Bitso Business, a division of the Mexican cryptocurrency exchange, is set to introduce a stablecoin pegged to the Mexican peso on the Ethereum layer-2 network, Arbitrum.

The new stablecoin, named MXNB, will be issued and overseen by Bitso’s recently founded subsidiary, Juno. It will be entirely backed by Mexican pesos on a one-to-one basis, as shared in a statement on March 26.

According to Ben Reid, the head of stablecoins at Bitso Business, one significant application for MXNB could be to facilitate foreign investments and trade in Latin American nations by offering a more streamlined approach compared to conventional financial systems.

“Global businesses encounter various monetary hurdles while trying to serve clients in new territories and executing cross-border transactions. This often includes high costs from intermediaries and slow transaction processing,” he noted.

Juno will function independently from Bitso to manage the stablecoin and will ensure regular audits of its reserves, with public attestation reports available on the token’s dedicated website.

Remittances in Mexico

A report from a crypto research firm indicated in October that Mexico is a crucial market to observe for its integration of cryptocurrency in remittance services.

The World Bank assessed in June 2023 that Mexico received approximately $61 billion in remittances annually, largely from the United States, making it the second-largest recipient globally.

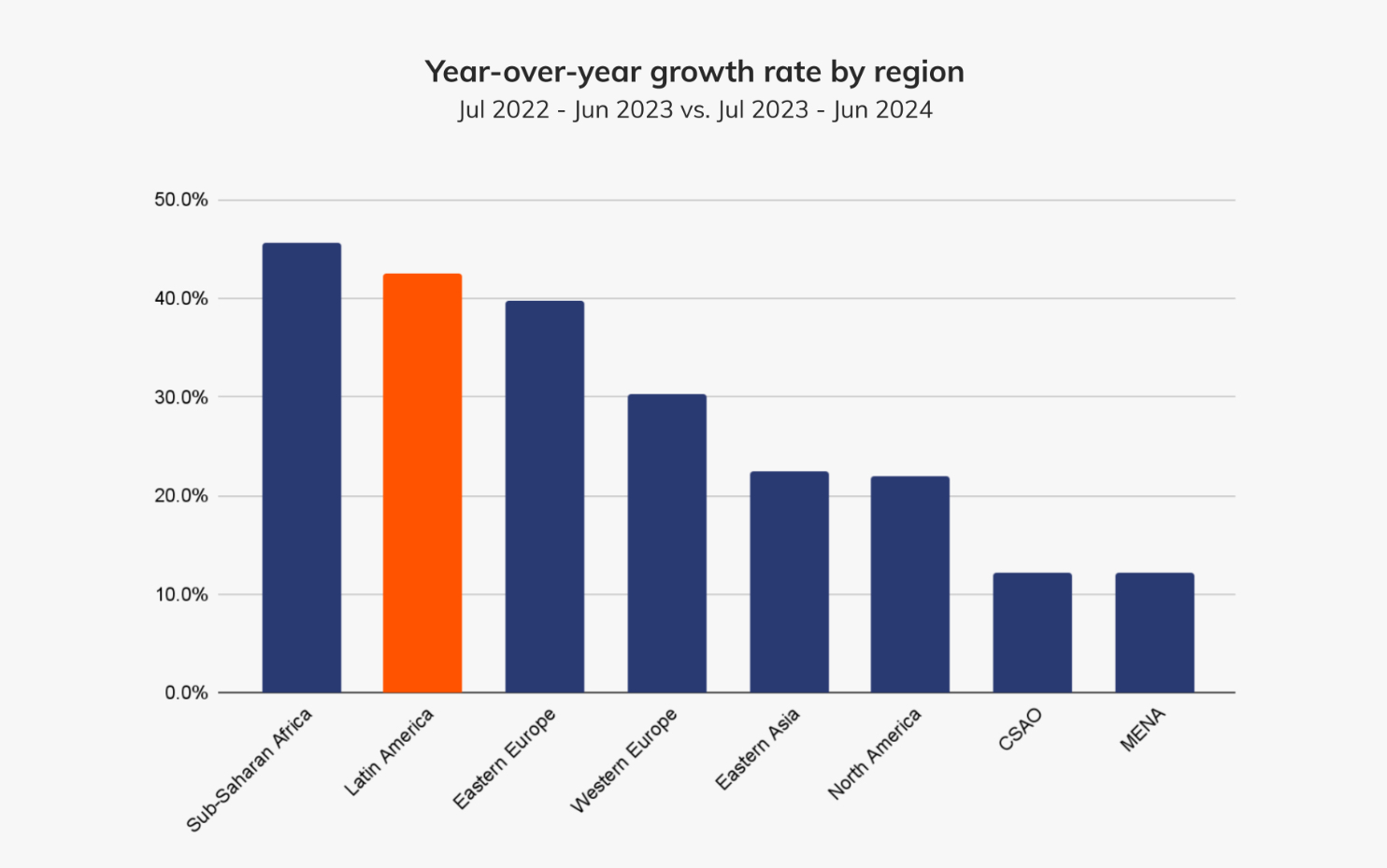

The same report found Latin America to be the second-fastest growing region worldwide, following sub-Saharan Africa, in terms of crypto transaction value received. From July 2023 to June 2024, Latin Americans are projected to have received $415 billion in cryptocurrency, marking a year-on-year growth of about 42.5%.

Image Source

According to Bitso’s report on the Latin America Crypto Landscape, stablecoin purchases on their platform have risen by 9%, as users are increasingly turning to stable currencies like USDC and Tether to mitigate rising inflation and the devaluation of local currencies.

“In Latin America, tough macroeconomic environments, defined by high inflation and currency declines, have led to greater cryptocurrency adoption, particularly stablecoins, as a dependable store of value,” the report stated.

Related: Integration of USDC with national payment systems in Brazil and Mexico

While USDC and USDT appear to be the most prevalent stablecoins in Latin America, several peso-pegged options have emerged in circulation in recent years.

The most notable among these is Tether’s MXNT, which was launched on Ethereum, Polygon, and Tron in 2022. At that time, Tether’s then-CEO, Paolo Ardoino, described the token as a reliable store of value for Mexican cryptocurrency users and a means to facilitate the transition from fiat pesos to digital currency.

Other smaller competitors in the peso-pegged stablecoin market include MMXN, backed by Monetary Digital, and MXNe, which was introduced by Brale on the Solana and Stellar networks in 2024.

Magazine Feature: The realities of using Bitcoin in El Salvador