The price of Dogecoin (DOGE) surged by about 7% in the past 24 hours, reaching $0.181 on March 25. During the day, the memecoin hit a peak of $0.189, marking its highest value in nearly two weeks.

Dogecoin/USD four-hour price chart. Source: TradingView

Several key factors have contributed to the increase in DOGE’s price today, including:

-

An initiative involving a DOGE reserve initiated by the Dogecoin Foundation.

-

A recovery in risk appetite as fears regarding the trade war ease.

-

A classic flag pattern observed on the DOGE price chart.

New Dogecoin Reserve Initiative

The ongoing rise in DOGE’s price aligns with the introduction of the Official Dogecoin Reserve, aimed at stabilizing the memecoin and enhancing institutional trust.

Important highlights:

-

On March 24, the Dogecoin Foundation announced the establishment of the “Official Dogecoin Reserve,” intended to facilitate long-term price stability and credibility for DOGE.

-

In connection with this initiative, the foundation acquired 10 million DOGE, totaling approximately $1.80 million.

-

This strategic purchase comes at a time when traders are paying close attention to signs of institutional investment in the memecoin market, especially with speculations about the potential approval of spot Dogecoin ETFs in the US.

Source: @CryptoWizardd

-

As of March 25, a popular crypto betting platform indicated that there is a 72% chance of a Dogecoin ETF launching by the end of the year, a significant increase from 27% at the beginning of January.

Altcoins Outperform Bitcoin Amid Rally

The gains for Dogecoin coincide with a broader rally in the altcoin market, driven by decreasing tensions related to trade wars.

Key observations:

Bitcoin and TOTAL2 market capitalization performance over the last five days. Source: TradingView

-

During the same timeframe, Bitcoin’s market cap experienced a slight decline of 0.61%.

-

This trend indicates that traders are reallocating funds from Bitcoin into altcoins like Dogecoin.

-

This shift appears to be occurring as trade war fears subside.

-

On March 24, the US President suggested that some trading partners might receive exemptions or reductions, further easing tensions.

-

Investors are leaning towards higher-risk assets as macroeconomic sentiment improves, opting for riskier altcoins over traditional safe havens like Bitcoin.

