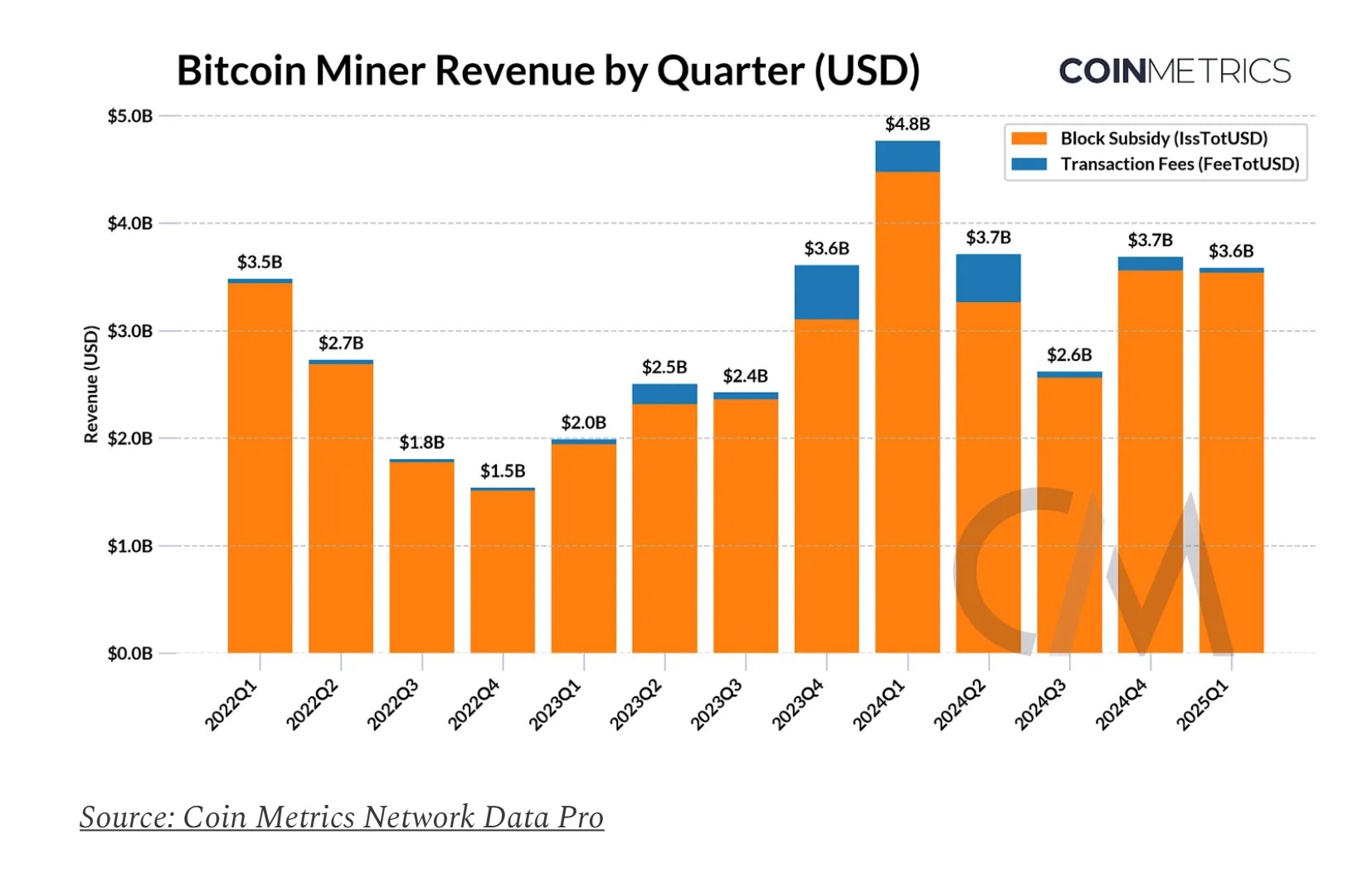

Mining revenues for Bitcoin (BTC) reached $3.7 billion in the final quarter of 2024, marking a 42% rise from the previous quarter, and are nearing comparable figures of around $3.6 billion in the first quarter of 2025, as revealed by recent data.

This increase in revenue indicates that miners’ earnings are stabilizing following the Bitcoin network’s “halving” event in April 2024, which cut mining rewards from 6.25 BTC to 3.125 BTC per block. Halvings take place every four years, halving the amount of BTC produced per block.

“With nearly a year passed since Bitcoin’s fourth halving, miners have navigated a phase of stabilization while adapting to diminished block rewards, tighter profit margins, and evolving operational conditions,” according to a recent report.

However, Ben Yorke, Vice President of Ecosystem at WOO X, a Web3 startup, cautioned that this recovery could face challenges if ongoing trade disputes disrupt the miners’ business models. “If semiconductor tariffs are reinstated, Bitcoin mining might incur higher costs, consolidating control among larger players and potentially forcing smaller operations to cease their activities,” he stated.

Trends in Bitcoin mining revenues since 2022.

Related: Bitcoin enters a ‘macro bullish’ phase with the first Hash Ribbon buy signal in eight months

Adapting After the Halving

Bitcoin miners have faced difficulties in 2025, as falling cryptocurrency values added further strain to business models already challenged by the April halving, according to analysis shared recently.

