Bitcoin analyst Timothy Peterson continues to express his positive outlook for BTC (BTC), estimating a 75% probability that the asset will achieve new highs within the coming nine months.

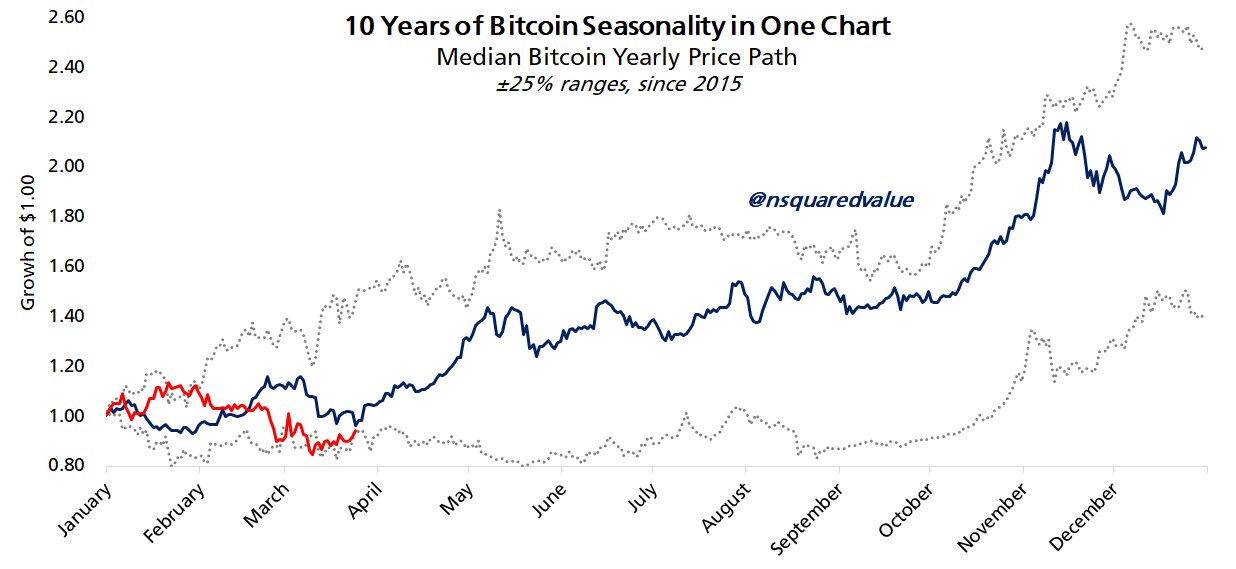

In a recent post, Peterson pointed out Bitcoin’s current positioning near the lower limits of its historical range. He noted that Bitcoin is operating within the bottom 25% threshold, which increases the likelihood of a bullish rally.

Bitcoin 10-year seasonality chart.

Peterson remarked,

“There’s a 50% chance it could rise by more than 50% in the near term.”

His comments follow earlier research indicating that a significant portion of Bitcoin’s annual price increases typically happens in April and October, with average gains of 12.98% and 21.98% respectively over the past decade.

Bitcoin monthly returns.

Related: Bitcoin turns ‘macro bullish’ as first Hash Ribbon buy signal emerges in eight months

