(All times ET unless specified otherwise)

Risk assets are showing a renewed sense of enthusiasm. Bitcoin (BTC) is trading above $87,000, while the S&P 500 has managed to reclaim its 200-day moving average for the first time since March 10.

Yet, with the quarterly options expiry scheduled for Friday, an increase in volatility is anticipated, as over $12 billion in notional value is set to expire on Deribit, with the max pain price standing at $85,000. Most of the open interest is concentrated on $100,000 call options.

President Trump is implementing new strategies in the trade war by introducing “secondary tariffs,” which could lead to a 25% tax on any country purchasing oil and gas from Venezuela. He also indicated that while certain nations might be granted exemptions from tariffs, additional tariffs on automobiles, lumber, and semiconductor chips will be announced soon, with implementation possibly starting as early as April 2, as part of his broader “America First” economic policy.

Reports indicate that Treasury Secretary Scott Bessent remains a proponent of tariffs, seeing them as a strategic instrument to leverage negotiations, increase government revenue, and rebalance trade in the U.S.’s favor.

In the U.K., Chancellor Rachel Reeves is gearing up for the Spring Statement scheduled for Wednesday, facing rising bond yields that complicate fiscal planning. Initial reports suggest that she may propose cutting civil service jobs while ruling out further tax hikes. Stay Alert!

What’s on the Horizon

Crypto:

March 25: The Mimir upgrade goes live on Chromia (CHR) mainnet.

March 25, 11:00 p.m.: Celo (CELO) mainnet’s hard fork network upgrade at block height 31056500 will transition it from an L1 to an Ethereum L2.

March 26: Circle’s stablecoin, USDC, starts trading on Japan-based crypto exchange SBI VC Trade.

March 26, 3:00 a.m.: Cronos (CRO) zkEVM v26 mainnet upgrade introduces Smart Account SSO for easier logins and lays the groundwork for the ZK Gateway to boost cross-chain interoperability.

March 26, 10:37 a.m.: Ethereum’s Hoodi testnet will activate the Pectra hard fork network upgrade at epoch 2048.

March 27: Walrus (WAL) mainnet goes live.

April 1: Metaplanet (TYO: 3350) 10-for-1 stock split takes effect.

Macro

March 26, 3:00 a.m.: The U.K.’s Office for National Statistics publishes the consumer price inflation data for February.

Core Inflation Rate MoM Est. 0.5% vs. Prev. -0.4%

Core Inflation Rate YoY Est. 3.6% vs. Prev. 3.7%

Inflation Rate MoM Est. 0.5% vs. Prev. -0.1%

Inflation Rate YoY Est. 2.9% vs. Prev. 3%

March 26: The U.K.’s Office for Budget Responsibility (OBR) will release its latest Fiscal and Economic Outlook. Later in the day, the Chancellor of the Exchequer will present her Spring Statement to the House of Commons.

March 27, 8:30 a.m.: The U.S. Bureau of Economic Analysis will release the (Final) Q4 GDP data.

GDP Growth Rate QoQ Est. 2.3% vs. Prev. 3.1%

Core PCE Prices QoQ Est. 2.7% vs. Prev. 2.2%

PCE Prices QoQ Est. 2.4% vs. Prev. 1.5%

Real Consumer Spending QoQ Est. 4.2% vs. Prev. 3.7%

March 27, 8:30 a.m.: The U.S. Department of Labor will issue unemployment insurance data for the week ending March 22.

Initial Jobless Claims Est. 225K vs. Prev. 223K

March 27, 10:00 a.m.: The U.S. Senate Banking Committee will conduct a hearing on the nomination of Paul Atkins as chair of the U.S. Securities and Exchange Commission (SEC). Livestream link.

March 27, 3:00 p.m.: Mexico’s central bank will announce its interest rate decision.

Target Rate Est. 9% vs. Prev. 9.5%

April 2, 12:01 a.m.: The Trump administration’s reciprocal tariffs scheme goes into effect.

