The native token of Ethereum, Ether (ETH), has seen a significant decrease in value, dropping from $4,100 in December 2024 to around $1,750 in March 2025—losing nearly half its worth in just three months. Despite this decline, the token appears to be in a strong position for a robust price recovery.

Potential for 65% Price Recovery by June

From a technical perspective, Ether is looking at a possible breakout as it tests a long-standing support area. Historically, rebounds from this multi-year support zone have resulted in dramatic price surges—most notably gains of over 2,000% and 360% during past cycles.

ETH/USD two-week price chart.

As of March 23, the ETH/USD pair was trading near $2,000, close to this support zone. A rebound from this area could potentially bring the price to $3,400 by June, reflecting a 65% increase from the current levels.

This target aligns with the lower boundary of the existing descending channel resistance for Ether.

Source:Ted Pillows

On the other hand, falling below the support zone could lead the ETH price to the 200-2W exponential moving average (200-2W EMA), represented by the blue wave in the first chart, around $1,560.

Institutional Confidence Grows with Over $1 Billion in ETH

The optimistic outlook for Ether coincides with a growing trust in Ethereum from institutional investors.

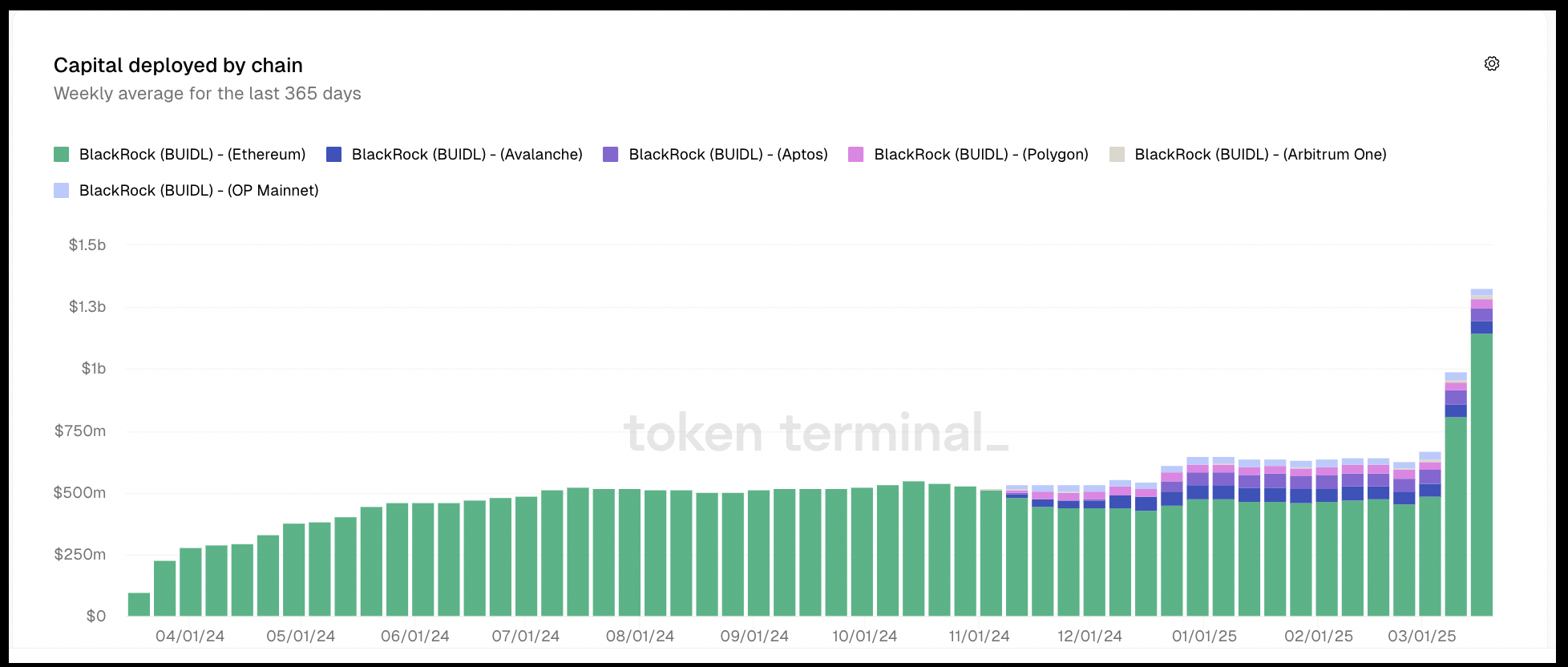

The BUIDL fund from BlackRock has amassed an impressive $1.145 billion in Ether, a notable increase from approximately $990 million just a week prior, according to recent data.

Capital invested in BlackRock’s BUIDL fund.

