- The price of Binance Coin climbed 3%, surpassing the $635 mark on Monday, with increasing volumes indicating a rise in market interest.

- A stablecoin backed by Trump-associated World Liberty Financial, known as USD1, was launched on March 4. However, it is not currently available for trading.

- According to reports, the project is in the process of developing three products, which include an on-chain marketplace for lending and borrowing.

On Monday, Binance Coin (BNB) experienced a 3% increase in price, surpassing the $635 level as trading volumes rose, indicating a heightened interest in the market. This increase comes as excitement builds around a new stablecoin initiative linked to World Liberty Financial (WLFI), a financial project backed by former U.S. President Donald Trump.

Binance Coin (BNB) reaches $635 thanks to Trump’s influence

After a weekend of consolidation, Binance Coin (BNB) joined the market upswing on Monday.

Binance Coin (BNB) price action, March 24 | Source: TradingView

The TradingView chart reveals that the price of BNB saw a 3.5% increase on Monday, breaking the $635 threshold.

Additionally, the rising trading volume observed on the 24-hour candles hints at growing market enthusiasm.

This uptrend is fueled by increasing anticipation surrounding the USD1 stablecoin initiative supported by World Liberty Financial.

World Liberty Financial (WLFI) introduces USD1 stablecoin on BNB Chain

World Liberty Financial has officially rolled out USD1, a stablecoin pegged to the U.S. dollar on the BNB Chain. This initiative aligns with WLFI’s broader objective of promoting stablecoin adoption and offering a decentralized alternative for global digital transactions.