Key investor levels and Bitcoin on-chain cost basis

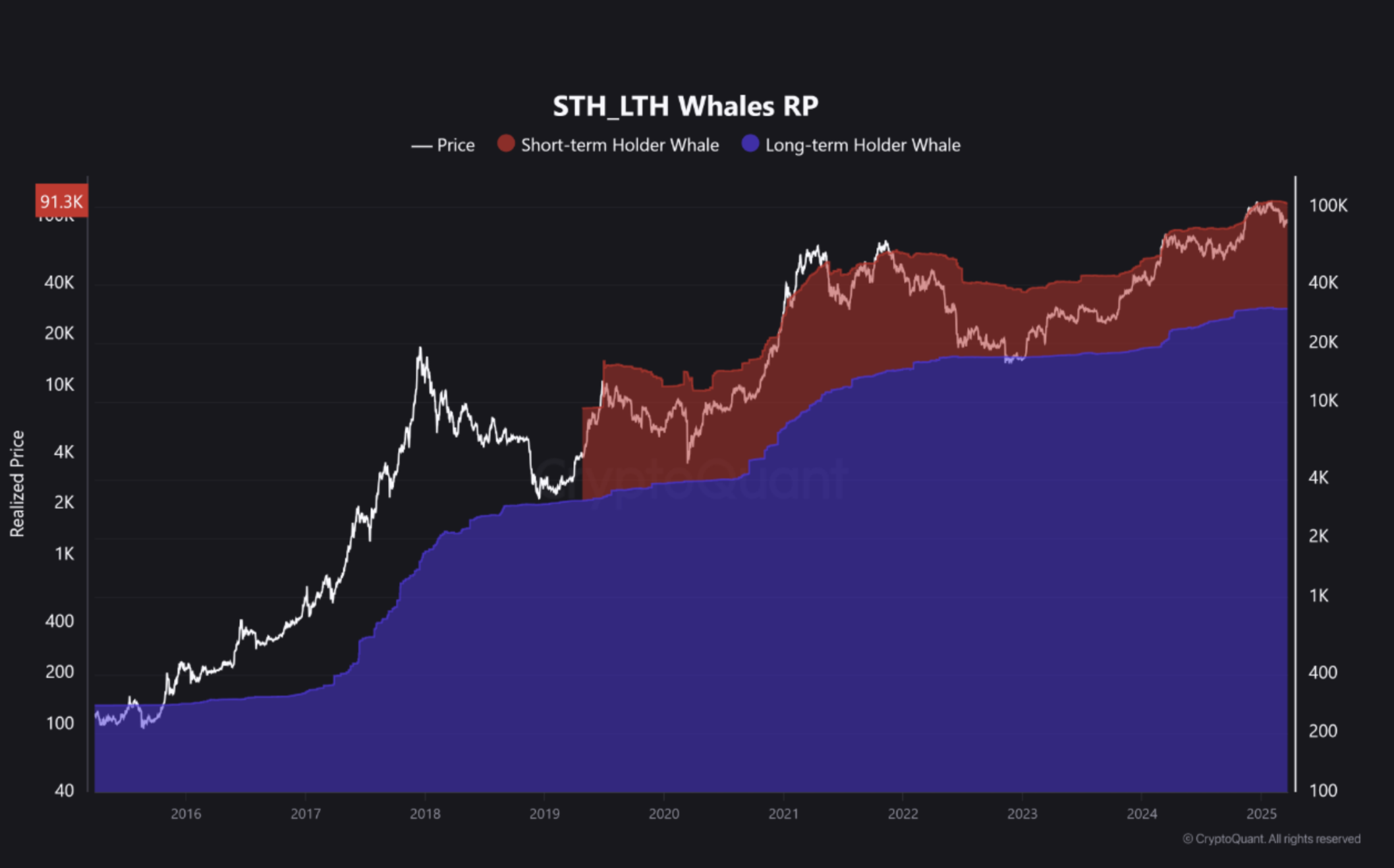

In a recent analysis, an anonymous expert noted that the realized price for short-term whales stands at $91,000, while the majority of actively engaged addresses maintain a cost basis between $84,000 and $85,000.

Positioning of short-term Bitcoin whales.

A decline below the established cost basis could incite selling, making the $84,000 to $85,000 range a crucial liquidity zone.

The analyst further mentioned,

“These cost basis levels on-chain represent critical decision points where market psychology can change. Observers should keep a close eye on price movements in these regions to assess trend stability and potential reversals.”

Related: Bitcoin ETP launched by BlackRock in Europe

This article is not intended as investment advice. All investing and trading carry risks, and readers are encouraged to conduct their own research when making decisions.