Earnings (Estimates based on available data)

March 27: KULR Technology Group, post-market, $-0.02

March 28: Galaxy Digital Holdings, pre-market, C$0.38

Token Events

Governance votes & calls

Uniswap DAO is considering the recognition of the canonical deployment of Uniswap v2 and v3 on Soneium.

Floki DAO is voting on removing the 0.3% transaction fee applied when users buy or sell through the TokenFi smart contract, following a request from a “very important and strategically significant partner.”

Sky DAO is discussing reallocating the Boost program’s budget to promote USDS on non-Ethereum networks and ceasing Sky token buybacks to redirect surplus toward Sky token holders.

March 26, 1 p.m.: Livepeer (LPT) will hold an Open Ecosystem Call.

Unlocks

March 31: Optimism (OP) will unlock 1.93% of its circulating supply valued at $28.47 million.

April 1: Sui (SUI) will unlock 2.03% of its circulating supply valued at $154.07 million.

April 1: ZetaChain (ZETA) will unlock 6.05% of its circulating supply valued at $13.43 million.

April 3: Wormhole (W) will unlock 47.64% of its circulating supply valued at $141.11 million.

April 7: Kaspa (KAS) will unlock 0.59% of its circulating supply valued at $11.82 million.

April 9: Movement (MOVE) will unlock 2.04% of its circulating supply valued at $22.82 million.

Token Listings

March 25: Particle Network (PARTI) will be listed on Binance, Gate.io, OKX, KuCoin, HashKey, Bitrue, Bitget, XT.com, and others.

March 27: Walrus (WAL) will be listed on Gate.io and Bybit.

March 28: Binance is set to delist Aergo (AERGO).

March 31: Binance plans to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

CoinDesk’s Consensus will take place in Toronto on May 14-16. Use code DAYBOOK to receive a 15% discount on passes.

Day 2 of 3: Merge Buenos Aires

Day 1 of 2: PAY360 2025 (London)

Day 1 of 3: Mining Disrupt (Fort Lauderdale, Fla.)

Day 1 of 4: Boao Forum for Asia (BFA) Annual Conference 2025 (Boao, China)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: Web3 Banking Symposium 2.0 (Lugano, Switzerland)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

Token Update

By Shaurya Malwa

MOG surged by 25% as demand for memecoins increased along with Bitcoin and Ether popularity.

This cat-themed cultural coin tends to rise whenever ETH sees buying interest, acting as a “beta bet” on the Ethereum blockchain, its underlying platform.

Tracking the top-performing memecoins during a market upswing can be beneficial for traders, offering insights on which tokens tend to excel when major cryptocurrencies rally.

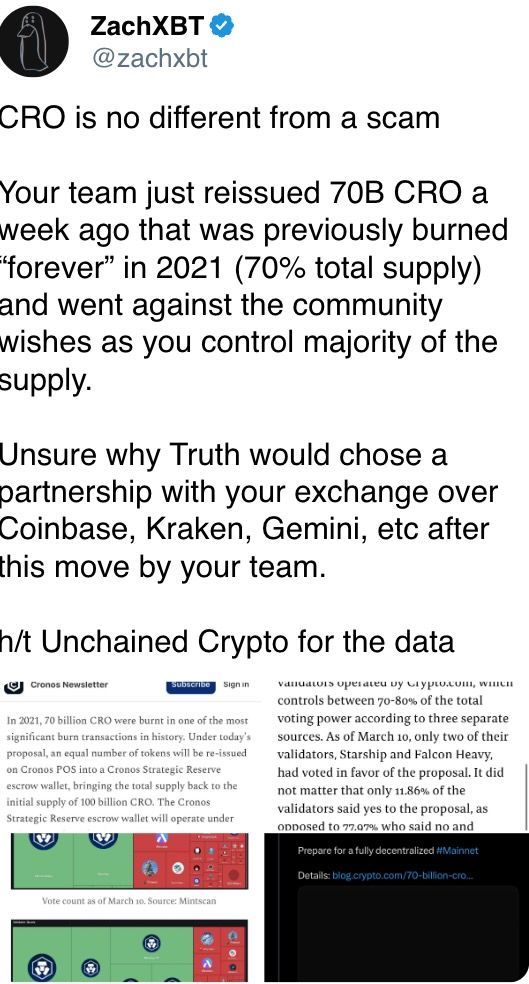

Cronos’ CRO faced criticism from well-known on-chain investigator ZachXBT following Trump Media’s non-binding agreement with Crypto.com to jointly launch U.S. crypto exchange-traded funds (ETFs) for the token via Crypto.com’s broker-dealer, Foris Capital US.