Nevertheless, miners with adequate funding have been able to adapt, with recent data indicating that Bitcoin’s hashrate—the total computing power securing the network—reached new highs in January.

Some common adaptations include upgrading to more energy-efficient ASICs, as well as relocating operations to areas with abundant renewable energy and lower costs, like Africa and Latin America. ASICs, or Application-Specific Integrated Circuits, are specialized hardware utilized in Bitcoin mining.

Moreover, miners are diversifying into AI data center hosting, which allows them to broaden their revenue sources and repurpose existing infrastructure for high-performance computing. For example, one Bitcoin mining operation has committed 200 megawatts of capacity to support AI workloads.

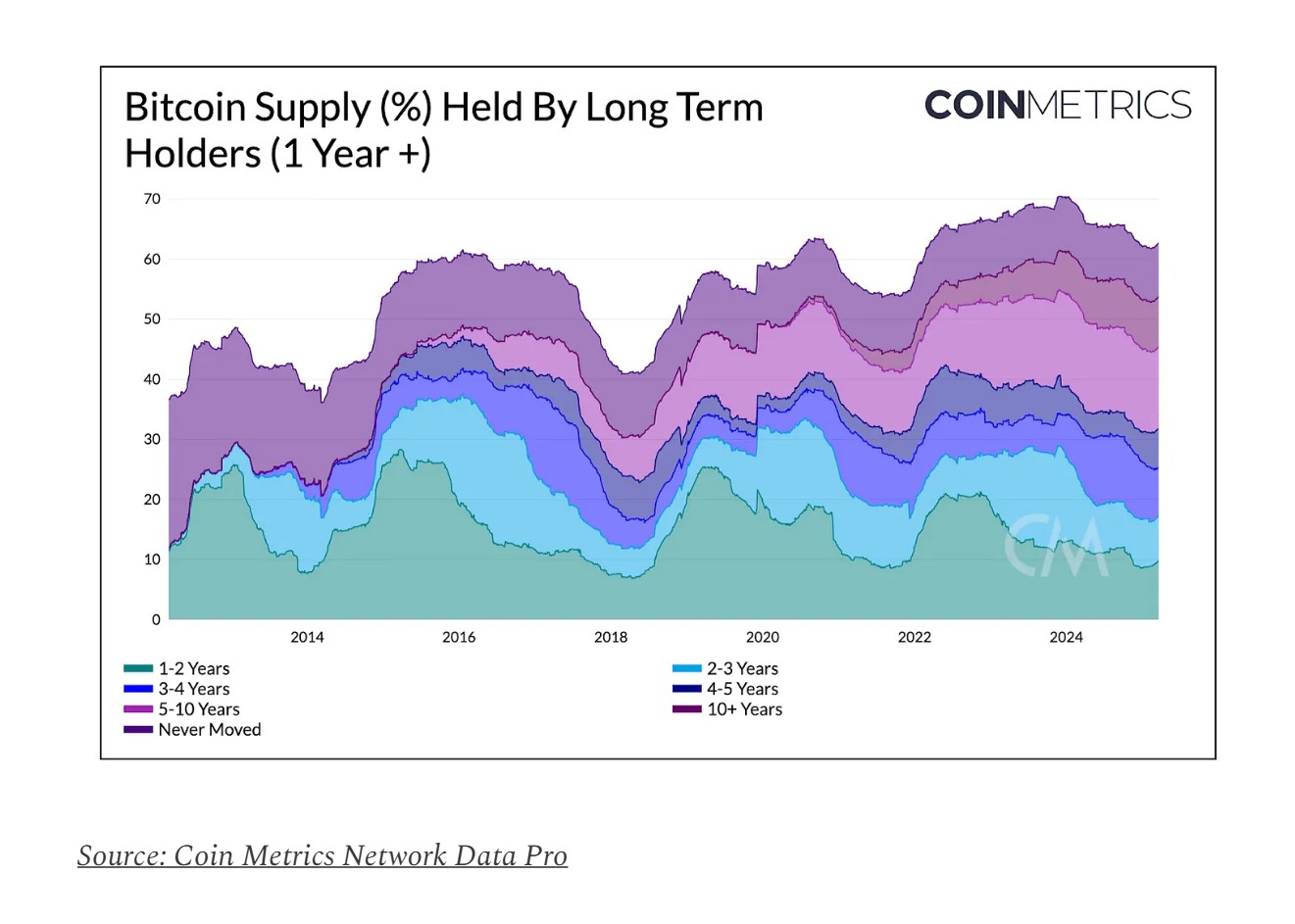

The trend of long-term Bitcoin supply accumulation has been on the rise.

Maintaining Mining Incentives

Increased transaction activity on the Bitcoin network could support ongoing economic incentives for miners after the halving. “Over time, greater engagement from higher-value or more urgent activities might bolster fee revenue, aiding miners as block rewards diminish,” the analysis noted.

Nevertheless, as it stands, “[t]ransactions under $100 currently account for approximately 60% of Bitcoin’s total transaction volume,” as highlighted in the analysis. This trend is partly due to the increasing tendency of holders to view Bitcoin as a long-term investment rather than a medium of exchange.

“The velocity of Bitcoin’s supply, which measures the ratio of adjusted transfer volume to its current supply, has been declining over time, reinforcing the notion that BTC is being held more than it is being transacted,” the report added.

Magazine: Fake Rabby Wallet scam linked to Dubai crypto CEO and numerous victims