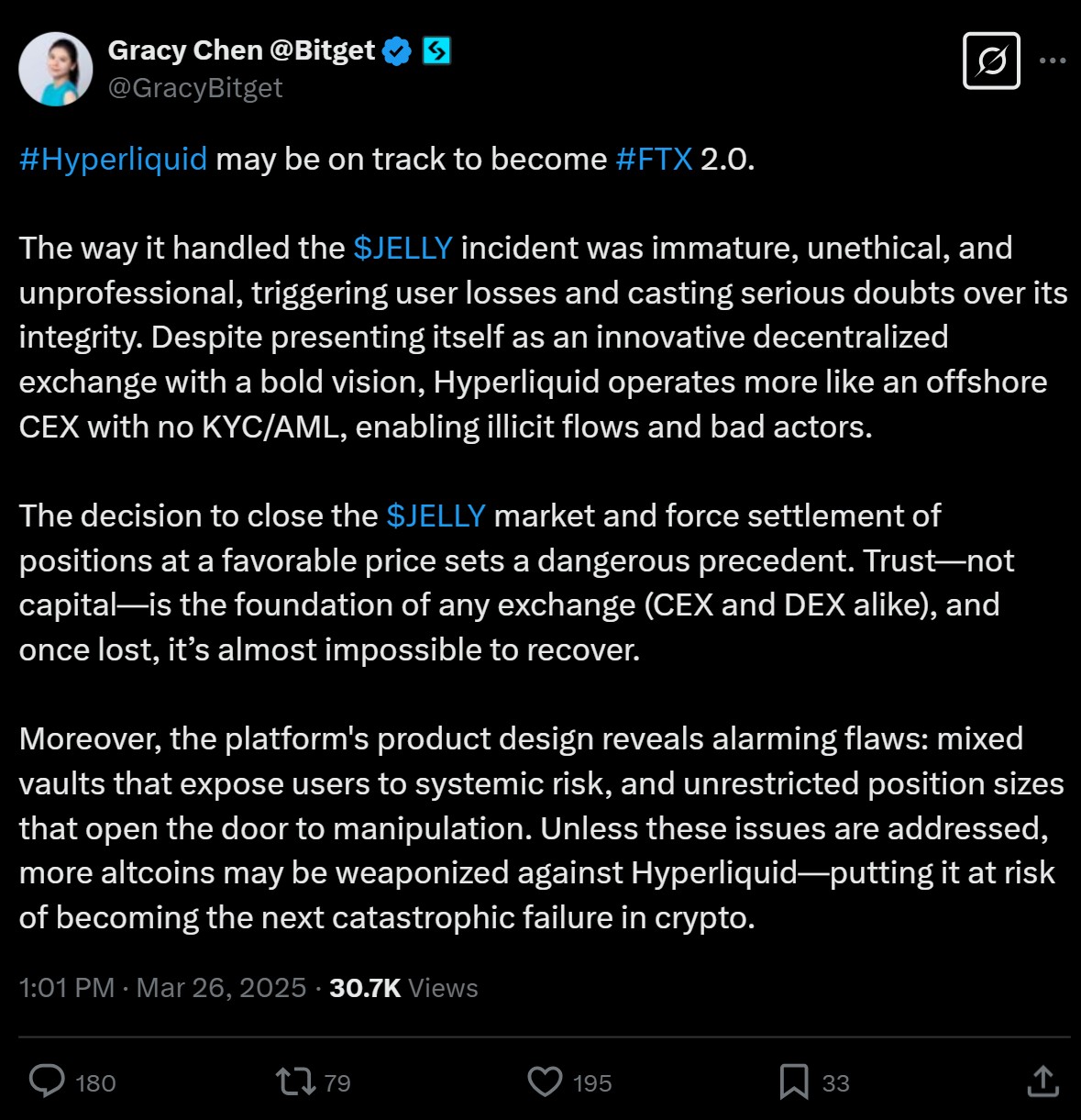

Gracy Chen, the CEO of Bitget, a cryptocurrency exchange, expressed her disapproval of Hyperliquid’s response to a situation on its perpetual exchange that occurred on March 26. She warned that this could lead the network to become the next “FTX 2.0.”

On the same date, Hyperliquid, a blockchain platform focused on trading, announced that it was removing perpetual futures contracts related to the JELLY token and would compensate users after uncovering “evidence of suspicious market activity” associated with those contracts.

This decision, made by Hyperliquid’s relatively small group of validators, raised existing alarms concerning the widely shared perception of the network’s centralization.

“Although it claims to be an innovative decentralized exchange with a visionary approach, Hyperliquid behaves more like an offshore centralized exchange,” Chen stated, adding, “Hyperliquid could potentially be heading toward becoming FTX 2.0.”

