This week saw many Bitcoin (BTC) traders turning optimistic as prices surged well into the $88,000 range. However, a failure to surpass this threshold in the near term might serve as a signal for profit-taking.

A crypto analytics platform reported that significant Bitcoin holders, often referred to as whales, have started taking short positions at the $88,000 mark.

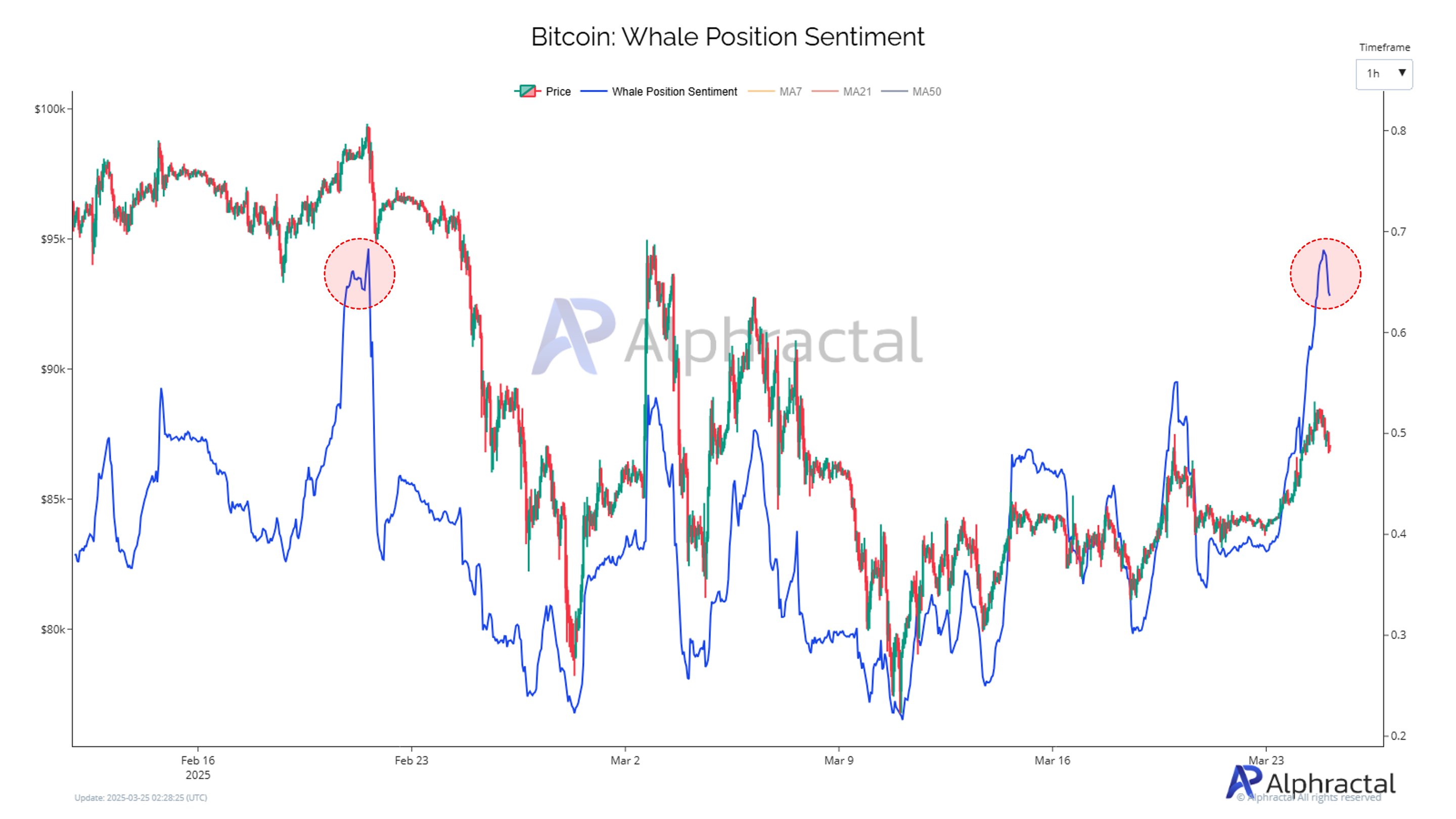

In a recent update, it was pointed out that the “Whale Position Sentiment” indicator demonstrated a notable shift, suggesting that key market players with a pessimistic outlook have entered the scene. This metric tracks the correlation between the combined open interest and trades exceeding $1 million across various exchanges.