“CRO resembles a scam,” ZachXBT noted in a tweet, regarding a governance proposal from last week that increased the CRO supply by over 200%.

The controversial proposal concluded Monday last week, and the community voted to raise the token supply from 30 billion CRO to 100 billion CRO over ten years. The vote was swayed by a small group of influential large token holders, resulting in a significant 3.2 billion token shift just before the vote’s conclusion, raising concerns among market analysts.

Derivatives Positioning

The CME futures basis for BTC and ETH remains low, fluctuating between 4% and 7%, indicating institutional players are hesitant to allocate capital despite recent market stabilization.

BTC perpetual funding rates have dipped below zero, suggesting an increasing preference for bearish short positions on offshore exchanges.

XMR, HBAR, NEAR, BNB, SUI, and AVAX all show positive cumulative volume deltas over 24 hours, reflecting net buying in perpetual futures markets.

Short-dated BTC and ETH options on Deribit are still exhibiting put skews. The $100K call option continues to be the most favored, especially with the quarterly expiry approaching.

Market Movements:

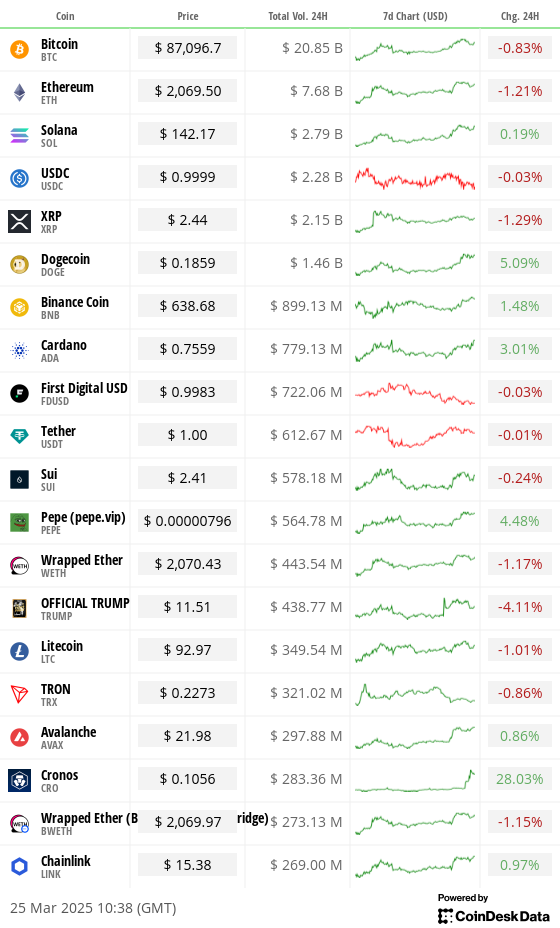

BTC is down 1.12% from 4 p.m. ET Monday at $86,889.75 (24hrs: -0.77%)

ETH is down 1.01% at $2,064.85 (24hrs: -1.31%)

CoinDesk 20 is down 0.35% at 2,782.83 (24hrs: -0.55%)

