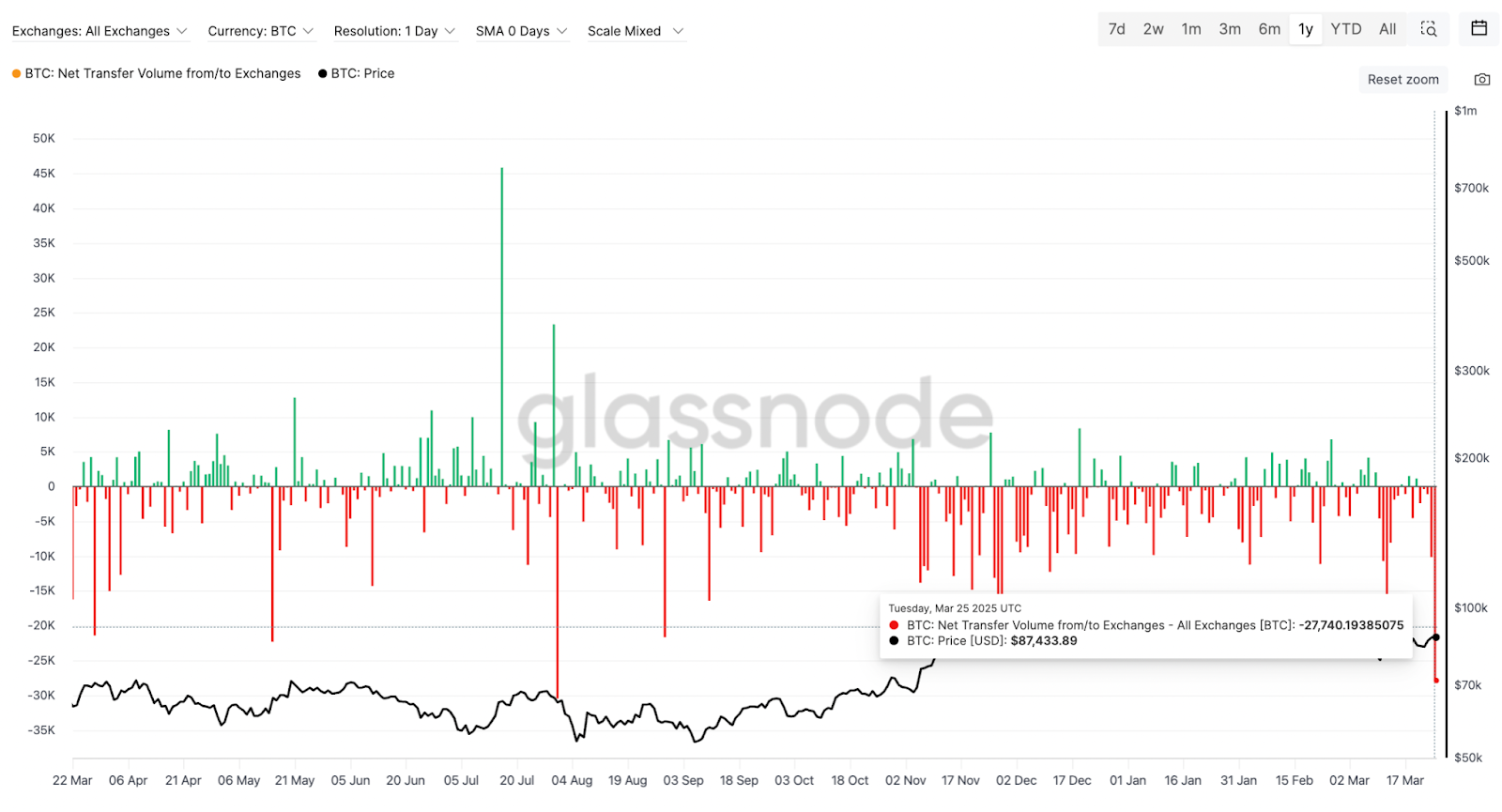

On March 25, over 27,740 Bitcoin (BTC), valued at $2.4 billion, were withdrawn from exchanges, marking the largest daily outflow since July 31, 2024. At the same time, flows into US spot Bitcoin exchange-traded funds (ETFs) are continuing, indicating a resurgence in institutional interest.

Could this signal the reemergence of a Bitcoin bull market?

Bitcoin exchange outflows reach a 7-month peak

Bitcoin is once again striving for a technical breakout above $90,000 as the available supply on exchanges diminishes.

