TRUMP token surges after President’s endorsement

The Official TRUMP memecoin, associated with US President Donald Trump, experienced a rapid increase of over 12% to $12.25 within 40 minutes on March 23, following the president’s remark on social media calling it “The greatest of them all.”

“I LOVE $TRUMP — SO COOL!!! The Greatest of them all!!!!!!!!!!!!!!!!” Trump wrote on a social media platform on March 23 at 2:33 am UTC.

Image Source: Image Credit

By 3:11 am, nearly $250 million was integrated into the market cap of the TRUMP token, reaching $2.5 billion. However, the memecoin dropped back to $11.38 roughly 90 minutes later, according to CoinGecko data, and is currently trading at $11.82.

Although it ranks as the 53rd largest coin by market cap, Trump’s post propelled it to be the eighth most-traded token over the past 24 hours, with a trading volume of $1.4 billion.

Not every investor profited from TRUMP on March 23.

One large investor who had previously gained around $108 million from TRUMP lost $207,000 in a recent transaction, as noted by a blockchain analytics firm.

The TRUMP token has largely trended downward and sideways since hitting a market cap peak of $14.6 billion on January 19.

Change in TRUMP’s price since January 18. Source: Price Chart

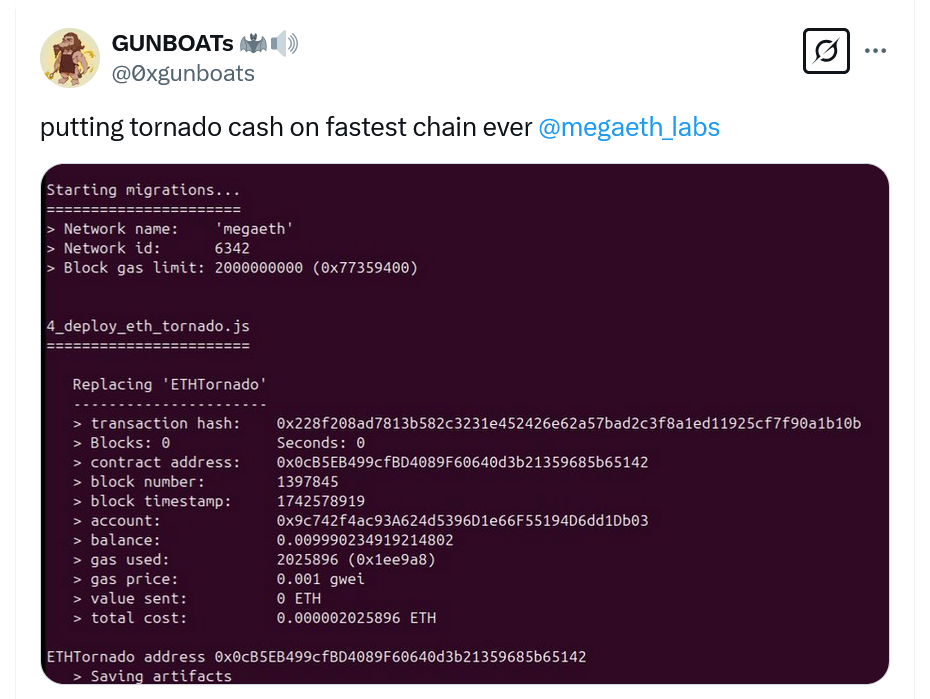

Tornado Cash launches on MegaETH testnet

A relatively unknown crypto developer named “GUNBOATs” on X has introduced the Tornado Cash privacy mixer on the MegaETH testnet—a new Ethereum layer 2 blockchain aimed at addressing Ethereum’s scalability challenges.

The developer showcased a command-line interface displaying the Tornado Cash smart contract “0x0cB…65142” that was deployed on the MegaETH testnet at block 1,397,845, which was timestamped on March 21 at 5:41 pm UTC, according to the MegaETH explorer.

Image Source: Developer’s Credit

This integration took place shortly after the US Treasury Department removed Tornado Cash from its sanctions list on March 21 and merely two months following a US appeals court’s ruling that the Treasury’s Office of Foreign Assets Control couldn’t impose sanctions on Tornado Cash smart contracts as they aren’t tied to any foreign national’s ownership.

MegaETH also initiated its testnet on the same day the Tornado Cash sanctions were lifted.

While the timeline for a full launch remains uncertain, the organization behind the MegaETH public testnet claims it offers “unparalleled performance” with 10 millisecond block times while managing about 20,000 transactions per second.

