A US securities exchange has sought approval to list a proposed exchange-traded fund (ETF) from Fidelity that would include Solana (SOL), as noted in filings from March 25.

This request is currently under consideration by the US Securities and Exchange Commission, which must authorize the filing before the Fidelity Solana Fund can begin trading on the exchange.

This marks the latest in a series of filings submitted to the federal agency by various exchanges and fund sponsors that aim to launch ETFs featuring SOL and other cryptocurrencies.

On March 12, the exchange also filed to list a separate spot SOL ETF sponsored by Franklin Templeton, an asset management firm.

Related: Solana CME futures signal approaching US ETF approvals — Executive

Multiple Proposals

The filing by the exchange follows the introduction of an ETF by Volatility Shares, utilizing futures contracts to track the value of spot SOL.

Launched in March, the Volatility Shares Solana ETF (SOLZ) along with the Volatility Shares 2X Solana ETF (SOLT) represent the first ETFs that provide US investors with access to Solana’s native token. The SOLT ETF is designed to track SOL’s performance with double leverage.

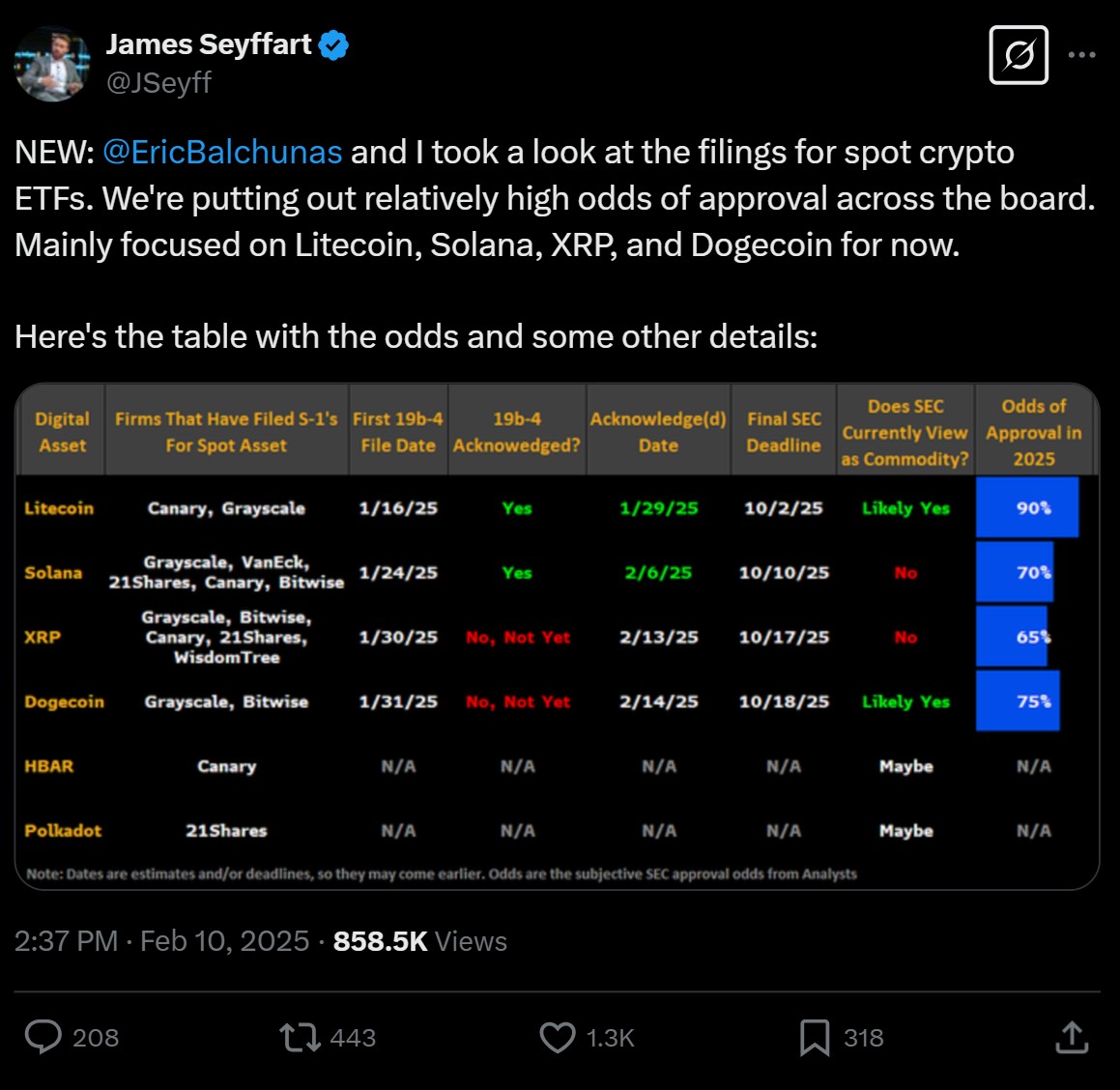

Analysts from Bloomberg Intelligence estimate a 70% chance that US regulators will approve a spot SOL ETF this year, as per a post on the X platform from February.

Other asset managers looking to introduce spot SOL ETFs include Grayscale, VanEck, 21Shares, Canary, and Bitwise, according to insights from Bloomberg Intelligence.

On March 17, the Chicago Mercantile Exchange (CME), the largest derivatives exchange in the US, rolled out SOL futures contracts. Experts view this as a strong indication that spot SOL ETFs might receive approval in the near future.

About a dozen asset managers are currently seeking the SEC’s endorsement to launch altcoin ETFs in the US. Proposed altcoin ETFs include those for Litecoin (LTC), XRP (XRP), Dogecoin (DOGE), and Official Trump (TRUMP).

There are also proposals for the SEC to approve adjustments to current ETFs, such as allowances for staking, options, and in-kind redemptions.

Since the start of US President Donald Trump’s second term in January, the SEC has softened its approach toward cryptocurrencies.

Under previous President Joe Biden, the SEC initiated over 100 legal actions against crypto entities, citing various violations of securities laws. In 2024, the regulator approved spot Bitcoin (BTC) and Ether (ETH) ETFs but stalled proposals linked to other cryptocurrencies.

Magazine: Memecoins may be fading — But Solana is ‘100x better’ despite revenue decline