Few concepts in the cryptocurrency world are as perplexing and frequently misinterpreted as “altcoin season.” Traditionally, this phrase described a fleeting period — typically lasting 2-3 months — that follows a Bitcoin (BTC) price surge, during which altcoins tend to outperform BTC in terms of overall returns. This trend was evident during the cycles from 2015 to 2018 and 2019 to 2022, but it’s still uncertain whether the current bull market has experienced its own altcoin season.

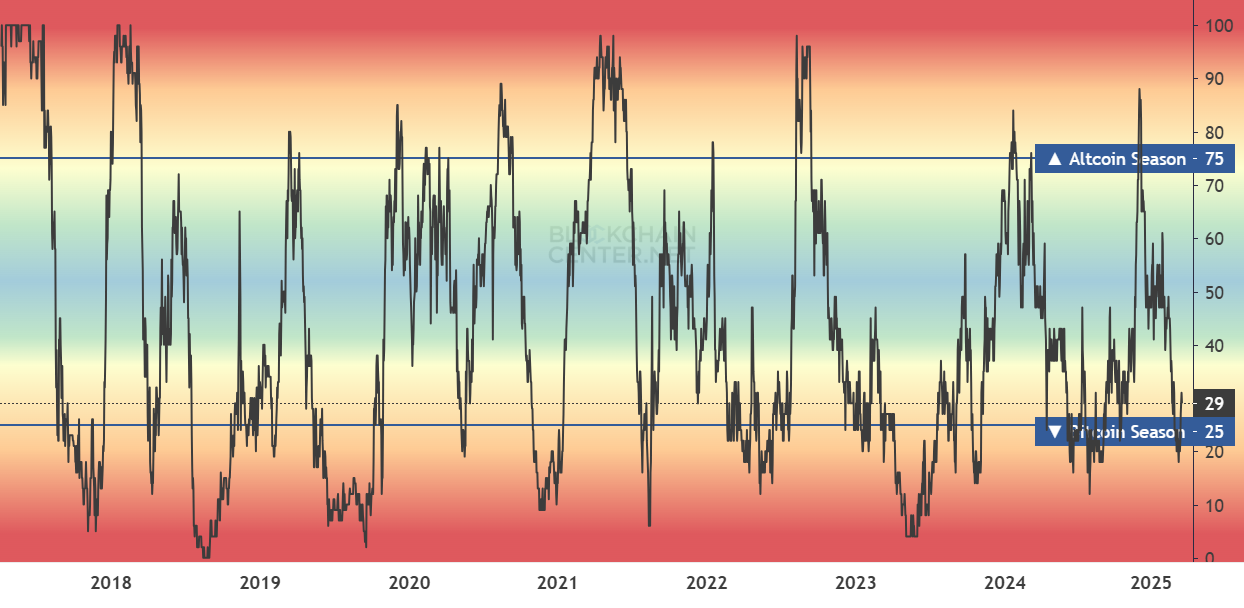

Altcoin season is generally characterized by a time when 75% of the top 50 altcoins outperform Bitcoin over a consecutive 90-day period. Recent data indicated slight increases in March 2024 and again in January 2025, but neither occurrence was sustained long enough to be deemed a true altcoin season.

Altcoin season index.

Analysts have suggested various explanations for the current state of the altcoin market. Some believe that memecoins have siphoned off liquidity from broader altcoin investments, while others point to an over-saturation of crypto investment products — especially ETFs — tailored for institutional investors, which tend to concentrate on only the largest altcoins. A third perspective calls for a more nuanced understanding of what altcoins represent, arguing that instead of a homogenous asset class, they encompass a diverse array of crypto assets with varying functions, value frameworks, and growth opportunities.

