The emergence of AI-powered crypto agents is following a well-known pattern similar to the early stages of ICO projects, characterized by initial excitement, subsequent decline, and eventual recovery. Just as early blockchain initiatives flourished amid significant buzz before evolving into more sustainable frameworks, the ongoing surge of AI agent projects is experiencing swift market fluctuations.

A recent analysis highlights that investors are becoming more prudent as competition escalates in the field, liquidity spreads thin, and numerous projects find it challenging to establish clear use cases. Nevertheless, as the sector transitions away from speculation, AI-driven crypto agents are anticipated to develop viable business models grounded in real-world utility.

For further insights into the progression of crypto agents and the future of AI-based blockchain innovations, access the complete analysis here.

Transformation from hype to reality: The journey of crypto agents

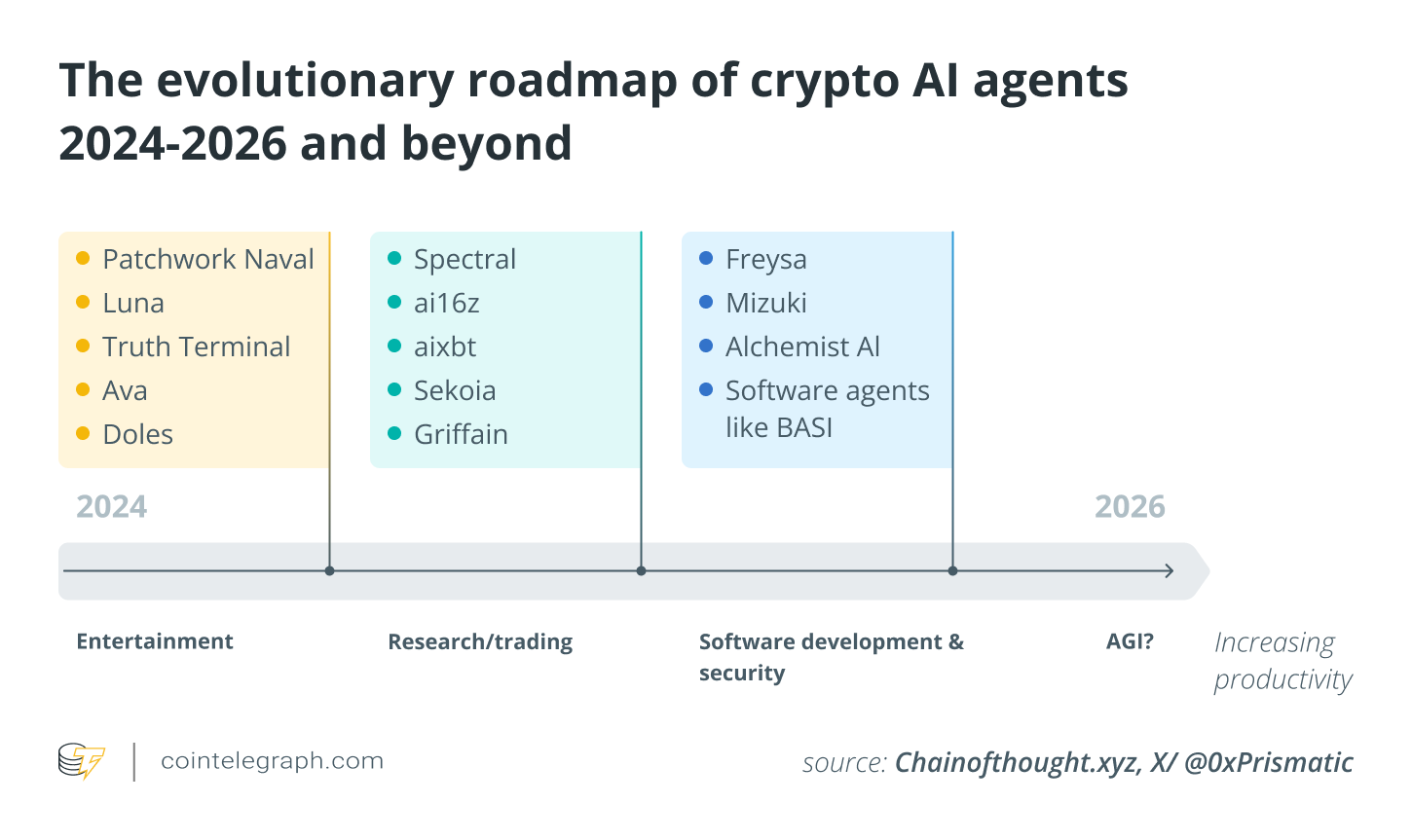

The first wave of crypto agent initiatives in 2024 stemmed from uncritical enthusiasm for AI applications. Following Marc Andreessen’s notable $50,000 Bitcoin contribution in October 2024 and the early-year success of token launch platforms, numerous AI agents flooded the market in the first quarter of 2024, resulting in a rapid liquidity crunch by the first quarter of 2025. As seen in other emerging industries, the early hype didn’t consistently lead to long-term sustainability, prompting a cooling-off period in the AI agent space.

