Fidelity Investments has submitted a registration for a tokenized version of its US dollar money market fund on Ethereum, positioning itself alongside BlackRock and Franklin Templeton in the realm of blockchain tokenization.

In its filing with the US securities regulator on March 21, Fidelity indicated that the new initiative, referred to as “OnChain,” would assist in monitoring transactions of the Fidelity Treasury Digital Fund (FYHXX), a fund valued at $80 million that is primarily composed of US Treasury bills.

Pending regulatory approval, Fidelity expects OnChain to launch on May 30.

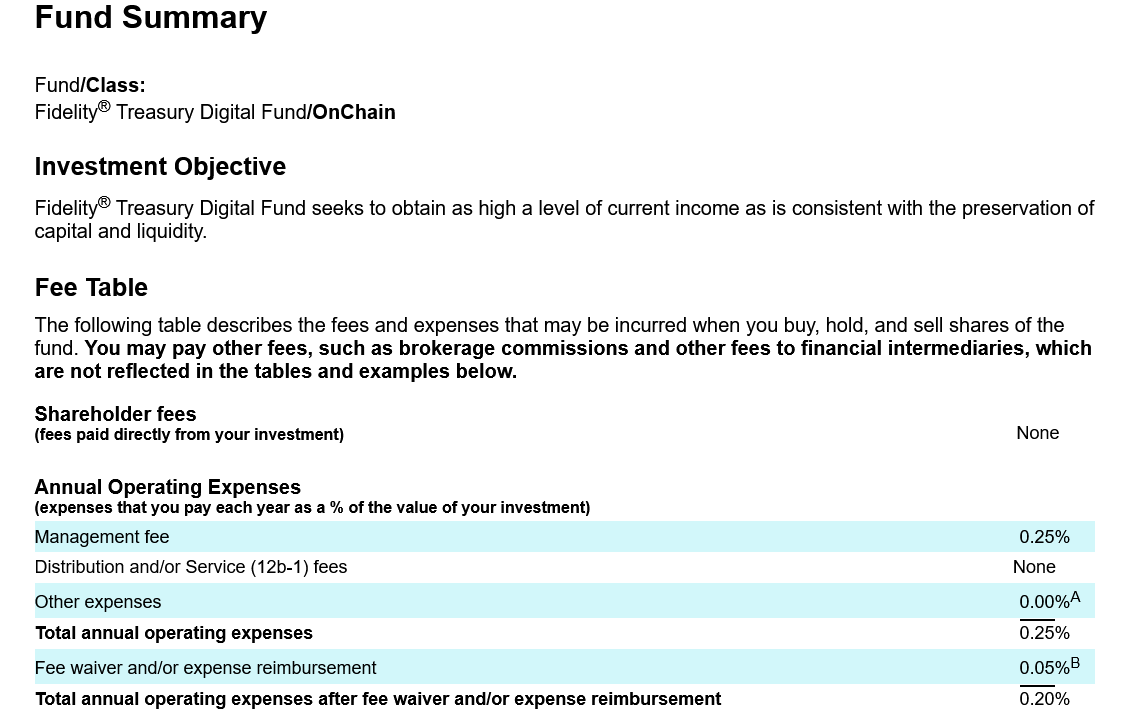

Fidelity’s filing for a tokenized version of the Fidelity Treasury Digital Fund.

The OnChain share class is designed to offer investors transparency and a verifiable means of tracking share transactions of FYHXX. However, Fidelity will continue to maintain traditional book-entry records as the official ownership log.

“While the OnChain class on a blockchain will not serve as the official record of ownership, the transfer agent will reconcile blockchain transactions with the official records of the OnChain class on a daily basis.”

Fidelity clarified that the US Treasury bills themselves will not be directly tokenized.

The $5.8 trillion asset management firm has also noted potential plans to expand OnChain to other blockchain platforms in the future.

Related: Ethereum anticipates 65% gains from ‘cycle bottom’ as BlackRock’s ETH holdings surpass $1B

In recent years, asset managers have increasingly utilized blockchain technology to tokenize Treasury bills, bonds, and private credit.