Memecoins took center stage

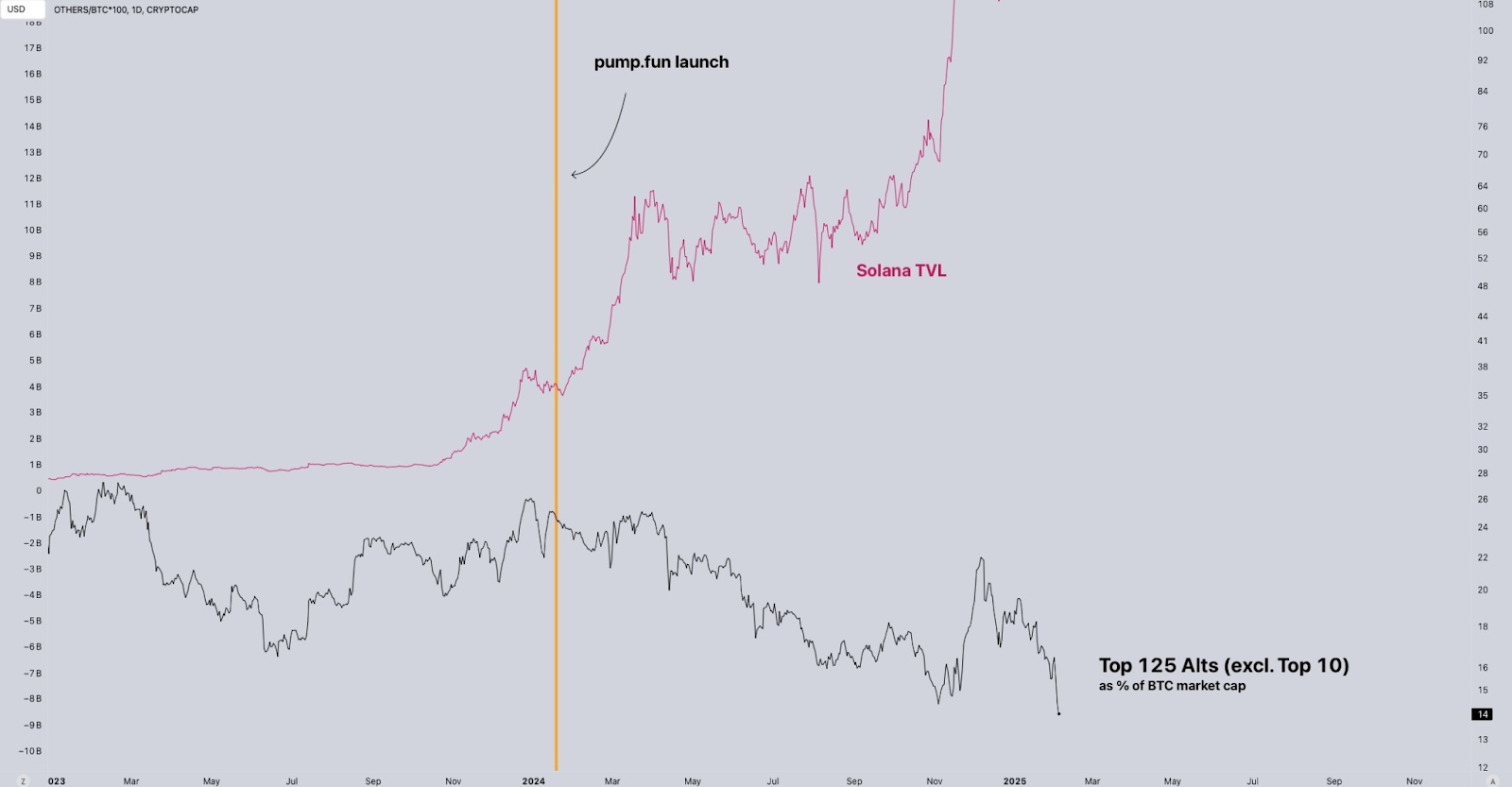

According to crypto analyst Miles Deutscher, the introduction of Pump.fun is directly tied to the downturn of the altcoin market relative to BTC.

“The absence of a notable ‘altseason’ among major coins is due to speculative capital that used to flow into the top 200 assets now favoring low-cap on-chain tokens instead.”

Deutscher highlights that while early investors saw substantial profits, many retail investors who entered late faced losses. Historically, this has been a common theme in prior altcoin cycles. However, unlike in 2022, where losses were mainly confined to CEX altcoins with adequate liquidity, many found themselves invested in illiquid on-chain memecoins, which plummeted by 70%-80%. This resulted in a “wealth destruction event greater than the early 2022 bear market (excluding LUNA),” despite BTC and certain major coins still being in an overall upward trend.

Solana TVL vs Top 125 Altcoins (excluding Top 10).

Political events in the United States also fueled the memecoin frenzy. For instance, Donald Trump’s public endorsement of memecoins initiated significant buzz, but the outcomes were quickly disappointing. TRUMP and MELANIA tokens have suffered declines of 83% and 95%, respectively, since their launch in late January, further dampening retail investor sentiment.

