The world’s largest asset manager has introduced a Bitcoin exchange-traded product (ETP) across several European stock exchanges.

The iShares Bitcoin ETP commenced trading on March 25 on platforms such as Xetra, Euronext Amsterdam, and Euronext Paris. This launch follows the successful performance of its iShares Bitcoin Trust exchange-traded fund (ETF), which leads the US market with assets totaling $50.7 billion, representing roughly 2.73% of the overall Bitcoin (BTC) supply.

According to Stephen Wundke, director of strategy and revenue at crypto investment firm Algoz, the reception of the iShares Bitcoin ETP in Europe may differ from the response seen in the US:

“High-quality investment products from regulated asset managers have been more widely available in Europe than in the US, and Bitcoin can also be purchased more easily. […] Nevertheless, the fact that traditional family offices across Europe can allocate a small portion of their assets to ‘digital gold’ is certainly a positive development. […] Just don’t expect $60 billion in purchases during the first quarter.”

Product Specifications and Fee Structure

The new ETP is traded under the IB1T ticker on both Xetra and Euronext Paris, while it is listed as BTCN on Euronext Amsterdam. Reports have indicated that the launch of this product was anticipated, especially after the firm’s introduction of a Bitcoin ETF in CBOE Canada.

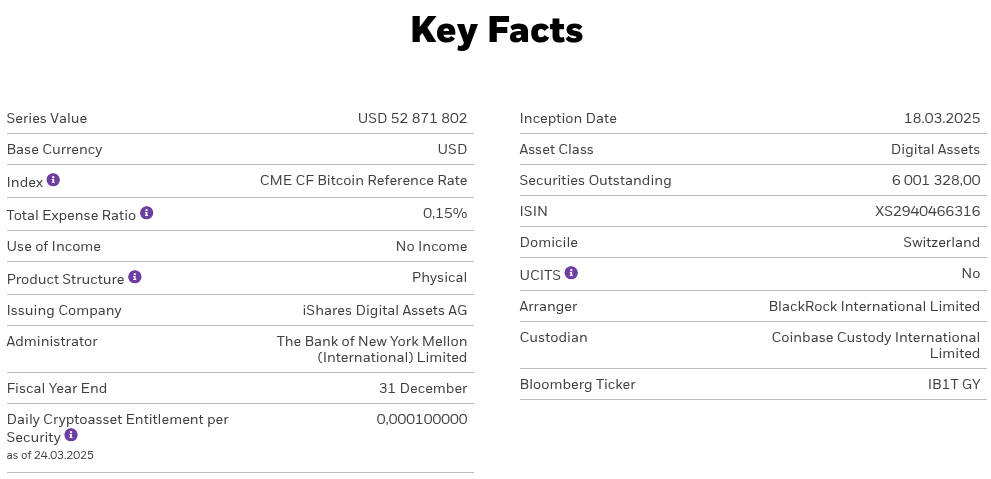

Details of the iShares Bitcoin ETP. Source:

Reports indicate that the product debuted with a temporary fee waiver of 10 basis points, lowering the expense ratio to 0.15% until the conclusion of 2025. Currently, the leading crypto ETP in Europe is the CoinShares Physical Bitcoin ETP, which charges 0.25%, making BlackRock’s offering considerably more affordable during this fee waiver period.

Wundke noted, “There’s no doubt that BlackRock’s competitive fee strategy is aimed at keeping rivals at bay and casting doubt on the commitment of any newcomers.”

He also remarked that “this level of competition benefits investors and ultimately strengthens digital currencies,” emphasizing that market participants will need to strive to present the best options to their clients.

Connecting Articles: ‘Successful’ ETH ETF falls short without staking

iShares Making Inroads in Europe

This marks the first launch of a crypto ETP from the firm outside of North America. Manuela Sperandeo, the head of iShares Products for Europe and the Middle East, remarked:

“[This launch] signifies what could truly be considered a tipping point in the industry—merging established interest from retail investors with a growing number of professionals entering the market.”

Related Articles: Bitcoin ETFs record first net inflows in weeks, while Ether sees continued outflows

Ajay Dhingra, head of research at a decentralized exchange aggregator, mentioned that this development illustrates the company’s confidence in the EU’s regulatory framework for crypto assets:

“While US digital asset policy has fluctuated from Trump to Biden and back to Trump, the EU has consistently supported compliant blockchain integration—providing the regulatory certainty that businesses seek.”

A recent earnings report indicated that the firm managed an average of over $11.55 trillion in assets during Q4 2024. Apart from the leading Bitcoin ETF, the firm also launched its Grayscale Ethereum Trust ETF, the primary Ether (ETH) ETF, boasting $3.46 billion in assets.

Special Feature: An EU politician shares her transformation to crypto — Eva Kaili