Solo Bitcoin miner captures BTC block, netting $266K

An independent Bitcoin miner believed to be operating a device with less than one terahash per second (TS/s) has successfully solved one of the blockchain’s blocks, earning a reward of $266,552.

“Another solo miner found a block!! This time on a self-hosted Public Pool. We can’t be certain, but it seems likely it was a miner with under 1 TH/s,” an account noted in an X post on March 23.

This miner secured a total of 3.15 BTC for solving block 888,989, which was timestamped on March 23 at 1:30 am UTC, according to blockchain data.

The reward consisted of the standard 3.125 Bitcoin subsidy along with an additional 0.027 Bitcoin ($2,254) from transaction fees.

If the claims are accurate regarding the use of a miner with less than 1 TH/s, it likely indicates the use of a compact or pocket-sized rig, significantly less powerful than industrial-grade application-specific integrated circuits (ASIC).

Example of a compact Bitcoin mining rig that may have solved Bitcoin block 888,989. Source: Mining Rig Source

For perspective, the Bitcoin mining marketplace estimates the odds of a 1.2 TH/s rig mining a block solo in a day is one in 4.6 million.

This event followed a previous instance where a 0.48 TH/s mining machine solved Bitcoin block 887,212 on March 10, obtaining $263,000 in total rewards.

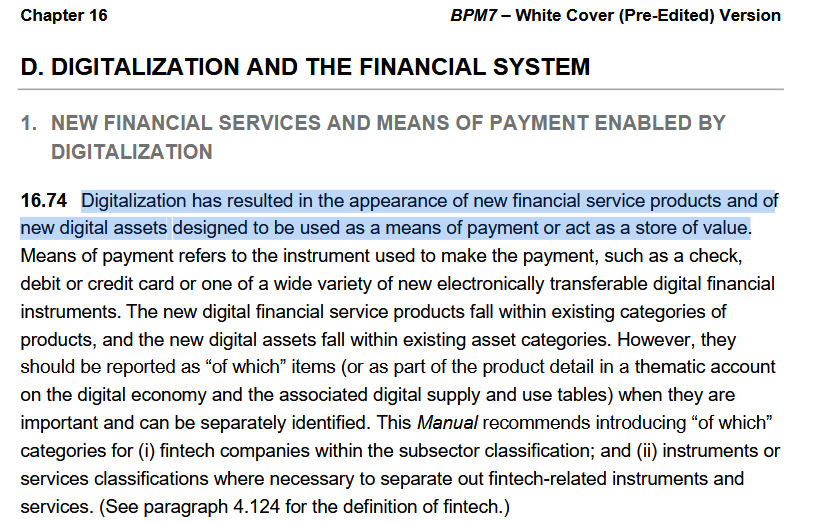

IMF did not label Bitcoin as “digital gold”

Although Bitcoin was mentioned multiple times in the International Monetary Fund’s seventh edition of its “Integrated Balance of Payments and International Investment Position Manual,” released on March 20, none of those mentions categorized it as “digital gold,” contradicting certain reports.

The IMF classifies various “crypto assets,” including Bitcoin, as a “medium of exchange,” while asserting that many new digital assets also aim to serve as a “store of value.”

Misinterpretations of the IMF’s comments on digital assets. Source: IMF Reference

“It’s a significant leap to claim: ‘IMF labels bitcoin as digital gold,’” stated the CEO of a notable crypto organization in a post on March 23.

“While it’s a positive indication of the IMF’s acknowledgment, it does not equate to an endorsement of Bitcoin as ‘digital gold.’”

The IMF also differentiated between fungible and non-fungible tokens, classifying the latter as either a medium of exchange or as securities.

Related: Who is competing in Trump’s pursuit to position the US as a ‘Bitcoin superpower?’

Bitcoin and “crypto assets” were among nine significant updates in the seventh edition, which comprises 1,076 pages.

The IMF’s seventh edition was published as it continues discussions with a specific country about refining the scope of its Bitcoin-related activities.

Additional news:

Stablecoin issuer Tether is reportedly collaborating with a major accounting firm to audit its asset reserves and confirm that its Tether (USDT) stablecoin is indeed backed by a 1:1 ratio. The CEO mentioned that the auditing of Tether’s $143.5 billion worth of assets will likely be less complicated under the current administration.

During the inaugural meeting of Pakistan’s Crypto Council on March 21, the council’s CEO proposed utilizing the country’s excess energy for Bitcoin mining. The council is reportedly exploring thorough regulatory frameworks to attract more foreign cryptocurrency investments, aiming to establish the country as a crypto hub.

Magazine: Understanding native rollups: A complete guide to Ethereum’s latest innovation