BlackRock’s tokenized money market fund has made its way onto the Solana blockchain, nearing a market capitalization of $2 billion.

On March 25, Carlos Domingo, the founder and CEO of Securitize, a platform focused on the tokenization of real-world assets, announced the integration of the Solana network with the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). This marks a significant step for the tokenized money market fund as it broadens its reach into another blockchain ecosystem.

BUIDL was introduced in March 2024 in collaboration with Securitize. In a report, Securitize’s COO Michael Sonnenshein stated that the fund strives to make offchain assets more appealing.

The executive mentioned that they are addressing some of the limitations that money markets face in their conventional forms.

BUIDL Reaches $1.7 Billion Market Cap

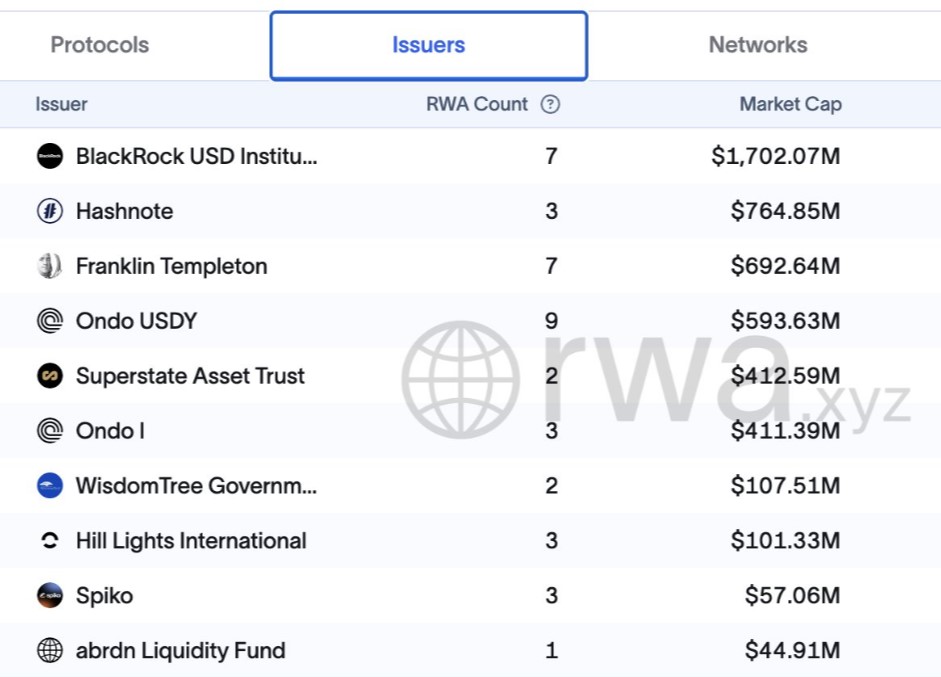

The data platform rwa.xyz indicates that the BUIDL fund leads the market capitalization for tokenized United States Treasuries. According to the platform, the fund currently has a market value of $1.7 billion, representing nearly 34% of the market share.

BUIDL hit a market cap of $1.7 billion. Source: RWA.xyz

BUIDL stands out as the top asset within the Tokenized US Treasuries category, followed by Hashnote, Franklin Templeton, and Ondo USDY.

In just seven months, the fund has seen significant growth. In July 2024, BUIDL’s market capitalization first touched $500 million, and it has since experienced a remarkable 240% increase.

The value of BUIDL is pegged to the US dollar and distributes daily accrued dividends to investors on a monthly basis through its partnership with Securitize. By August 2024, the fund had disbursed $7 million in dividends to its holders.

Related: Community approves frxUSD stablecoin backed by BUIDL

BUIDL’s Solana Integration Marks Over a Year Since Launch

The expansion of this tokenized product into the Solana ecosystem comes several months after its transition to multichain functionality.

On November 13, the tokenized money market fund, initially launched on the Ethereum blockchain, branched out to Aptos, Arbitrum, Avalanche, Optimism, and Polygon. This chain extension aimed to draw in a larger pool of investors.

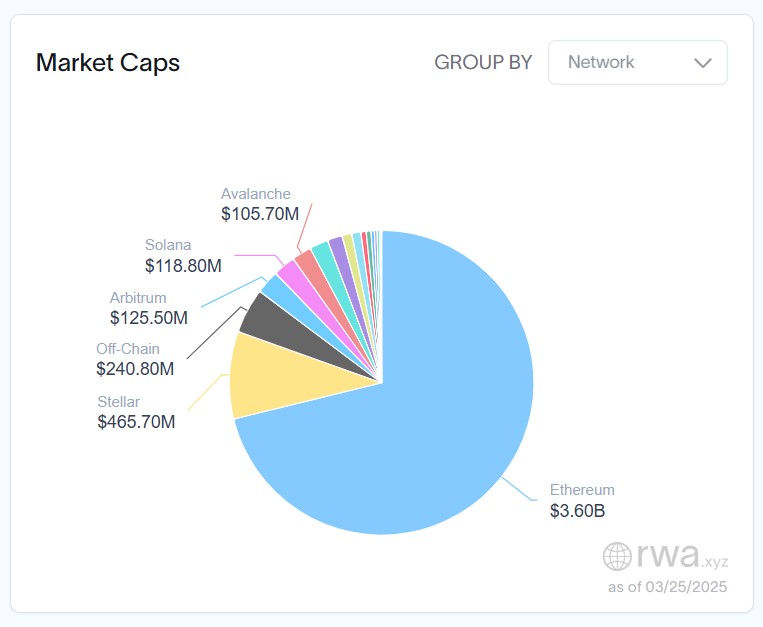

Despite the expansion of tokenized treasuries to a variety of blockchains, Ethereum remains the dominant player in this asset class. RWA.xyz reports that Ethereum-based treasuries hold a market capitalization of $3.6 billion, capturing 72% of the market share.

Market capitalization of tokenized treasuries by blockchain. Source: RWA.xyz

Magazine: While memecoins fade, Solana proves to be ’100x better’ despite revenue drops