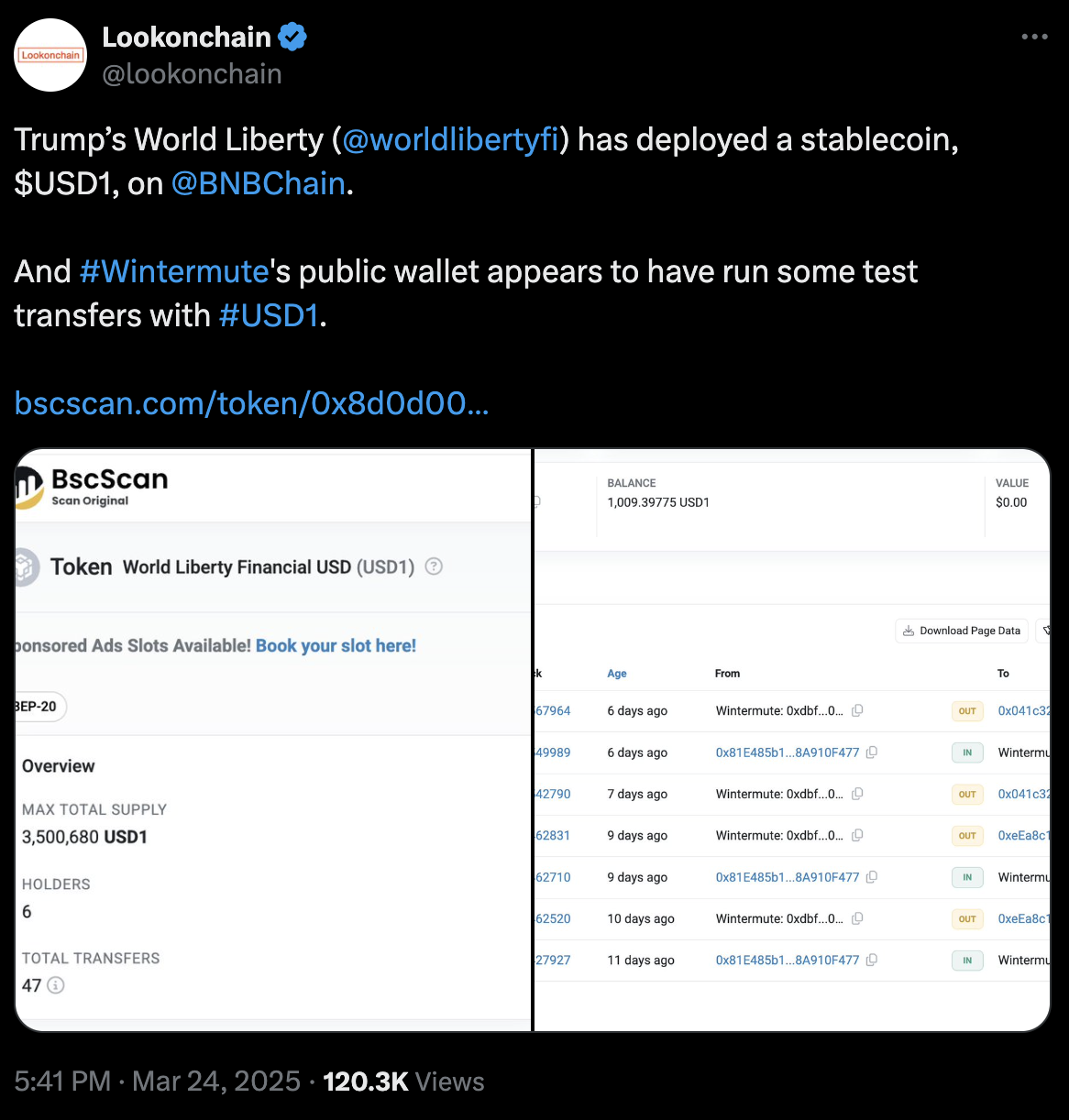

WLFI launches USD1 stablecoin contract on BNB chain | Source: Lookonchain March 24

Blockchain analytics firm LookOnChain has confirmed the deployment of this stablecoin, noting exchanges between the contract and a wallet associated with crypto market maker Wintermute, implying preliminary transfers are taking place.

According to Binance founder Changpeng Zhao, the stablecoin contract was set up around 20 days ago.

Nevertheless, WLFI has made it clear that while the stablecoin exists, it is not yet trading, advising caution to users due to the potential for scams.

The USD1 contract is accessible on the BNB Chain’s blockchain explorer.

However, as there is no official acknowledgment from WLFI or the Trump family regarding the launch, BNB’s price movement remains relatively subdued compared to competitor layer-1 assets like ADA, SOL, and XRP, which saw substantial gains after Trump endorsed a proposal for a crypto strategic reserve earlier in March.

Binance Co-founder Changpeng Zhao reacts to USD1 launch speculations | March 24 | Source: X.com/cz

Despite the USD1 contract being publicly viewable on the BNB Chain’s blockchain explorer, BNB’s price remains restrained as there is no formal confirmation of the launch from WLFI or the Trump family. This contrasts with the significant gains seen in assets like ADA, SOL, and XRP after receiving Trump’s endorsement.

The USD1 launch represents Trump’s latest venture into the cryptocurrency realm.

In January 2024, Trump introduced a memecoin on the Solana network, which rapidly surged to a market cap of $12.8 billion within just 24 hours.

In this context, the launch of USD1 is poised to draw considerable attention from both institutional and retail investors.

WLFI aims for a DeFi lending & borrowing marketplace on BNB Chain

In addition to launching stablecoins, WLFI is reportedly working on three financial products, including an on-chain marketplace for lending and borrowing.

This venture is intended to enhance liquidity and broaden the use cases of stablecoins in the decentralized finance (DeFi) sector.

If executed successfully, this platform could significantly promote the adoption of assets on the BNB Chain, possibly pushing Binance Coin (BNB) closer to the $700 milestone in the near future.

BNB Price Projection: Overcoming $660 resistance to confirm $700 target

The price of BNB is consistently trending upwards, gaining 3.4% on Monday to settle at $635.33 as bullish momentum builds.

The daily candlestick chart presents a pattern of higher lows, indicating a sustained upward trend. The Donchian Channel (DC) points to the next significant resistance level at $643.72, and a decisive breakout above this threshold could pave the way towards $660, a vital psychological level before targeting $700.

BNB price forecast | BNBUSD

An increase in trading volume (291.53K) demonstrates amplifying investor interest, bolstering the bullish outlook.

The Money Flow Index (MFI) at 65.96 remains within neutral territory, hinting at further upside potential before reaching overbought conditions.

If buyers maintain their momentum and BNB manages to overcome the $660 resistance, the pathway to $700 becomes increasingly plausible, supported by strong market fundamentals and positive sentiment regarding BNB Chain developments.

However, if BNB fails to breach this resistance, it could experience a pullback towards the lower boundary of the Donchian Channel at $575.36, where buyers might seek to re-enter the market.

A drop below $575 would undermine the bullish perspective, subjecting BNB to increased downward pressure towards $507, identified as the lower liquidity zone.

For the time being, the bulls are firmly in command, with $660 standing as the immediate challenge to validate a sustained rise towards $700.