-

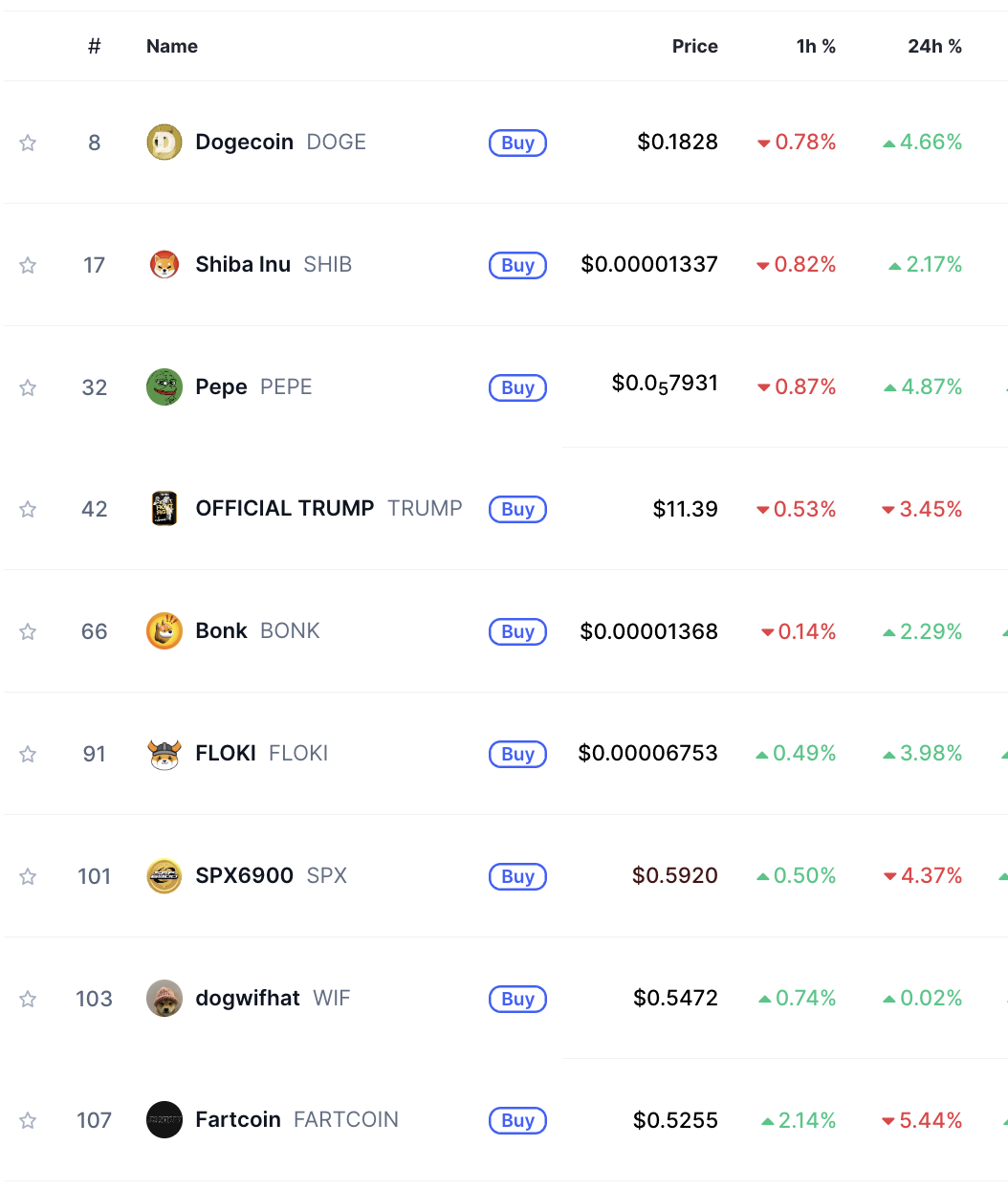

Memecoins often see a surge in retail interest during altcoin rallies, as evidenced by the performance of leading joke cryptocurrencies in a 24-hour adjusted timeframe.

Top memecoin performance on March 25, 2025. Source: CoinMarketCap

Related: Dogecoin millionaires capitalize on price dips as DOGE aims for a 30% rally

