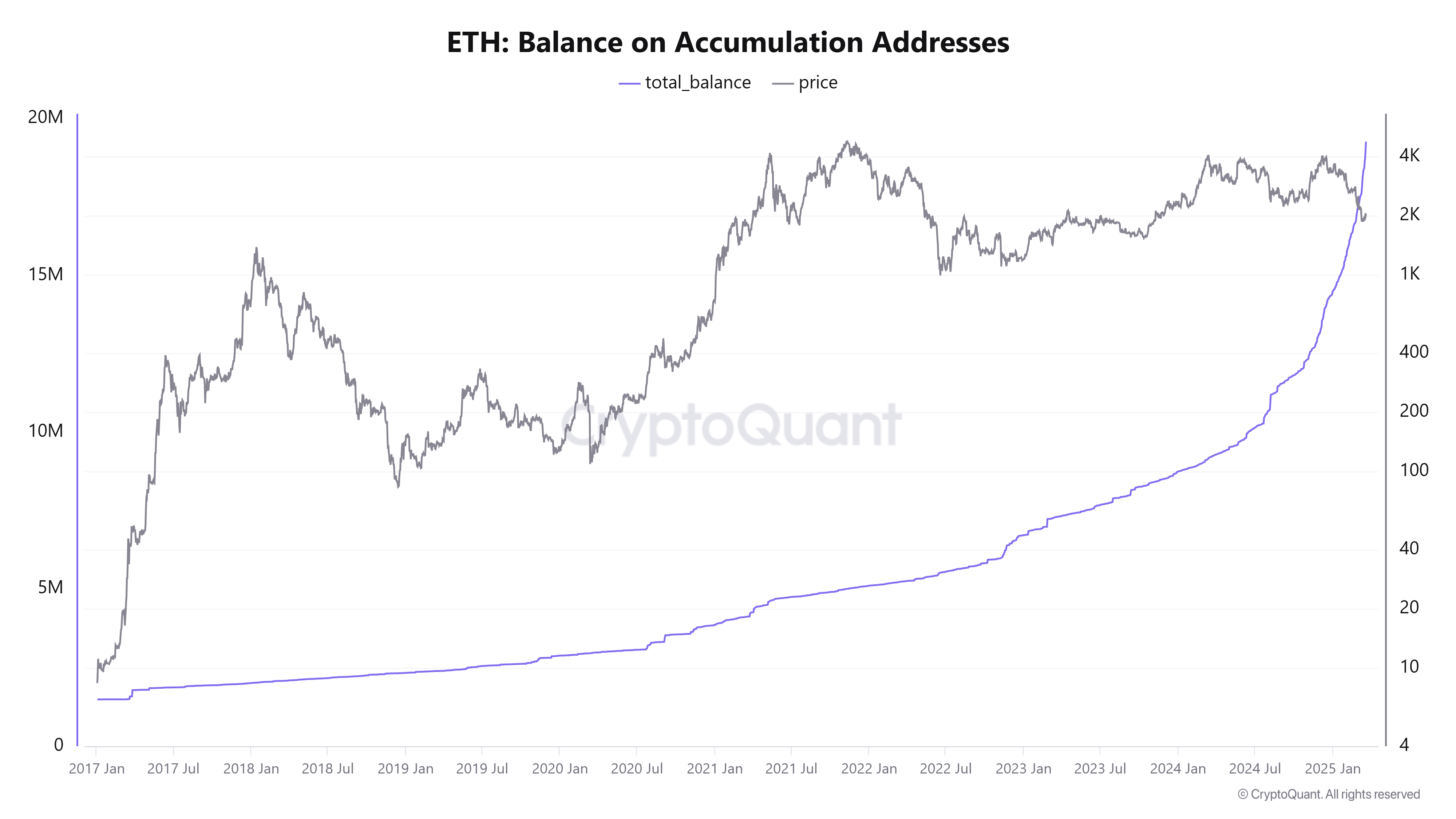

A similar trend of increasing buying is evident in the balance of ETH accumulated in wallets that have not recorded any outflows, which has surged by 4.77 million ETH since the start of the year, representing a substantial 32% increase. Remarkably, approximately 45% of this growth (2.11 million ETH) occurred in March following ETH’s drop below the $2,000 mark.

ETH balance on accumulation addresses.

Additionally, ETH’s open interest in the futures market has grown from 9.40 million ETH to 10.10 million ETH over the last three days, demonstrating a modest increase in confidence among derivative traders regarding the leading altcoin.

The sustained buying pressure at present price levels could establish a key support area and potentially ignite a rally if ETH receives a strong market catalyst.

The upcoming Ethereum Pectra upgrade might provide the essential boost needed for a turnaround. This upgrade promises to introduce several new features to the network, such as transaction batching, gas fee payments in various ERC-20 tokens, sponsored transactions, higher staking limits, and the expansion of blobspace.

Despite challenges faced during its deployment on test networks Holesky and Sepolia, developers have addressed these issues admirably.

Pectra is set to debut on a new testnet, Hoodi, this Wednesday. If successful, the mainnet deployment will follow after 30 days.

Ethereum Price Projection: ETH eyes $1,800 if trendline support is breached

Recent data shows that Ethereum experienced $25.06 million in futures liquidations within the last 24 hours. The combined total for long and short liquidations was $17.13 million and $7.93 million, respectively.

On Friday, ETH is testing support near a descending trendline. A bounce off this trendline could enable a retest of the resistance at $2,070. Conversely, a solid decline below the trendline might lead to support emerging around the $1,800 level. A drop below $1,800 could push ETH down to $1,500.

ETH/USDT daily chart.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are currently below their neutral levels and are testing their moving averages. A drop beneath these moving averages could heighten bearish sentiment.

A daily close below $1,500 would negate the current outlook and possibly direct ETH towards the $1,000 psychological mark.

Ethereum FAQs

Ethereum is a decentralized, open-source blockchain that supports smart contracts. Its native currency, Ether (ETH), ranks as the second-largest cryptocurrency and the leading altcoin by market cap. The Ethereum network is designed for creating crypto solutions, including decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), and decentralized autonomous organizations (DAOs).

Ethereum is a public decentralized blockchain that allows developers to create and deploy applications that operate independently of a central authority. The network utilizes the Solidity programming language and Ethereum virtual machine to help developers build and launch applications featuring smart contract capabilities.

Smart contracts are codes that can be publicly verified, automating agreements between two or more parties. These codes execute defined actions automatically when specific conditions are met.

Staking allows holders to earn yield on idle crypto assets by locking them in a protocol for a designated period, contributing to its security. Ethereum shifted from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event known as “The Merge.” This transition is a crucial part of Ethereum’s roadmap aimed at achieving enhanced scalability, decentralization, security, and sustainability. Unlike PoW, which demands expensive hardware, PoS lowers the entry barrier for validators by utilizing crypto tokens as the basis of its consensus process.

Gas serves as the unit for calculating transaction fees that users pay to perform transactions on Ethereum. During times of network congestion, gas fees can escalate significantly, leading validators to prioritize transactions based on the fees offered.