Institutional investors and ETFs influenced the landscape

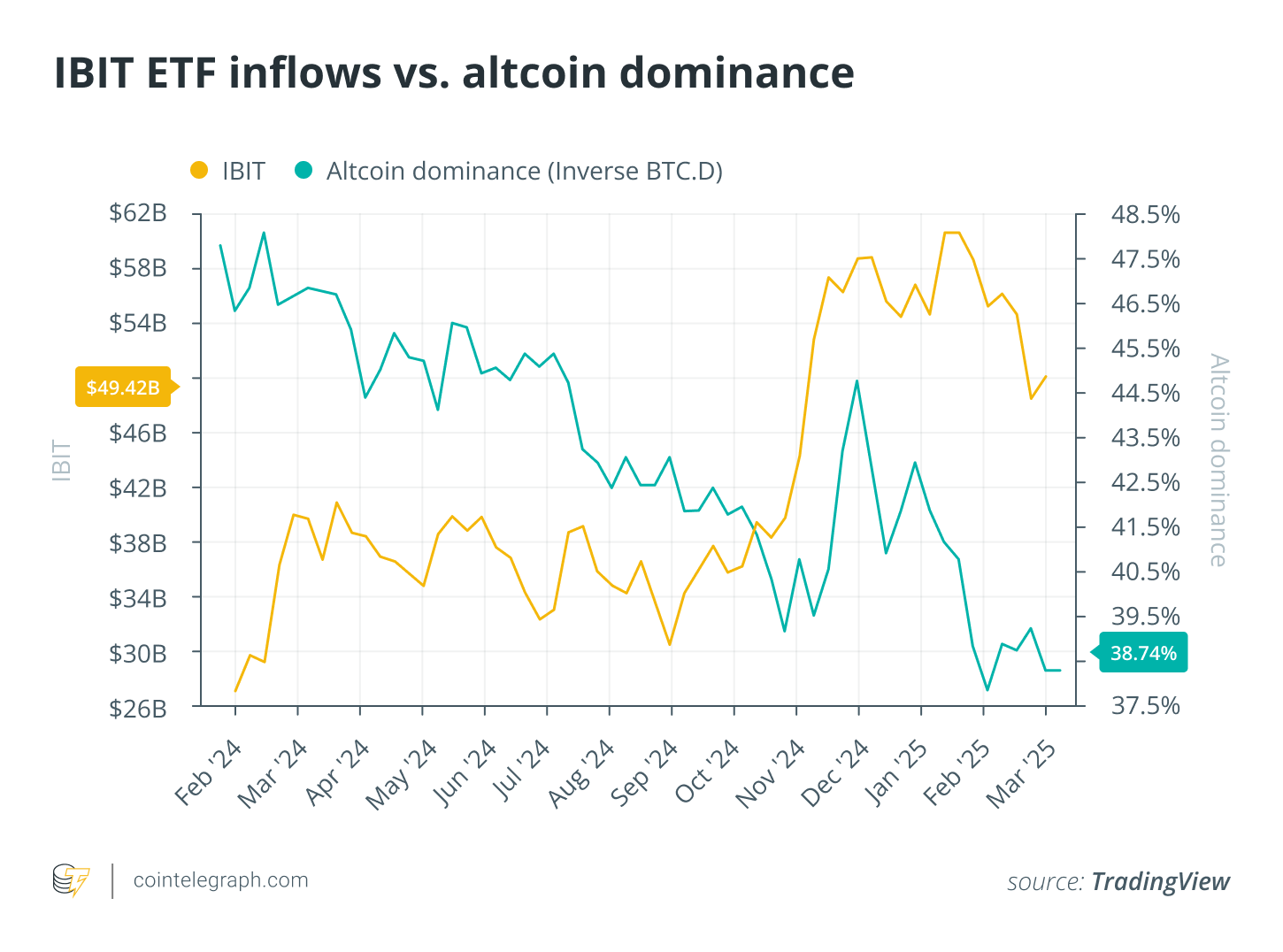

Another influence on the current bull market’s altcoin dynamics has been the entrance of institutional players. The introduction of spot Bitcoin ETFs in January 2024 led to $129 billion worth of inflows, as investors flocked to well-known investment vehicles that offer custodial services, regulation, and ease of access. BlackRock’s IBIT quickly emerged as a leading option, with the addition of ETF choices in July 2024 further enhancing the market.

Some analysts argue that the safety and scalability offered by spot BTC ETFs have diverted capital away from riskier assets. The ability to hedge via options and futures significantly reduces the inclination to invest in illiquid, low-volume altcoins.

Nonetheless, this explanation has its limits. The cryptocurrency market is not a zero-sum game; global liquidity continues to rise, and incoming capital can be allocated in various ways. In fact, institutional interest may broaden the overall crypto market.

Moreover, some altcoins also have their own ETF offerings. Spot Ether ETFs made their debut in July 2024 and have since reported a modest net inflow of $565,000. The stark contrast in scale when compared to spot BTC ETFs indicates that the ETF structure alone does not suffice — the conviction of investors is still crucial.