Bitcoin: Whale position sentiment. Source: X

The chart illustrates two highlighted areas that correspond to Bitcoin’s price dropping to the $88,000 level. The analytics platform stated,

“A decline in Whale Position Sentiment, even with a temporary price uptick, strongly indicates that whales are moving into short positions, which could trigger a price decline.”

The CEO of the platform also confirmed that whales have liquidated their long positions, noting that historically, prices tend to align with their directional trends.

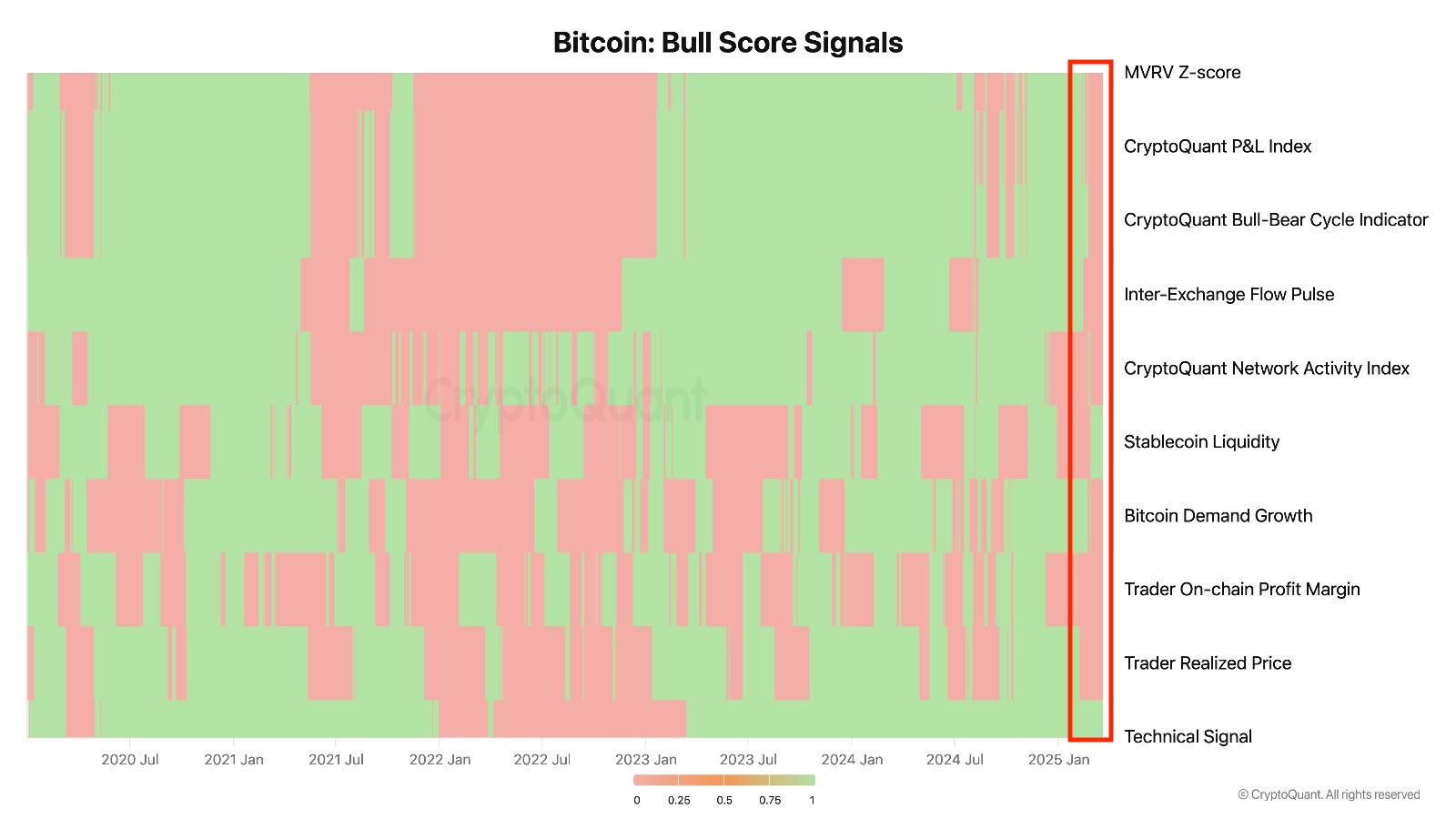

Bitcoin: Bull score signals. Source: CryptoQuant

Similarly, 8 out of 10 on-chain indicators on another analytics service have turned negative. Aside from stablecoin liquidity and technical signal metrics, all other indicators are signaling potential declines in Bitcoin’s price.

