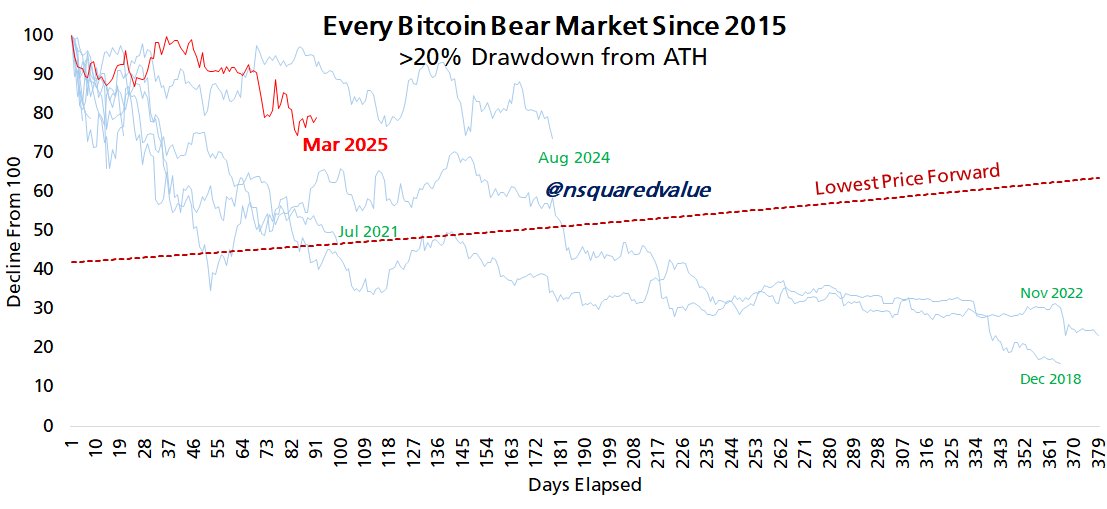

The current bear market for Bitcoin (BTC), characterized by a decline of 20% or more from its peak price, is relatively mild and is projected to last for around 90 days, as noted by market analyst Timothy Peterson.

Peterson has assessed the present downturn against the previous ten bear markets, which generally appear about once a year. He indicated that only four of those past bear markets—specifically in 2018, 2021, 2022, and 2024—experienced greater declines in terms of duration compared to the current situation.

The analyst forecasts that BTC is unlikely to drop significantly below the $50,000 mark, given the ongoing trends in adoption. He also expressed skepticism about BTC falling below $80,000 based on current momentum. Peterson elaborated:

“There may be a decline over the next 30 days, followed by a rally of 20-40% after April 15. This is evident in the charts around the 120-day mark. Such a spike could attract those who have exited the market back in, potentially driving Bitcoin to new heights.”

Markets for cryptocurrencies have suffered a notable decline following trade tensions sparked by tariffs from the U.S. President on several trading partners, which resulted in retaliatory tariffs on American exports and ignited concerns about an extended trade conflict.

Comparison of all bear markets since 2025.

Related: Could Bitcoin reach $65K? Traders discuss their ongoing bearish outlook.

Investors retreat from riskier assets amidst trade war anxieties

The interest in speculative investments is waning due to the persistent trade war and uncertain macroeconomic conditions.

The Glassnode Hot Supply metric, which tracks BTC held for a week or less, has plummeted from 5.9% during the historic bull run in November 2024 to just 2.3% as of March 20.

Nicolai Sondergaard, a research analyst with Nansen, noted that the crypto sector will likely continue to feel the effects of the trade war until April 2025, when there may be opportunities for international negotiations to alleviate or eliminate these tariffs.

A recent study from CryptoQuant indicated that most retail traders are already positioned in BTC, squashing long-held expectations that a significant influx of new retail investors would bring additional capital and boost prices in the near future.

The ongoing trade conflict has also cast doubt on Bitcoin’s reputation as a safe haven asset, as its value dropped in reaction to tariff announcements, much like other riskier investments.

Magazine: Bitcoin enthusiasts are ‘all in’ on Trump since Bitcoin ’24, but it’s becoming increasingly risky.

This article is not intended as investment advice or recommendations. All investments and trading activities carry risk, and individuals should undertake their own research prior to making any decisions.