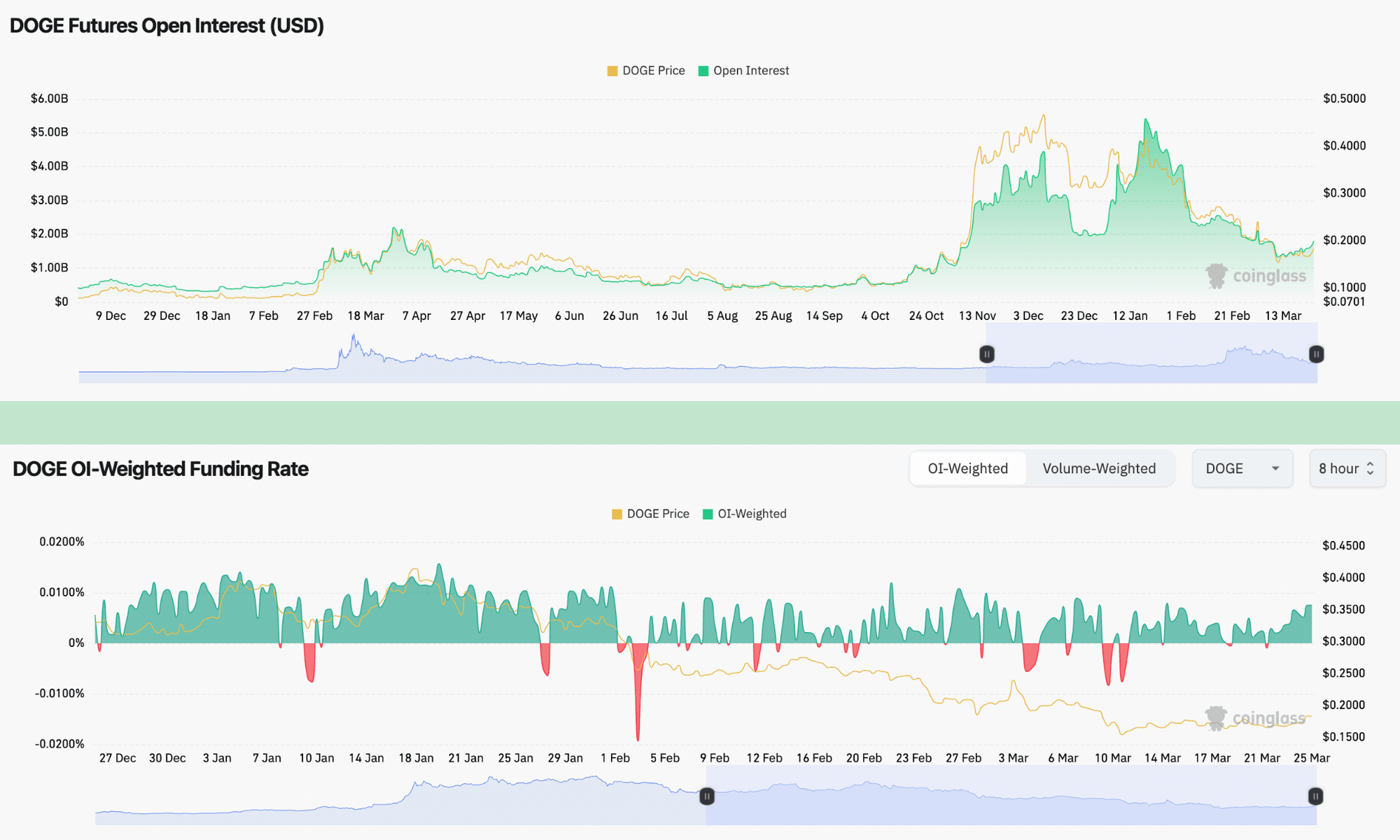

Increased speculation is evident in the Dogecoin Futures market, with rising DOGE open interest (OI) and funding rates.

What to note:

-

As of March 25, DOGE’s open interest in the futures market stood at roughly $1.80 billion, up from a low of $1.33 billion recorded on March 11, which was the lowest in four months.

Dogecoin OI and funding rates. Source: Coinglass

-

At the same time, DOGE’s weekly funding rates have risen to 0.157% from negative figures on March 21.

-

The growth in DOGE open interest and positive funding rates point to increasing interest in leveraged long positions, reflecting an optimistic market outlook.

Dogecoin’s Price Action within a Bear Flag Structure

The upward movement of Dogecoin’s price today is part of its ongoing bear flag formation.

Key insights:

-

A bear flag pattern emerges when prices consolidate at higher levels within a rising parallel channel, following sharp declines.

-

According to technical analysis, this pattern is resolved when prices break below the lower trendline, potentially falling by a distance equal to the size of the preceding downtrend.

-

As of March 25, Dogecoin was trending within the flag channel, with its recent bounce occurring after testing the lower trendline as support.

Dogecoin/USD daily price chart. Source: TradingView

-

However, its overall forecast remains tilted to the downside if it breaks below the flag’s lower trendline next.

-

If that occurs, DOGE’s price could decline towards a target around $0.117, representing a drop of approximately 35% from current levels by April.

-

On the other hand, a breakout above the upper trendline of the flag could invalidate the bearish scenario, propelling DOGE towards the 50-day EMA (the red wave around $0.214) instead.

This article does not provide investment advice or recommendations. All investments and trading entail risk, and readers should perform their own analysis before making decisions.