Bitcoin appears to have reached its lowest point and might potentially rise towards $90,000 following a recent indication from the U.S. President regarding tariff adjustments and the Federal Reserve’s resistance to immediate market pressures last week, as noted by a cryptocurrency analyst.

“It seems that Bitcoin is in the process of forming a bottom, bolstered by Trump’s latest approach to ‘flexibility’ regarding the upcoming reciprocal tariffs set for April 2, which marks a shift from his previous stance,” remarked an analyst in a recent report.

In a meeting held on March 18-19, the Federal Reserve also signaled its intention to “overlook short-term inflation concerns, paving the way for possible future easing measures,” the analyst further explained.

“Powell’s somewhat dovish remarks suggest that the Fed’s protective stance remains intact, adding further support for a potential stock price recovery.”

The Bitcoin reversal indicators identified by the analyst have now turned positive, with the cryptocurrency’s 21-day moving average resting at $85,200.

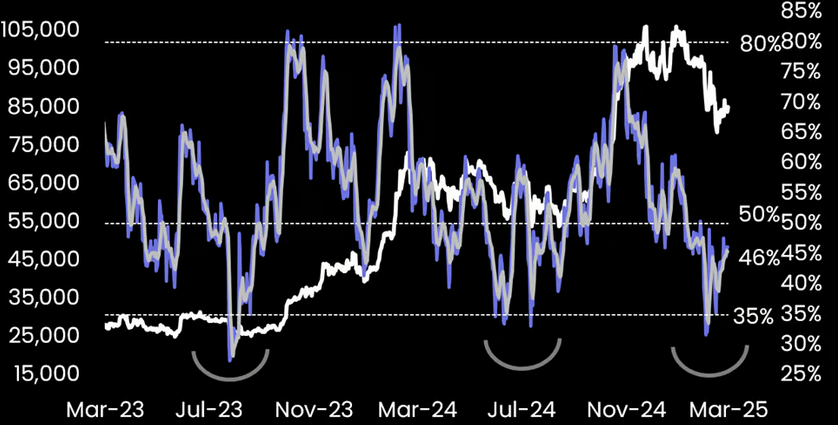

Bitcoin’s bottoming patterns observed over the past two years.

The expert highlighted that these weekly reversal indicators have dropped to levels reminiscent of previous bull market beginnings, notably in September 2023, driven by Bitcoin exchange-traded fund discussions, and in August 2024 prior to the U.S. elections.

“In summary, the technical landscape has reset to a place where a renewed uptrend could conceivably begin.”

The analyst also pointed out that several altcoins are breaking free from their downward trends and are now trading at more favorable prices.

Currently, Bitcoin is trading at $85,720, showing a 2.1% increase over the last 24 hours, according to data.

In addition, Ether (ETH), Tron (TRX), and Avalanche (AVAX) have experienced price increases of 4.3%, 6.4%, and 8.9% respectively over the past week.

However, the research analyst anticipates “significant resistance” at the $90,000 level for Bitcoin, should it manage to reach that point.

Despite the generally optimistic outlook, the analyst stated that “there is currently no clear catalyst for an immediate dramatic surge.”

Related: Bitcoin positioned for its first key RSI breakout in six months at $85K

Initially, the analyst predicted that Bitcoin would not fall below $73,000, thereby avoiding a “deep bear market,” due to the fact that the largest Bitcoin holder group (wallets containing 100-1000 Bitcoin) are likely comprised of family offices and wealth managers focused on long-term investments.

Additionally, it was noted that U.S.-based spot Bitcoin exchange-traded funds saw inflows for the first time last week since the end of January.

“We anticipate that selling from arbitrage-driven Bitcoin ETFs will decrease, as the opportunities for arbitrage have largely been exhausted for weeks,” the analyst added.

Magazine: SEC’s change in stance on crypto raises important questions