Last week, the CEO of a prominent analytics firm mentioned that the market is entering a bearish phase, advising investors to prepare for “6-12 months of bearish or sideways price movements.”

Related: Is a $130K Bitcoin price achievable in 90 days? One analyst thinks so.

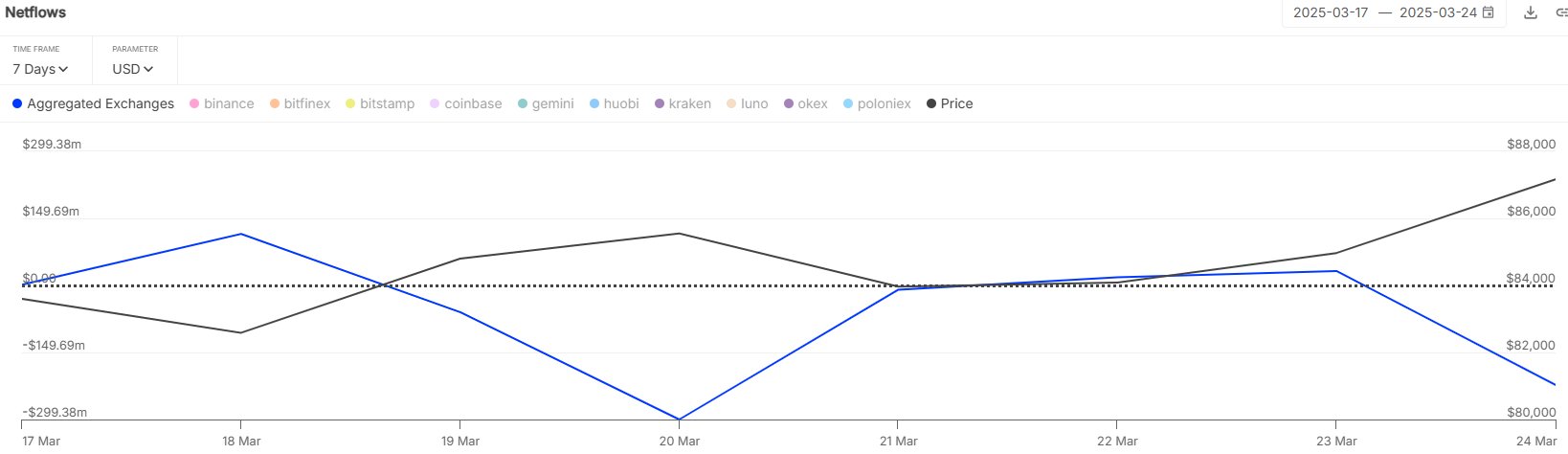

Bitcoin outflows hit $424M in a week

While on-chain indicators are showing bearish signs, some investors appear to be bullish on Bitcoin. Data revealed net BTC outflows of $220 million from exchanges over the last 24 hours, totaling $424 million from March 18 to March 24. This trend suggests that some investors are accumulating Bitcoin.

Bitcoin net outflows analysis. Source: X

On the lower timeframe chart, Bitcoin reached an intraday high of $88,752 on March 24, but has not managed to set a new high since then.

Bitcoin 4-hour chart. Source: Cointelegraph/TradingView

As Bitcoin trades within an ascending channel pattern, it is anticipated that the price may encounter resistance near the upper boundary of this pattern and the 50-day and 100-day exponential moving averages on the daily chart.

If whales continue shorting between $88,000 and $90,000, Bitcoin must close above $90,000 for a sustained rally toward $100,000.

Related: Bitcoin eyes the ‘spoofy’ $90K resistance as new price surge emerges.

This article does not provide investment advice or recommendations. Every investment carries risks, and readers should conduct their own research before making any decisions.