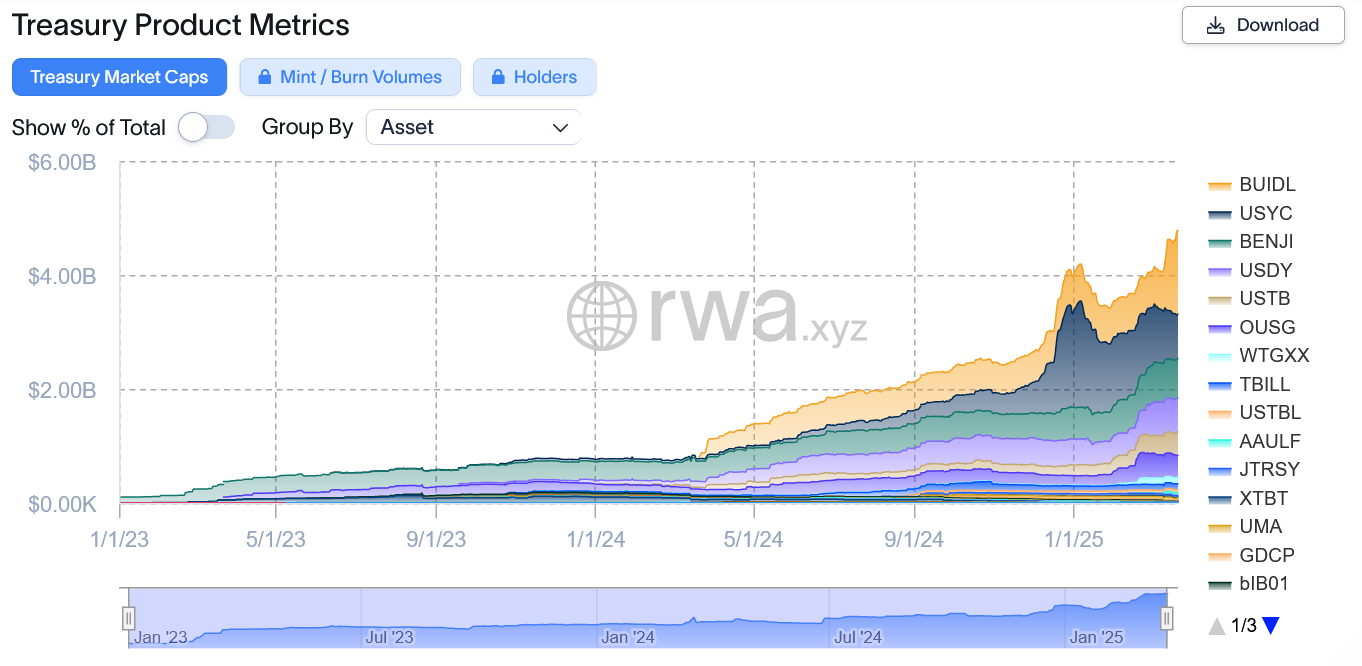

The market for tokenized Treasury products is currently valued at $4.78 billion, with the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) leading at $1.46 billion, according to rwa.xyz.

Market caps of blockchain-based Treasury products.

More than $3.3 billion worth of RWAs have been tokenized on the Ethereum network, followed by Stellar with $465.6 million.

Recently, BlackRock’s head of crypto, Robbie Mitchnick, remarked that Ethereum remains the “natural default answer” for traditional finance firms looking to tokenize RWAs on-chain.

“There was no question that the blockchain we would start our tokenization on would be Ethereum, and that’s not just a BlackRock thing, that’s the natural default answer,” he stated at the Digital Asset Summit in New York on March 20.

“Clients clearly value decentralization, credibility, and security, which are strong advantages Ethereum continues to offer,” he added.

Magazine: Comeback 2025: Is Ethereum ready to catch up to Bitcoin and Solana?