This fund mainly invests in tokenized real-world assets (RWAs), with Ethereum continuing to serve as the primary foundational layer. Although the fund diversifies into other chains such as Avalanche, Polygon, Aptos, Arbitrum, and Optimism, Ethereum remains its principal focus.

BlackRock’s recent acquisition of ETH reflects increasing institutional confidence in Ethereum’s capacity to lead in real-world asset tokenization.

Related: Ethereum open interest reaches new peaks — Will ETH price follow suit?

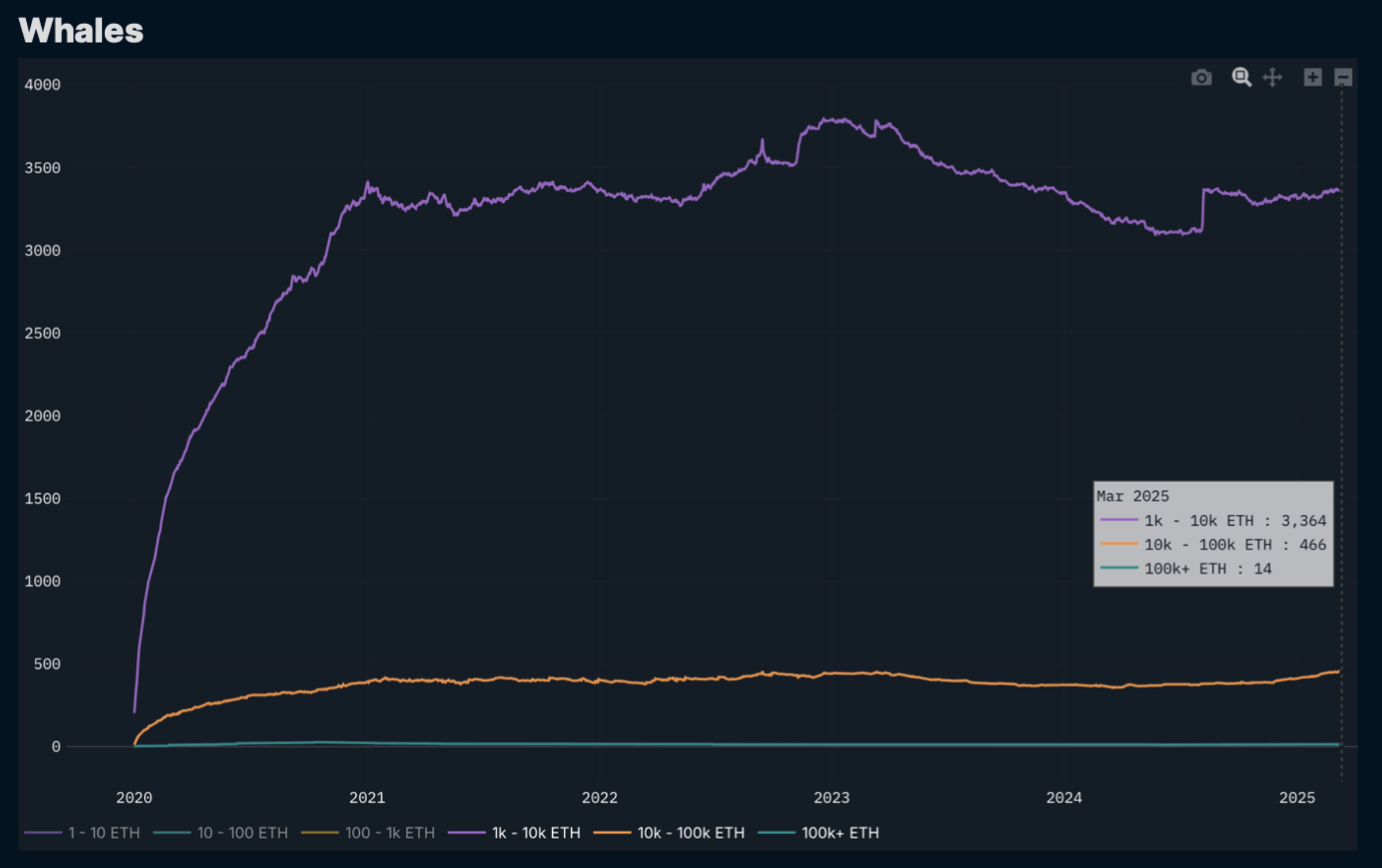

The bullish sentiment around Ethereum also aligns with a notable uptick in whale accumulation.

Recent onchain data illustrates that since March 12, 2024, addresses holding between 1,000–10,000 ETH have boosted their holdings by 5.65%, while the 10,000–100,000 ETH bracket has surged by 28.73%.

Ethereum whale holdings.

Although the number of addresses holding more than 100,000 ETH has remained relatively stable, this accumulation trend highlights growing confidence among significant investors.

This article does not provide any investment advice or recommendations. All investments and trading activities carry risks, and readers should perform their own due diligence prior to making any decisions.