The market is now progressing towards a more mature stage, where emphasis is shifting from speculative excitement to income generation and product performance. Those who succeed in this evolving environment will be adept at producing stable revenues, managing AI model operating costs, and delivering tangible benefits to both users and investors.

AI agent applications focus on practical deployment and commercialization of technology, especially in sectors such as automated trading, asset management, market analysis, and cross-chain interaction. This methodology aligns with multi-agent systems and decentralized finance combined with AI, as seen in initiatives like Hey Anon, GRIFFAIN, and ChainGPT.

Recent studies underscore the benefits of multi-agent systems (MAS) in managing portfolios, particularly in cryptocurrency investments. Projects like Griffain, NEUR, and BUZZ showcase how AI can enhance user interactions with DeFi protocols and facilitate informed decision-making. Unlike single-agent AI systems, multi-agent frameworks utilize collaboration among specialized agents to improve market analysis and execution. These agents operate in teams consisting of data analysts, risk assessors, and trading execution groups, each with unique training for specific tasks.

The MAS approach integrates communication mechanisms that enable agents within a team to refine predictions through collective learning, thereby diminishing errors in market trend assessments. The forthcoming phase of decentralized finance combined with AI is likely to witness deeper engagement with governance models, where multi-agent systems contribute to protocol management, treasury optimization, and on-chain compliance.

For further insights into the progression of crypto agents and the future of AI-based blockchain innovations, access the complete analysis here.

