The cryptocurrency exchange Kraken is contemplating a significant capital raise in anticipation of a possible initial public offering (IPO) slated for early next year, as reported on March 24.

According to unnamed sources, Kraken is exploring a debt package ranging from $200 million to $1 billion. The exchange is said to be in initial discussions with Goldman Sachs and JPMorgan Chase regarding the facilitation of this transaction.

The funds, as indicated by the source, are intended to bolster Kraken’s growth rather than cover operational costs.

Reports about Kraken’s IPO plans have been ongoing for nearly a year. Interest in going public has heightened following the election of US President Donald Trump, with suggestions that Kraken’s IPO could occur in the first quarter of 2026.

Inquiries made to a Kraken representative regarding the potential debt package and IPO were met with no comment.

Kraken ranks among the largest cryptocurrency exchanges globally, handling over $1.1 billion in trading volume within the last 24 hours, according to CoinMarketCap data.

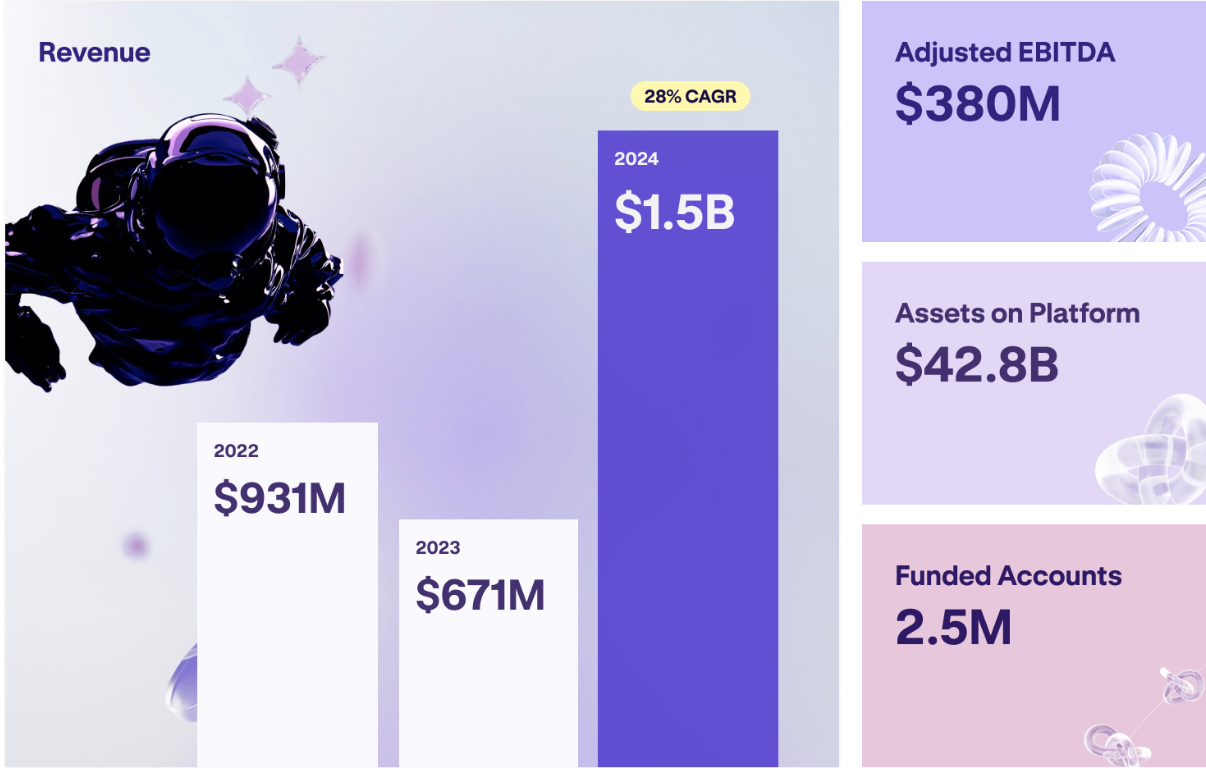

The exchange experienced rapid growth in 2024, with year-end financial documents reflecting $1.5 billion in revenue—an increase of 128% compared to 2023. The company’s adjusted earnings for the year reached $380 million.

Kraken’s year-end financial reports indicate substantial growth in revenue, funded accounts, and assets.

Related: Kraken obtains MiFID license to provide derivatives in Europe

Kraken’s Latest Acquisition

Kraken is intensifying its presence in the derivatives sector through the $1.5 billion acquisition of NinjaTrader, a well-known brokerage that specializes in futures contracts. This move is part of the exchange’s larger strategy to diversify into multi-asset services, including equities and payment solutions.

NinjaTrader, established in 2003, is registered with the US Commodity Futures Trading Commission.

Source: Arjun Sethi

This acquisition reflects how crypto firms are confidently expanding their businesses following the establishment of a pro-crypto Republican administration. Recent reports indicate that Kraken was among several exchanges released from enforcement actions by the US Securities and Exchange Commission.

A favorable regulatory environment may have also influenced Kraken’s decision to resume crypto staking services for US clients after a hiatus of nearly two years. Clients in 37 states can now access staking services for 17 cryptocurrencies, including Ether (ETH) and Solana (SOL).

Magazine: Unstablecoins: Depegging, bank runs, and other risks loom