Gold-backed stablecoins are predicted to surpass US dollar-pegged alternatives on a global scale, thanks to gold’s ability to hedge against inflation and its relatively low volatility, as stated by Bitcoin maximalist Max Keiser.

Keiser emphasized that gold holds greater trust globally compared to the US dollar and noted that nations with adversarial relations to the United States are unlikely to adopt dollar-pegged stablecoins. He remarked:

“Countries like Russia, China, and Iran will not accept a US dollar stablecoin. I forecast they will counter with a gold-backed version. Together, China and Russia possess about 50,000 tonnes of gold, which is likely understated.”

The emergence of gold-backed stablecoins potentially posing a threat to dollar-pegged tokens in international markets could disrupt the intentions of US lawmakers aiming to maintain USD supremacy through these digital tokens.

Image Source

Related: Government can realize benefits from gold certificates to acquire Bitcoin: Bo Hines

Can gold-backed stablecoins fulfill the original promise of the dollar?

Tether, the stablecoin issuer, introduced a gold-backed stablecoin named Alloy (aUSD₮), which is supported by Tether’s XAU₮—a token that offers a claim on physical gold—in June 2024.

According to Gabor Gurbacs, founder of PointsVille and former executive at VanEck, “Tether Gold represents what the dollar used to be prior to 1971.”

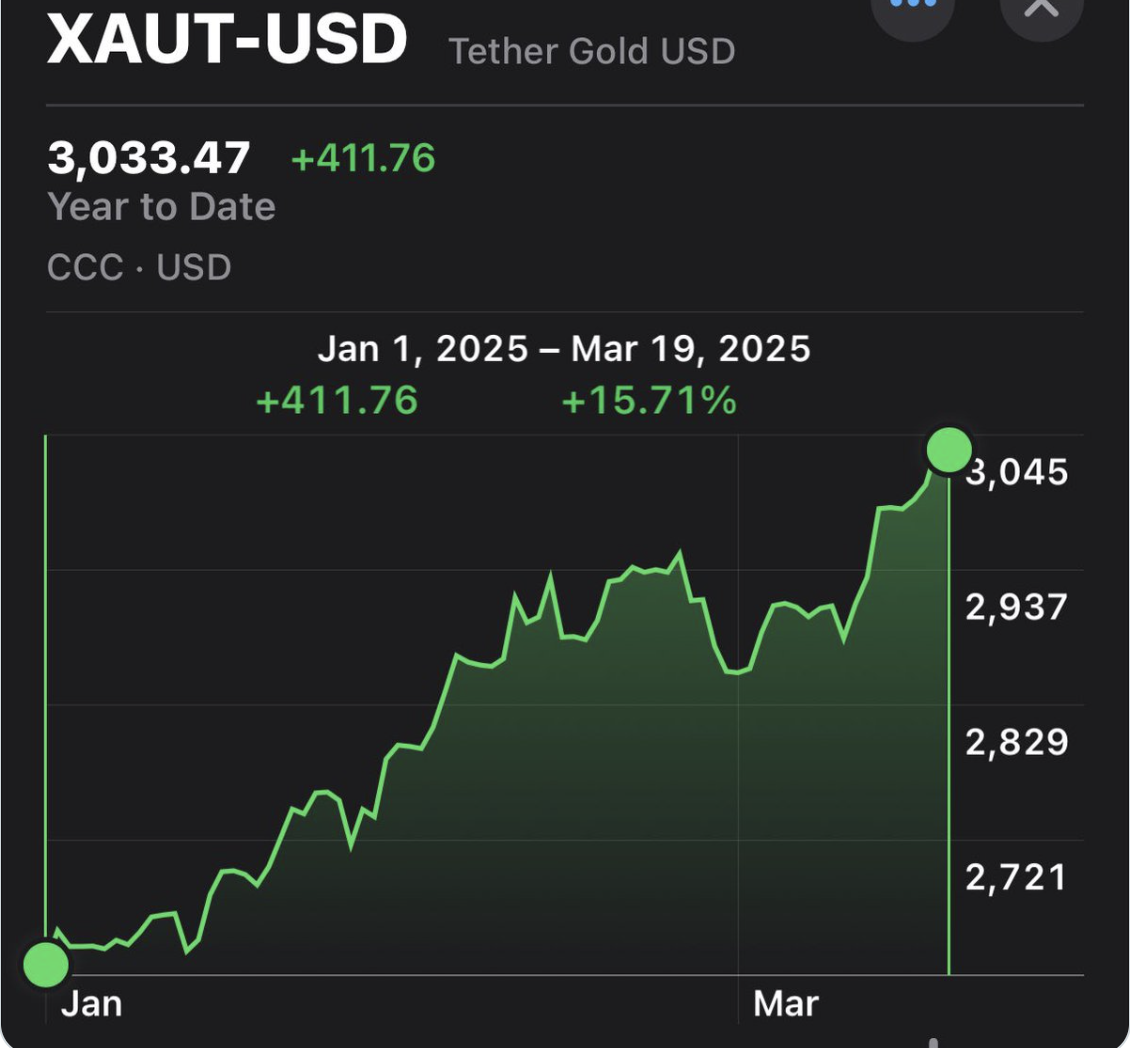

“XAU₮ has risen 15.7% year-to-date, while the wider crypto market is struggling. Organizations and businesses should consider using XAU₮ to hedge their investments,” he noted in a post on X dated March 19.

XAUT has reached an all-time high following a major rally in the gold market. Source: Gabor Gurbacs

Meanwhile, US policymakers have a different vision

US Treasury Secretary Scott Bessent indicated that the Trump administration would prioritize the use of dollar-pegged stablecoins to maintain the dollar’s status as the reserve currency and uphold its dominance in the global financial system.

During the White House Crypto Summit on March 7, Bessent highlighted that developing a stablecoin framework would be a key focus for the administration.

Federal Reserve Governor Christopher Waller expressed similar sentiments, supporting the use of stablecoins to reinforce the US dollar, prior to Bessent’s comments at the summit.

Additionally, US lawmakers have introduced various bills aimed at establishing a regulatory framework for tokenized fiat assets, including the Stable Act of 2025 and the GENIUS stablecoin bill.

Magazine: Unstablecoins: Risks of depegging, bank runs, and other challenges ahead