DeepSeek-R1: A significant advancement in AI agent training

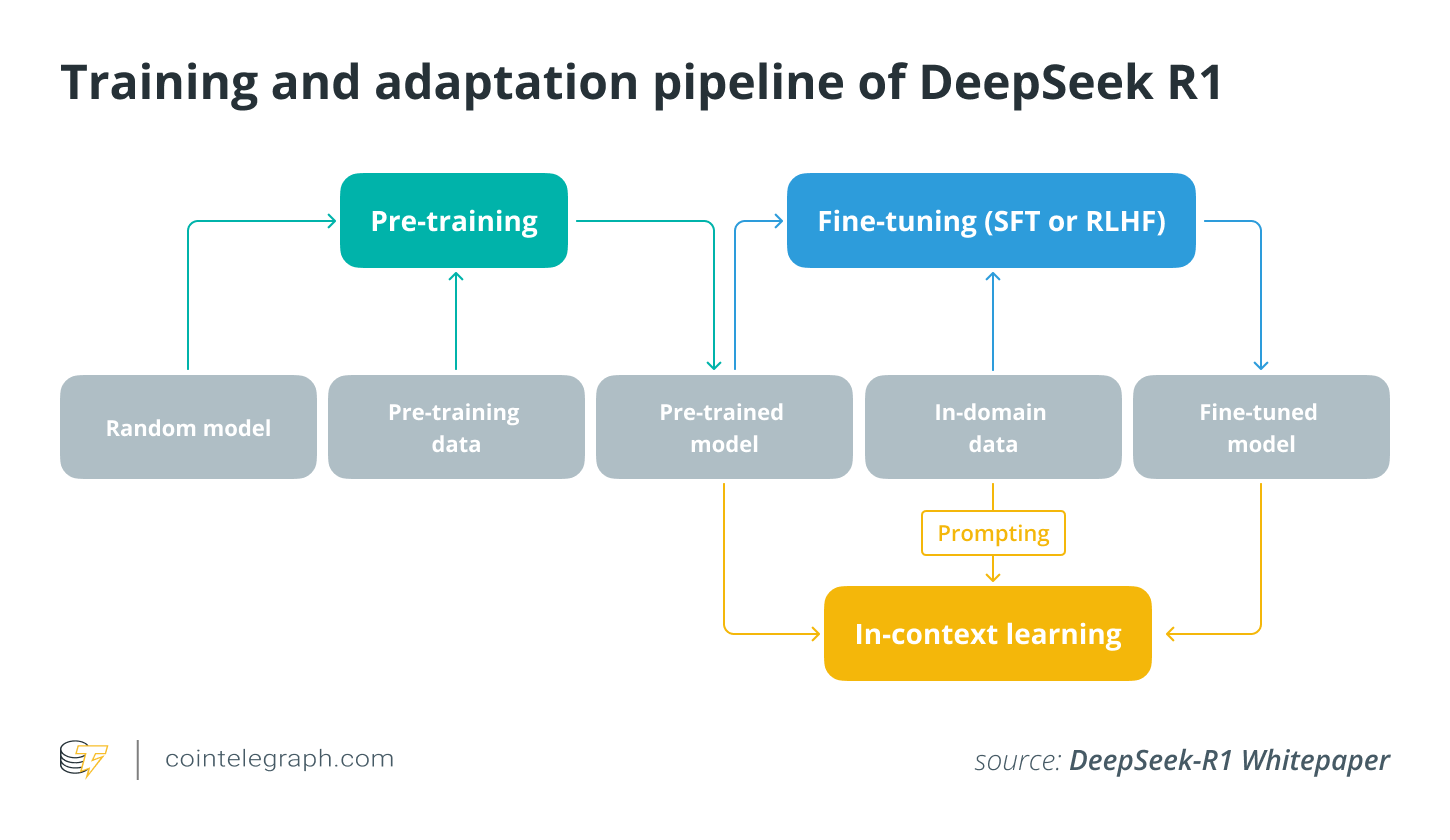

A revolutionary development in AI agent technology has emerged with DeepSeek-R1, an innovation that disrupts conventional AI training methodologies. Unlike earlier models that depended on a supervised fine-tuning phase followed by reinforcement learning, DeepSeek-R1 employs pure reinforcement learning from the outset. This shift has resulted in significant enhancements in reasoning abilities and adaptability, paving the way for more advanced AI-driven crypto agents.

To grasp this paradigm shift, consider two distinct learning strategies. In the conventional SFT and reinforcement learning model, a student begins with a workbook, practicing problems with fixed solutions (SFT), and later undergoes tutoring to deepen their understanding (RL). Conversely, the DeepSeek-R1 model immerses the student directly into an exam, allowing them to learn through trial and error. This approach enables the student to adapt dynamically based on feedback rather than depending on established answers.

Utilizing DeepSeek-R1’s pure reinforcement learning framework, AI agents learn through experiential trial and error within real-world contexts, continuously refining their strategies based on real-time feedback.

This technique enhances adaptability, making it especially beneficial for multi-agent AI setups in decentralized finance, where instantaneous market changes require agents to make autonomous, data-informed decisions. For instance, AI-driven agents can oversee liquidity pools, identify arbitrage possibilities, and optimize asset distributions based on prevailing market conditions. These agents respond swiftly to market dynamics, ensuring more efficient allocation of resources.

Introduced in late November 2024, iDEGEN is the first crypto AI agent built on DeepSeek-R1. This integration of the DeepSeek model underscores how crypto AI agents can benefit from enhanced reasoning capabilities, enabling them to compete with existing AI models at a significantly lower cost.

This trend towards reinforcement learning-based, multi-agent AI in decentralized finance highlights why closed-source AI frameworks, like those based on proprietary models such as OpenAI’s, are becoming increasingly unfeasible due to high operational costs. With workflows frequently requiring processing of over 10,000 tokens per transaction, these proprietary systems lead to considerable computational expenses, hindering scalability. In contrast, open-source reinforcement learning frameworks like DeepSeek-R1 facilitate decentralized, cost-effective AI development tailored specifically for decentralized finance applications.

The future of AI agents within Web3

The foundation for longevity in this sector hinges on ongoing innovation, adaptability, and cost-effectiveness. Open-source AI frameworks like DeepSeek-R1 significantly lower entry barriers, enabling blockchain-native startups to create niche AI solutions. Progressions in decentralized finance combined with AI and multi-agent systems are set to drive the long-term integration of these technologies.

The message is clear: Projects must demonstrate value beyond mere speculation. Those capable of establishing sustainable economic models and harnessing cutting-edge AI developments will shape the future of intelligent blockchain ecosystems. The era of ICOs for crypto agents is advancing, and the next cohort of success stories will be those that convert innovation into lasting viability.

For further insights into the progression of crypto agents and the future of AI-based blockchain innovations, access the complete analysis here.

Disclaimer: This content is intended for informational purposes only. Readers should conduct their own research and bear full responsibility for their decisions. This article should not be interpreted as legal or investment advice. The views expressed here are those of the author and do not necessarily reflect the opinions of any affiliated entities.