Bitcoin: Net inflow to exchanges. Source: Glassnode

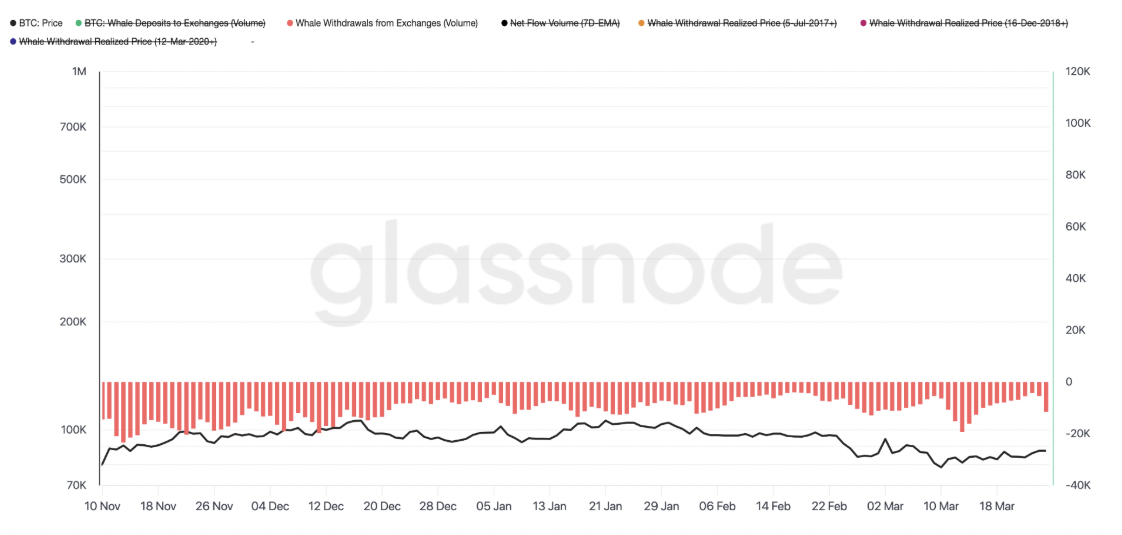

A detailed examination of the data indicates that a substantial portion of these withdrawals came from large holders, often referred to as whales, who pulled over 11,574 BTC, approximately valued at $1 billion, from exchanges on March 25.

Withdrawals from exchanges by Bitcoin whales. Source: Glassnode

Significant outflows from exchanges, particularly those attributed to whales, alleviate sell pressure, often indicating accumulation and a bullish outlook, which can contribute to upward price movements.

Related: Bitcoin, Ethereum anticipated to finish Q1 in decline, ‘vertical swing upward’ unlikely

Furthermore, a blockchain analytics company noted that a prominent “billionaire Bitcoin whale” acquired 2,400 BTC valued at over $200 million on March 24. Despite some selling activities in February, this particular whale now possesses over 15,000 BTC.

The whale began purchasing Bitcoin five days prior after selling their assets when prices fluctuated between $100,000 and $86,000 in February, potentially signaling that these significant investors view the recent price dips as favorable opportunities for buying, anticipating future price increases.

Positive trend in spot Bitcoin ETF inflows

Another indication that large-scale investors are re-entering the Bitcoin market is the ongoing inflow of capital into spot Bitcoin exchange-traded funds (ETFs) since March 14. Over the past eight days, these ETFs have amassed inflows totaling $896.6 million.

“ETFs have shown a positive trend since March 14, as have Bitcoin and altcoins,” said a market analysis provider.

“This marks the first streak of this length in 2025.”

💸📈 ETFs have taken a positive turn since March 14, and so has $BTC and altcoins. We have now seen seven consecutive days with more inflows into Bitcoin ETFs than outflows. This is the first streak of this kind for 2025. pic.twitter.com/9V1LNQ95uX

— Market Data Provider March 26, 2025

According to reports, digital asset investment products have also experienced weekly net inflows for the first time in five weeks.

BTC price eyes essential trendline to reignite bull market

Information from market analytics and trading platforms shows BTC/USD trading at $88,265, reflecting a 1.2% increase over the past day. The Bitcoin price faces resistance from the 20-week exponential moving average (EMA), currently positioned at $88,682.

For Bitcoin to sustain its upward momentum, it must convert this resistance into support. Historical data indicates that breaking above the 20-week EMA has often preceded significant price rallies.

BTC/USD weekly chart. Source: TradingView

It’s noteworthy that when the Bitcoin price crossed this moving average in October 2023, it surged approximately 170% from $27,000 on October 16, 2023, to set a new all-time high above $73,000 by March 14, 2024.

A similar scenario occurred when Bitcoin’s price surpassed the 20-week EMA in September 2024, leading to a 77% increase from $60,000 to $108,000 by December 2024.

Renowned analysts have emphasized the significance of this trendline, highlighting that this moving average is currently a critical level for Bitcoin.

Additionally, a co-founder of a trading resource pointed out that for Bitcoin to confirm a pathway to previous all-time highs, it needs to reclaim the yearly open for 2025, located around $93,300.

This piece does not offer investment advice or recommendations. All investment and trading activities carry risks, and readers should perform their own due diligence before making financial decisions.