Ether CESR Composite Staking Rate is up 6 bps at 2.97%

BTC funding rate is at -0.003% (-1.141% annualized) on Binance

DXY remains steady at 104.24

Gold has risen 0.38% to $3,024.40/oz

Silver is up 1.38% at $33.72/oz

The Nikkei 225 closed +0.46% at 37,780.54

The Hang Seng closed down -2.35% at 23,344.25

FTSE increased 0.4% to 8,672.92

Euro Stoxx 50 is up 0.52% to 5,444.05

The DJIA closed +1.42 at 42,583.32

The S&P 500 closed +1.76 at 5,767.57

The Nasdaq ended +2.27% at 18,188.59

The S&P/TSX Composite Index closed +1.34% at 25,304.10

The S&P 40 Latin America closed -0.62% at 2,455.50

The U.S. 10-year Treasury yield increased by 1 bps to 4.36%

E-mini S&P 500 futures are down 0.18% at 5,804.75

E-mini Nasdaq-100 futures are down 0.33% at 20,307.25

E-mini Dow Jones Industrial Average Index futures are down 0.15% at 42,833.00

Bitcoin Stats:

BTC Dominance: 61.44 (-0.20%)

Ethereum to bitcoin ratio: 0.02375 (-0.17%)

Hashrate (seven-day moving average): 829 EH/s

Hashprice (spot): $49.32

Total Fees: 6.17 BTC / $540,108

CME Futures Open Interest: 146,560 BTC

BTC priced in gold: 28.8 oz

BTC vs. gold market cap: 8.19%

Technical Analysis

Bitcoin is approaching the trendline that outlines the steep price decrease from its record highs.

A breakout past the trendline resistance could lead to resistance at $100K, ultimately paving the way for new record highs.

The strengthening upward momentum, indicated by the rising MACD histogram, favors a trendline breakout.

Crypto Equities

Strategy (MSTR): closed at $335.72 (+10.43%), trading down 0.94% at $332.58 in pre-market

Coinbase Global (COIN): closed at $203.04 (+6.94%), down 1.11% at $200.79

Galaxy Digital Holdings (GLXY): closed at C$19.30 (+7.58%)

MARA Holdings (MARA): closed at $14.61 (+18.01%), down 1.71% at $14.36

Riot Platforms (RIOT): closed at $8.72 (+9.69%), down 0.8% at $8.65

Core Scientific (CORZ): closed at $9.31 (+9.4%), down 0.97% at $9.22

CleanSpark (CLSK): closed at $8.79 (+18.15%), down 1.48% at $8.66

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $16.31 (+10.2%)

Semler Scientific (SMLR): closed at $42.88 (+9.33%)

Exodus Movement (EXOD): closed at $52.64 (+6.3%), trading up 3.84% at $54.66

ETF Flows

Spot BTC ETFs:

Daily net flow: $84.2 million

Cumulative net flows: $36.22 billion

Total BTC holdings approximately 1,117 million.

Spot ETH ETFs

Daily net flow: $0 million

Cumulative net flows: $2.43 billion

Total ETH holdings approximately 3.419 million.