Altcoin functionalities and their fluctuations are becoming more complex

The label “altcoin” originally referred to any token that wasn’t Bitcoin, but today it encompasses a broad spectrum of assets: blockchain-native currencies, governance tokens, stablecoins, memecoins, DApp tokens, and tokens related to real-world assets — each serving distinct purposes and attracting different investor demographics. Just like it doesn’t make sense to categorize gold, Nvidia shares, and the US dollar under a single index in traditional finance, treating all altcoins as one unified group lacks rationale.

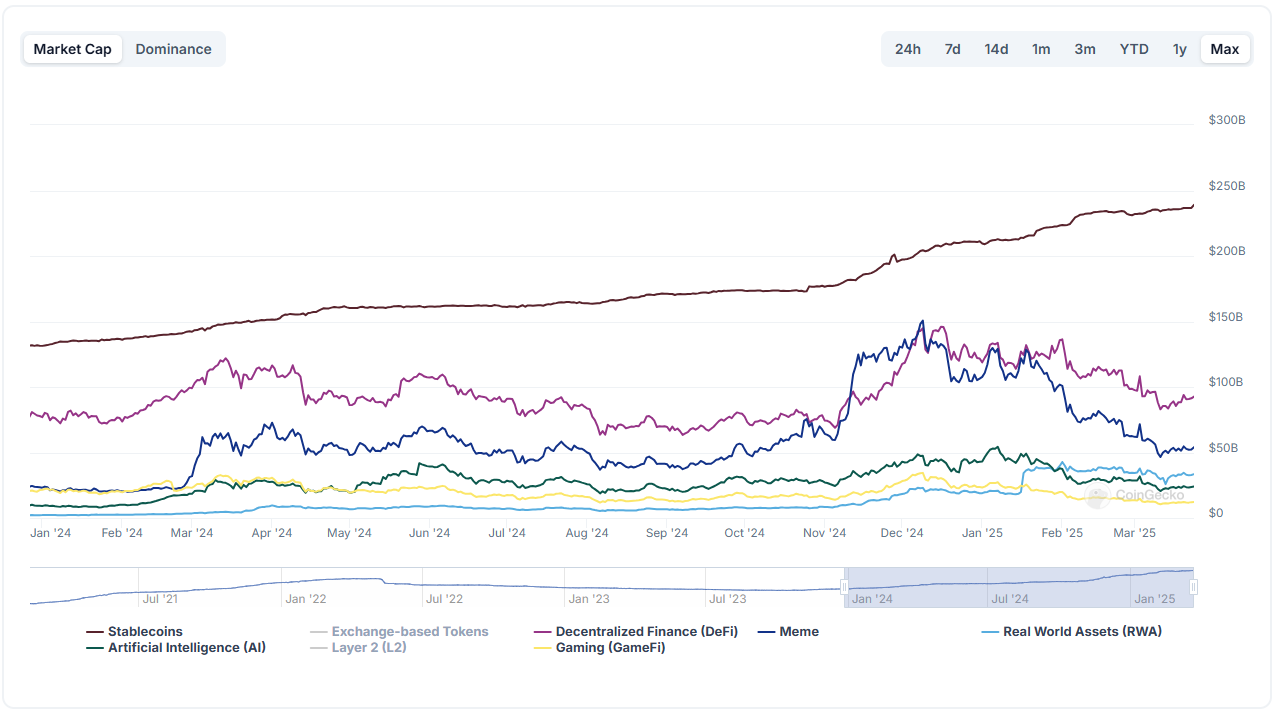

A deeper investigation into price behaviors supports this notion. As per data, major categories of altcoins have diverged significantly this cycle. Tokens tied to real-world assets (RWA) experienced a 15x surge, while GameFi saw its market cap halve. This indicates that narratives are increasingly influential in shaping investors’ capital allocation strategies.

Crypto category market capitalizations.

Even established blockchain tokens are beginning to specialize. Ethereum remains the go-to for DeFi applications, Solana leads the memecoin category, Tron ranks second in stablecoin transactions, and ImmutableX is establishing its niche in gaming. In every instance, a token’s performance is becoming increasingly linked to the activity within its respective ecosystem. This suggests that it might be time to move away from the term “altseason” and start focusing on specific narratives within the cryptocurrency realm.

Altcoins don’t seem to be moving in unison anymore, and this could signify a crucial development in the maturity of the crypto market.

This article is not intended as investment advice or recommendations. All investments and trading activities involve risk, and readers should perform their own research before making decisions.