The UK ought to implement taxes on cryptocurrency purchases to encourage residents to invest in domestic stocks, potentially enhancing the nation’s economy, suggests the head of an investment banking firm.

“It should alarm us that more than half of those under 45 own crypto and no stocks,” the chair noted. “I would like to see a reduction in taxes on equities, offset by a new tax on crypto investments.”

At present, the UK imposes a 0.5% tax on shares traded on the London Stock Exchange, which is the nation’s primary securities market, generating approximately 3 billion British pounds ($3.9 billion) annually in tax revenue.

The chair further stated that lower taxes on equities could encourage individuals to invest their savings in shares of local businesses, potentially leading to an increase in firms going public within the UK and stimulating economic growth.

In contrast, she described cryptocurrency as “a non-productive asset” that “doesn’t contribute back to the economy.”

“Equities supply growth capital to businesses that hire staff, innovate, and pay corporate taxes. This reflects a social contract. We shouldn’t hesitate to advocate for this.”

The Financial Conduct Authority reported in November that 12% of adults now own cryptocurrency, roughly translating to around 7 million people. A significant portion of crypto owners, 36%, were under the age of 55.

The chair observed that many individuals have “shifted to saving rather than investing,” claiming this approach “won’t secure a sustainable retirement.”

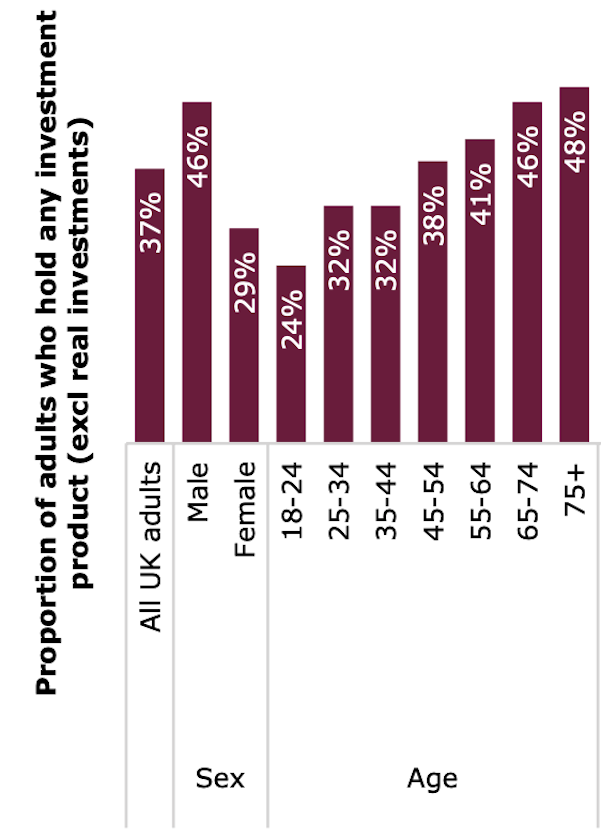

A 2022 survey by the same authority indicated that 70% of adults maintained a savings account, while 38% either directly owned shares or held them through accounts allowing for nearly 20,000 British pounds ($26,000) in tax-free savings annually — roughly three out of four individuals aged 18 to 24 had no investments.

In 2022, a quarter of those aged 18-25 and a third of those aged 25-44 held some form of investment. Source: Relevant Authority

However, in a follow-up review, the regulator revealed that during the 12 months leading to January 2024, the cost-of-living crisis led 44% of all adults to either reduce or halt their savings and investments, with almost a quarter relying on savings or liquidating investments to meet daily expenses.

The chair is also part of a taskforce comprised of industry leaders focused on revitalizing the domestic market, which would benefit her firm as it advises companies on navigating potential public listings.

Related: Will upcoming SEC regulations attract crypto firms into the domestic market?

A consulting firm reported in January that the London stock market had one of its “quietest years ever,” with only 18 companies going public last year, a decrease from 23 in 2023.

Simultaneously, the firm noted that 88 companies delisted or exited the exchange, citing reasons such as “declining liquidity and lower valuations compared to other markets” like the US.

Nonetheless, the chair asserted that the UK remains a “safe haven” compared to markets like the US, which has seen trillions of dollars lost in their stock markets due to various economic threats and recession fears.

Cryptocurrency markets have also declined along with US equities, with Bitcoin (BTC) having dropped 11% over the past month and struggling to maintain support above $85,000 since early March.

Recently, however, Bitcoin has shown a slight increase, trading around $85,640, up 2% within the last 24 hours.

Magazine: Memecoins may be fading — But Solana is ‘100x better’ despite revenue drops