FTX was a cryptocurrency exchange led by Sam Bankman-Fried, who was found guilty of fraud in the United States following the exchange’s sudden collapse in 2022.

While Chen stopped short of accusing Hyperliquid of specific legal violations, she highlighted what she viewed as the platform’s “immature, unethical, and unprofessional” handling of the incident.

“The move to shut down the $JELLY market and settle positions at favorable prices creates a perilous precedent,” Chen remarked. “Trust—not capital—forms the backbone of any exchange, and once it’s lost, restoration is nearly impossible.”

Referenced: Gracy Chen

Related: Hyperliquid removes JELLY perps, citing ‘suspicious’ activities

JELLY incident

The JELLY token was launched in January by Iqram Magdon-Ismail, co-founder of Venmo, as part of a Web3 social media initiative known as JellyJelly.

Initially, it achieved a market cap of approximately $250 million but quickly diminished to single-digit millions in the subsequent weeks, according to DexScreener.

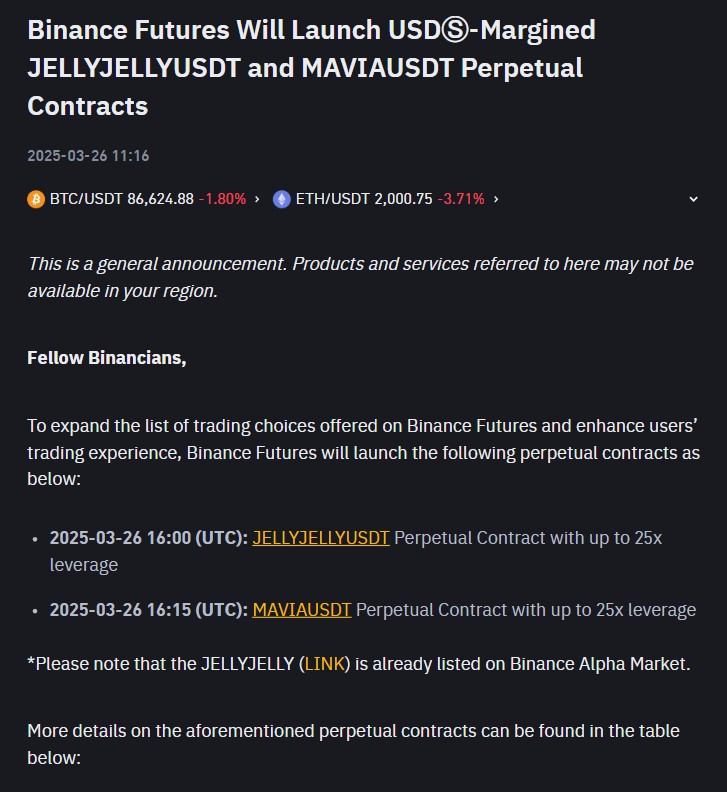

On March 26, JELLY’s market valuation surged to about $25 million after Binance, the leading cryptocurrency exchange, introduced its own perpetual futures linked to the token.

On that same day, a trader on Hyperliquid “initiated an enormous $6M short position on JellyJelly” and then “intentionally self-liquidated by artificially increasing JellyJelly’s price on-chain,” Abhi, founder of AP Collective, mentioned in a post.

Arthur Hayes, founder of BitMEX, commented that initial reactions to Hyperliquid’s JELLY incident overly estimated the reputational risks to the network.

“Let’s stop pretending Hyperliquid is decentralized. And let’s stop acting like traders actually care,” Hayes stated in a post. “I bet $HYPE returns to its original position rapidly because speculators will be speculators.”

Binance launched JELLY perps on March 26. Source: Binance

Growing pains

On March 12, Hyperliquid faced a similar crisis when a whale purposely liquidated a long Ether (ETH) position valued at around $200 million.

This trade resulted in losses of about $4 million for depositors in Hyperliquid’s liquidity pool, as it forced the pool to unwind the trade at disadvantageous prices. Following this incident, Hyperliquid has tightened collateral requirements for open positions to “mitigate the systemic impact of large positions potentially affecting market closure.”

Hyperliquid is currently the leading platform for leveraged perpetuals trading, holding approximately 70% of the market share as reported by VanEck in January.

Perpetual futures, or “perps,” are leveraged contracts that do not have an expiration date. Traders must deposit margin collateral, such as USDC, to secure their open positions.

According to L2Beat, Hyperliquid operates with two principal validator sets, each containing four validators. In contrast, competitor chains like Solana and Ethereum are backed by around 1,000 and 1 million validators, respectively.

A greater number of validators generally reduces the risk of a small group of insiders manipulating a blockchain.