The video game retailer GameStop Corporation (GME), which transitioned to a memecoin stock, is reportedly gearing up to invest in Bitcoin following a unanimous decision by its board to acquire digital assets.

A recent report revealed that the company plans to allocate a part of its corporate cash or funds from future debt issuances to make investments in Bitcoin (BTC) and stablecoins pegged to the US dollar.

This strategy was further supported by the firm’s earnings report for the fourth quarter, also published recently, which highlighted its intention to acquire Bitcoin and stablecoins.

“The Company’s investment policy allows for investments in specific cryptocurrency assets, including Bitcoin and US dollar-denominated stablecoins,” read the financial statement.

As of February 1, GameStop’s cash reserves exceeded $4.77 billion, a significant increase from $921.7 million just a year prior.

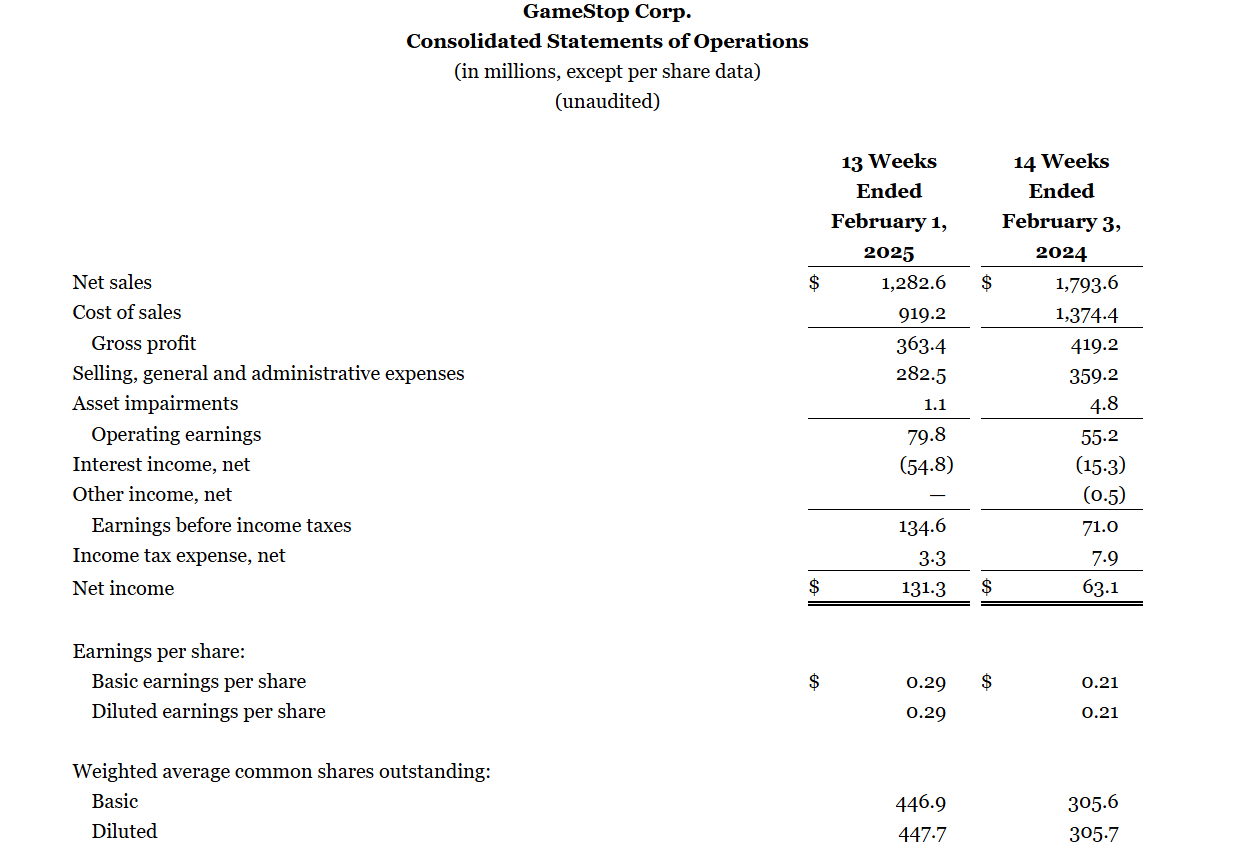

The retailer reported $1.283 billion in net sales for the fourth quarter and total revenues of $3.823 billion for fiscal year 2024.

Quarterly financial statements of GameStop.

Related: GameStop’s potential Bitcoin investment could disrupt traditional finance, according to industry executives

Continuing the Strategic Play

GameStop defied the norms during the pandemic when it became the focal point of a meme stock phenomenon that revitalized its prospects. Since then, the retailer has shown substantial recovery, declaring profitability in fiscal 2023.

Speculation regarding GameStop’s foray into Bitcoin began circulating in February, contributing to an uptick in GME’s stock price.

Earlier that month, the CEO shared a photo on social media featuring himself and the Strategy executive chairman, a well-known Bitcoin advocate, sparking further excitement about a potential BTC investment.

Photo shared by Ryan Cohen.

Now, more than a month later, GameStop seems ready to follow a similar path by incorporating Bitcoin into its financial strategy.

Recently, it was announced that Strategy had procured an additional 6,911 Bitcoin, bringing its total to 506,137 BTC, which constitutes around 2.4% of Bitcoin’s total supply.

Related: Strategy unveils a preferred stock offering aimed at acquiring more Bitcoin