- On Tuesday, cryptocurrency markets experienced a 1.75% decline, with an outflow of $60 billion pushing total market valuation below $3 trillion.

- The price of Bitcoin struggled to rise as hints of additional tariffs from Trump created a nervous atmosphere in global markets.

- BlackRock is preparing to launch an ETP in Europe, introducing an initial fee discount to attract investors.

The BNB ecosystem increased by 1.2% in response to the announcement of a Trump-endorsed USD1 stablecoin on the BNB chain.

Bitcoin Market Updates: What’s Causing Today’s BTC Price Decline?

- The value of Bitcoin dropped towards $87,100 on Tuesday, shortly after reaching a 17-day high of $88,700.

- This retreat in Bitcoin’s price coincides with a downward trend in global financial markets following US President Donald Trump’s announcement to impose 25% tariffs on countries purchasing oil and gas from Venezuela, referred to as “secondary tariffs.”

Bitcoin ETF Flows at close of March 24 | Source: SosoValue

- This week, Bitcoin ETFs kicked off positively with another $84 million inflow on Monday, marking the seventh consecutive day of gains.

- The Japanese investment firm Metaplanet announced another acquisition on Monday.

- A defunct crypto exchange was noted moving another 11,000 BTC, which could introduce volatility risks in the near term.

Altcoin Market Insights: BNB Chain Shines While Traders Cash in on Trump Tariff News

The market surge on Monday saw the total cryptocurrency market capitalization exceed $3 trillion, but Trump’s hint at secondary tariffs led many investors to sell prematurely.

As of Tuesday, Coingecko data reveals that the total global crypto market capitalization has dropped by 1.7%, equating to more than a $60 billion decrease over the past 24 hours.

Currently, with a market valuation resting at $2.9 trillion, data indicates that large-cap assets are experiencing losses, while mid-cap altcoin traders continue to benefit from significant gains secured on Monday.

- The price of Ripple (XRP) is stabilizing at $2.37, following favorable outcomes from the closure of its long-standing case against the US Securities and Exchange Commission (SEC).

- Solana (SOL) remains above the $140 support level, fueled by bullish momentum from Trump’s recent promotion of the $TRUMP token.

Chart of the Day: BNB Chain Emerges Amid USD1 Stablecoin Confirmation

World Liberty Financial Inc. (“WLFI”), backed by Trump, has confirmed plans to launch USD1, a stablecoin pegged 1:1 to the US Dollar.

The team states that USD1 will be entirely backed by short-term US government treasuries, US Dollar deposits, and similar cash equivalent assets.

“USD1 delivers what algorithmic and anonymous crypto projects cannot—access to the advantages of DeFi, supported by the credibility and protections of esteemed figures in traditional finance.

We’re providing a stablecoin that sovereign investors and major institutions can seamlessly and securely incorporate into their transactions across borders.”

– Zach Witkoff, WLFI co-founder

Following an alert from Blockchain analyst Lookonchain about a contract on the BNB Chain, the team confirmed that the stablecoin will also be issued on the Ethereum (ETH) network, with plans for future expansion to other protocols.

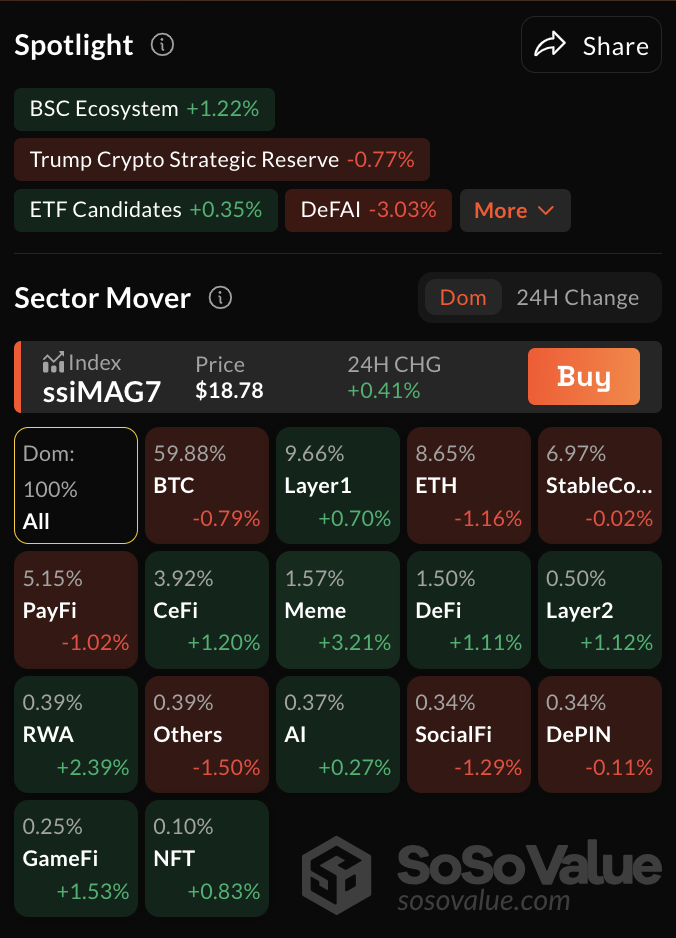

Crypto Market Performance by Sector, March 25 2025 | Source: SosoValue

In response, the BNB Chain recorded a 1.2% rise, according to data from SosoValue, defying the overall market downtrend.

With the confirmation of the USD1 launch on both the BNB Chain and Ethereum, the Binance native coin is expected to attract greater speculative interest in upcoming trading sessions.

Crypto News Updates:

-

Standard Chartered Substitutes Tesla with Bitcoin in New Mag 7B Index

Standard Chartered has released a revamped version of the “Magnificent 7” tech index, renaming it “Mag 7B” by replacing Tesla with Bitcoin.

The bank’s findings indicate that this newly adapted index has delivered superior performance compared to the original, yielding higher returns while exhibiting less volatility.

This shift signifies a greater acknowledgment of Bitcoin’s capacity to serve as both a technological asset and a financial hedge.

The results imply that Bitcoin may offer more stability in the index compared to Tesla, making it an appealing choice for institutional investors.

Standard Chartered’s move underscores the increasing incorporation of digital assets into traditional finance as institutions seek to explore Bitcoin’s practical applications beyond mere speculation.

-

Kentucky Governor Andy Beshear Signs Bitcoin Rights Bill

Kentucky’s Governor Andy Beshear has enacted the Bitcoin Rights bill, providing legal protections for the rights of cryptocurrency users, including self-custody and non-discriminatory operation of nodes.

The bill, HB701, presented by Rep Adam Bowling, also shields crypto mining activities from local zoning modifications and clarifies that crypto mining and staking are not classified as securities.

This advancement follows progress in Bitcoin legislation across other US states, with Oklahoma and Arizona also pushing forward with their digital asset initiatives.

-

Binance Suspends Employee Over Insider Trading Allegations

Binance has put an employee on suspension after an internal probe revealed insider trading related to a token generation event (TGE).

The individual, who had transitioned from a business development role at BNB Chain to the Binance Wallet team, allegedly utilized multiple wallet addresses to acquire tokens before their public release.

Post-announcement of the TGE, the employee sold part of their holdings at considerable profit while retaining additional tokens with unrealized gains. Binance is offering a $100,000 reward for information from whistleblowers who helped uncover the misconduct.