Overnight Flows

Chart of the Day

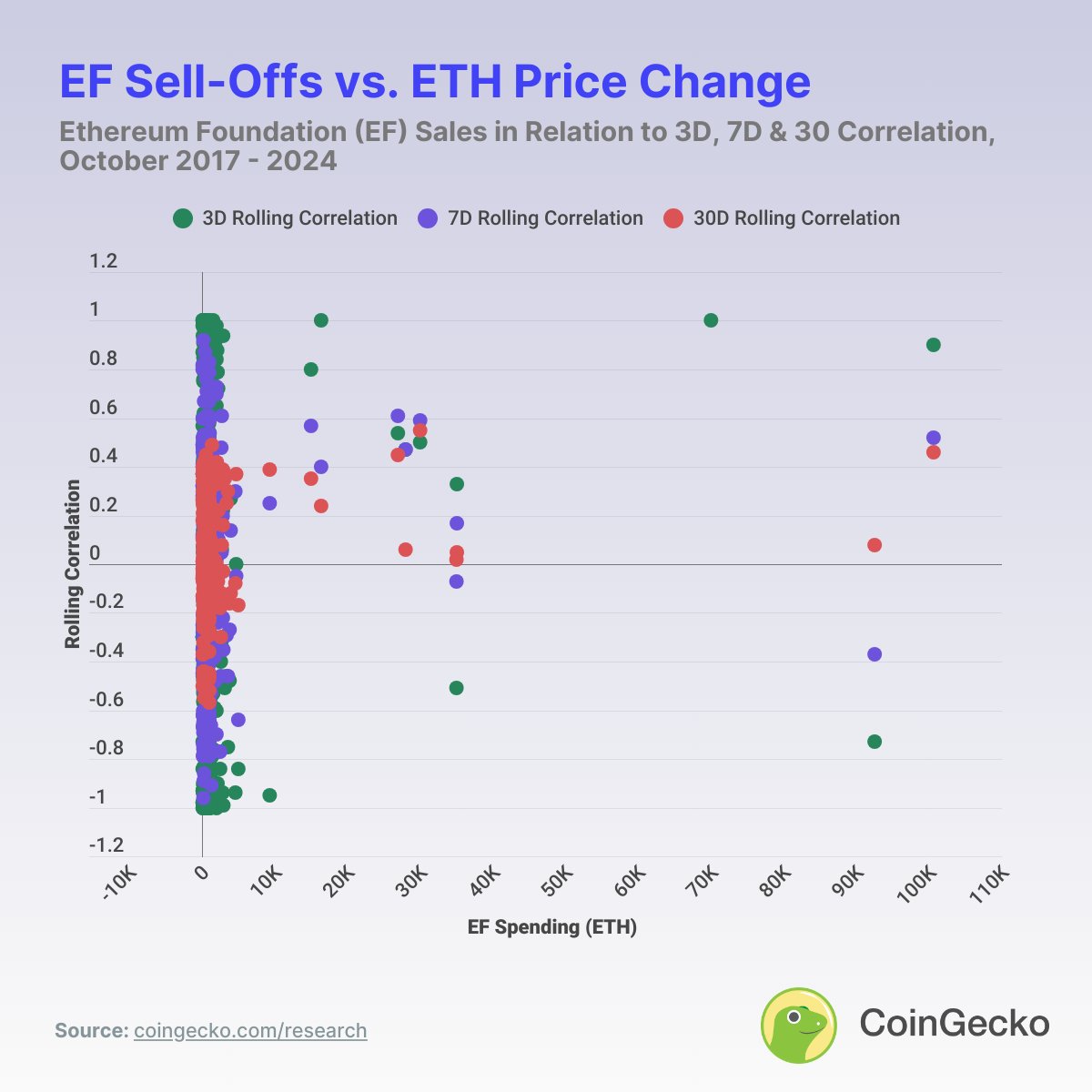

This chart illustrates the effect of ether sales by the Ethereum Foundation on the token’s spot-market price.

Sales exceeding 15,000 ETH have a noticeable impact on pricing.

While You Were Sleeping

BlackRock Launches Bitcoin ETP in Europe as the Firm’s First Move into Crypto Beyond U.S.: The asset management powerhouse introduced its iShares Bitcoin ETP on Xetra, Euronext Paris, and Amsterdam with a 0.15% fee valid until year-end.

Binance Wallet Suspends Staff After Front-Running Allegations: A staffer is accused of using confidential information from a prior business development role at BNB Chain to front-run a token launch. Binance’s investigation found no proof of insider trading.

Circle is Set to Introduce USDC in Japan on March 26 Through SBI Partnership: Japan-based crypto exchange SBI VC Trade, having secured regulatory approval to list USDC on March 4, will commence trading of the stablecoin on March 26.

China Faces Its Own ‘China Shock’: China has lost 7.4 million factory jobs since 2011 due to rising wages and competition from low-cost nations like Vietnam and Indonesia, leading to fears of long-term unemployment.

China’s Vice Premier Engages with Blackstone Chairman in Beijing: He Lifeng expressed that China welcomes further U.S.-funded enterprises and long-term capital, contributing to the healthy advancement of U.S.–China economic relations.

Uranium Stocks Drop as Ukraine Ceasefire Talks Progress: Uranium stocks have declined in 2025 due to potential new U.S. tariffs on Canada and eased restrictions on Russia, both key suppliers of the nuclear fuel.

In the Ether