A crypto analyst highlights that misleading narratives continue to thrive in the cryptocurrency market, primarily fueled by distorted information rather than reliable onchain data to substantiate them.

“Be wary of misinformation. Even with the available data, incorrect narratives continue to circulate,” noted a contributor in a recent market overview.

“These assertions frequently lack onchain validation and are influenced more by sensational market sentiment than by factual analysis,” the analyst remarked, adding:

“Trust the data, not the noise; always verify your sources and cross-reference onchain metrics.”

The analyst referred to the recent activities of Bitcoin (BTC) long-term holders (those who have held for more than 155 days) to illustrate how false narratives contradict actual data.

While some narratives suggest that Bitcoin long-term holders are “capitulating,” the data indicates they are maintaining their positions. “The evidence leaves little room for speculation,” the analyst stated.

The Inactive Supply Shift Index (ISSI) — which gauges the extent to which long-dormant Bitcoin supply is moving — “does not indicate any significant selling pressure from long-term holders, reinforcing the idea that structural demand is outpacing supply,” the expert explained.

Narratives are constantly being tested

A crypto analytics platform recently echoed this sentiment, observing that “Long-Term Holder activity remains predominantly subdued, with a marked decrease in their selling pressure.”

Narratives in the crypto market are perpetually evolving and being reassessed.

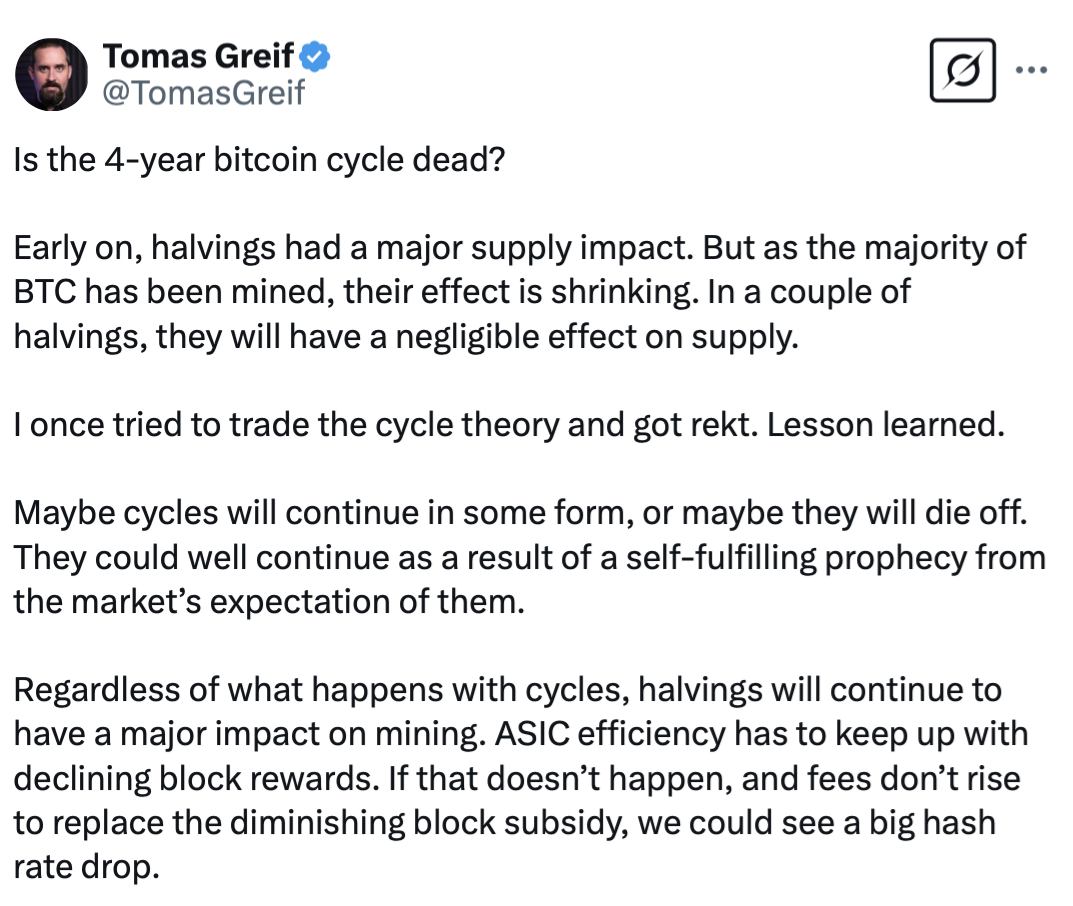

One ongoing debate centers around the validity of the four-year cycle theory, which posits that Bitcoin’s price follows a predictable pattern linked to its halving event every four years.

Source: Tomas Greif

MN Trading Capital founder Michael van de Poppe recently expressed in an X post, “I believe we can move past the four-year cycle theory and may be experiencing a longer cycle for Altcoins.”

Related: Crypto markets will face pressure from trade wars until April: Analyst

Similarly, Bitwise Invest’s chief investment officer, Matt Hougan, remarked that “the traditional four-year cycle has ended in crypto” due to recent shifts in the US government’s stance.

“Crypto has historically operated in four-year cycles. However, the changes in Washington signal a new phase that will unfold over a decade,” Hougan stated.

In addition, some analysts are even questioning whether the Bitcoin bull market has concluded.

The founder and CEO of CryptoQuant recently remarked in an X post, “The Bitcoin bull cycle has ended; I anticipate 6-12 months of bearish or sideways price movements.”

He noted that all Bitcoin onchain metrics suggest a bear market. “As fresh liquidity dries up, new whales are offloading Bitcoin at lower price levels,” he added.

Magazine: A beginner’s guide to native rollups: L2s as secure as Ethereum itself