Ether must reestablish the “macro” range above the $2,200 threshold to gain additional upward momentum, as the cryptocurrency market continues to face pressure from global macroeconomic concerns at least until early April.

The price of Ether (ETH) has declined over 51% during a three-month downtrend, following a peak above $4,100 on December 16, 2024, according to available data.

ETH/USD, 1-day chart. Source: TradingView

For a reversal to occur from its current downtrend, Ether’s price needs to reclaim the “macro range” above $2,200, as noted by a prominent crypto analyst in a recent social media update:

“If price can generate a strong enough response here, then #ETH will be able to reclaim the $2,196-$3,900 Macro Range (black).”

ETH/USD, monthly chart. Source: Source

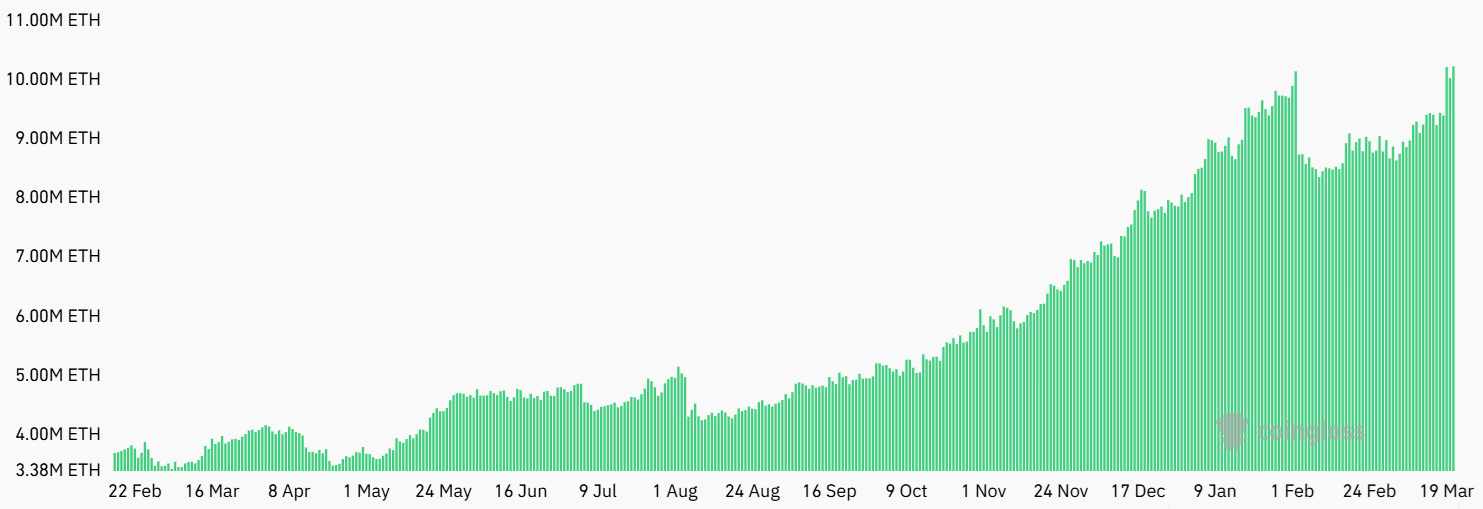

In the meantime, Ether’s open interest reached an all-time high on March 21, boosting investor optimism that large traders are positioning themselves for a rally above $2,400.

Ether futures aggregate open interest, ETH. Source: CoinGlass

Despite encouraging developments in crypto regulations, such as the US Securities and Exchange Commission dropping its lawsuit against Ripple, Ether has struggled to gain significant momentum.

Some analysts predict that both traditional and crypto markets will remain under pressure from global trade war anxieties until at least the beginning of April, when a resolution regarding retaliatory tariffs may be reached.

Whales are the Only Buyers: Analyst Insight

While many crypto traders attribute market declines to large investors or whales, these market participants are simply “trading the market in any direction,” according to a research analyst.

During a recent online segment, the analyst noted:

“The ETH whales holding between 10,000 to 100,000 ETH have actually been accumulating, while other investors have been selling off.”

The number of addresses holding at least $100,000 worth of Ether increased at the beginning of March, rising from just over 70,000 on March 10 to more than 75,000 by March 22, according to available data.

ETH: Number of Addresses with Balance ≥ $100k. Year-to-date chart. Source: Source

In comparison, on December 8, when Ether was priced above $4,000, there were over 146,000 wallets with balances exceeding $100,000.

Despite the potential for short-term fluctuations, investors remain optimistic about the remainder of 2025, with forecasts suggesting a price top of $6,000 for Ether and $180,000 for Bitcoin during the year.

Magazine: SEC’s Policy Shift on Crypto Leaves Key Questions Unresolved