The case involving a blockchain company and the US Securities and Exchange Commission (SEC) may reach its conclusion after more than four years, pending court approval.

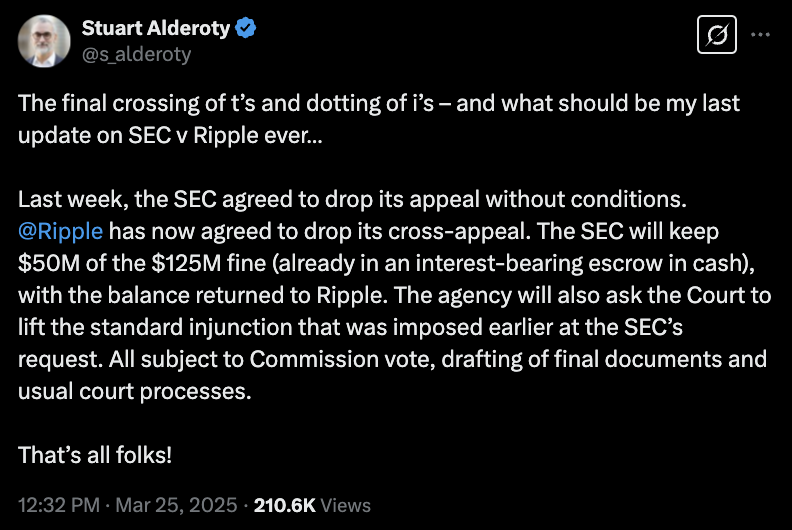

On March 25, the Chief Legal Officer of the firm announced what he referred to as “my final update on the SEC case.” He stated that the company would withdraw its cross-appeal against the SEC in the Second Circuit Court of Appeals. An August 2024 ruling from the US District Court for the Southern District of New York, which found the company liable for $125 million, will largely remain intact, although the SEC will retain just $50 million from that sum in escrow, with the rest being returned to the firm.

“The agency will also request that the previously imposed standard injunction be lifted, which was initially sought by the SEC,” the Chief Legal Officer shared. “All of this is contingent on a Commission vote, the drafting of final documents, and the usual court proceedings.”

Statement from the Chief Legal Officer regarding the latest developments in the SEC case.

This announcement followed closely behind the CEO’s statement that the SEC was set to abandon its appeal concerning the August 2024 ruling. As of the time of this update, there had been no filings from either the SEC or the blockchain company in the Second Circuit since January 31, or in the Southern District of New York since October.

On March 11, the Chief Legal Officer mentioned that if both the SEC and the blockchain firm agreed to drop their respective appeals, it would allow the lower court’s $125 million ruling to remain effective. Furthermore, both parties could jointly approach Judge Analisa Torres in the Southern District of New York to seek modifications to the judgment.

Related: Coinbase appeals court ruling on crypto trades as non-securities

Ripple’s Political Engagement

The SEC’s action against the blockchain firm, initiated under President Donald Trump in December 2020, became one of the commission’s longest-standing enforcement actions against a significant US crypto entity.

The CEO remarked in a December 2024 interview that the company might not have become so involved in US politics had the SEC been under different leadership than that of former Chair Gary Gensler, even though the proceedings began under then-Chair Jay Clayton.

During the 2024 election cycle, the firm contributed $45 million to the political action committee Fairshake to back “pro-crypto” candidates and pledged $5 million in cryptocurrency to Trump’s inauguration fund. The Chief Legal Officer indicated to that the SEC’s decision to drop cases was “independent” of any political contributions.

Since Trump’s election win over then-Democratic Vice President Kamala Harris on November 5, both the CEO and Chief Legal Officer have participated in events in Washington, DC during the inauguration as official attendees, and the CEO was involved in a White House summit on March 7 where Trump outlined his vision for stablecoins and a regulatory framework for cryptocurrency.

On March 27, the Senate Banking Committee is expected to deliberate on the nomination of former SEC Commissioner Paul Atkins to return to lead the agency. He is likely to face inquiries regarding his views on cryptocurrency regulation and potential conflicts of interest.

Magazine: Latest updates on the SEC lawsuit, Trump at DAS, and more: Overview from March 16 – 22